Remek! Premium

Actionable real-time market intelligence for short-term traders

Designed to remove the obstacles between you and successful trading.Join us on Friday, Jun 28, 2019 10am ET for our weekly Premium workshop. Click here to register!

Pw: remek-premium_2019

FOR THE TRADING DAY OF friday, 2019 06 28

News at 8.30am (ET)

General observations:

July 4 weekend. Expect limited volume and increased lack of follow-through.

Indexes: bulls maintaining control.

Currencies:

6E: bullflag (240min/daily), triggered

6J: monitoring 240min bearflag for potential failure. Expecting daily structure to prevail.

6C: performing well, see yesterday’s chart as well

4pm ET update:

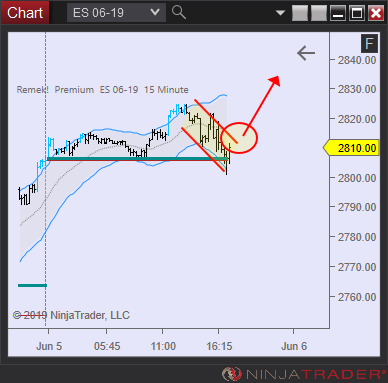

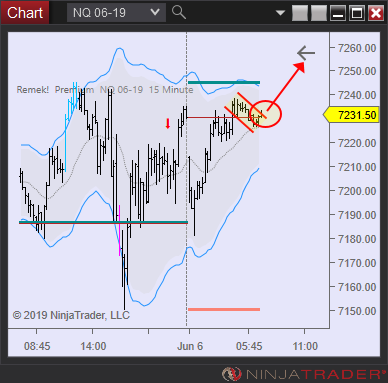

The market tends to do things that upsets the largest number of people. This move at 4pm, on both the ES and the NQ, was no exception.

8.30am ET update:

FOR THE TRADING DAY OF thursday, 2019 06 27

News at 8.30am (ET)

DAILY GAME PLAN

General observations: Uncertainty is the market’s natural state. We get a dose of that today. In order for the bulls to retain control over the market, that bearflag on the 240min should fail, the bullflag (simple pullback or complex pullback) on the daily to emerge, and price action should stay above the 2850 area.

Potential entries:

6E: bullflag on 240min, feeding into the daily bullflag. Target on daily. Initial stop at 240min Keltner low. (Note bearish structure on DX.)

6J: expecting the 240min bearflag pattern to fail, and a bullflag on the daily to emerge. Monitoring.

6C: bullish potential, see chart below. Monitoring for entry.

FOR THE TRADING DAY OF wednesday, 2019 06 26

Please note: I’ll be travelling back to Toronto today, with limited access to the market. I will post to this page before I leave, and again, after I land.

News at 8.30am (ET)

Indexes: potential bearflag on 240min may lead to further downside move. Scale back until some clarity surfaces.

Currencies: 6C: breakout on daily. 6S: monitoring a potential long, see below.

FOR THE TRADING DAY OF tuesday, 2019 06 25

News at 10am (ET).

Notes for today’s session:

Indexes: Bullish bias. If trading intraday, look for pullbacks on your intraday chart to join the 240min/daily move.

Currencies: 6J: bullish structure on 240min/daily. Look to join the HTF trend upon intraday pullbacks. 6C: consolidation above support on 240min, see target on daily

Financials: ZB: look to go long upon breakout, see below.

Mindful trading!

FOR THE TRADING DAY OF Monday, 2019 06 24

1pm ET update: I missed this on the 6S. Any of you traded this? Since we don’t chase trades, we’ll have to wait for a day or two and a little pullback on the daily. Note: the new high on the 240min Remek!MACD before the pullback marked in red.

No major News.

Notes:

Indexes: bullish bias until proven wrong. See measured move on yesterday’s daily chart.

Currencies: Daily DX touches lower Keltner: sign of weakness in long trend on DX. Standing by. 6J: intraday bullflag, in sycn with breakout setup on the weekly.

Commodities: CL: uncertainty, with a potential to reach the 60 area. If interested, you may want to look for a pullback to join on the 240m. GC: expect mean reversion after run-up to 1400 area. (see below).

We’ll be focusing on the Indexes in today’s session. Mindful trading on the last week of the second quarter! Protect your profits, think defensive this week.

12noon ET update: Managing positions.

9am (ET) update:

ZB: bullflag above support, bullflag on LTF

NQ: bullish bias for the day, intraday bullflag

FOR THE TRADING DAY OF FRIDAY, 2019 06 21

Convincing performance this week as well. See you Sunday night ET!

Note: it’s graduation day at CEU, and I will be away from the computer starting 12noon CET, i.e. for most of the US day session. See notes below for today’s game plan! Mindful trading!

Remek! Premium continues to buzz along nicely, see the performance report for the past several weeks.

News at 10am ET.

Indexes: measured move, all time highs expected, see chart below. Always look for signs you’re wrong. Make sure if you’re proven wrong you get out. Respect your stops.

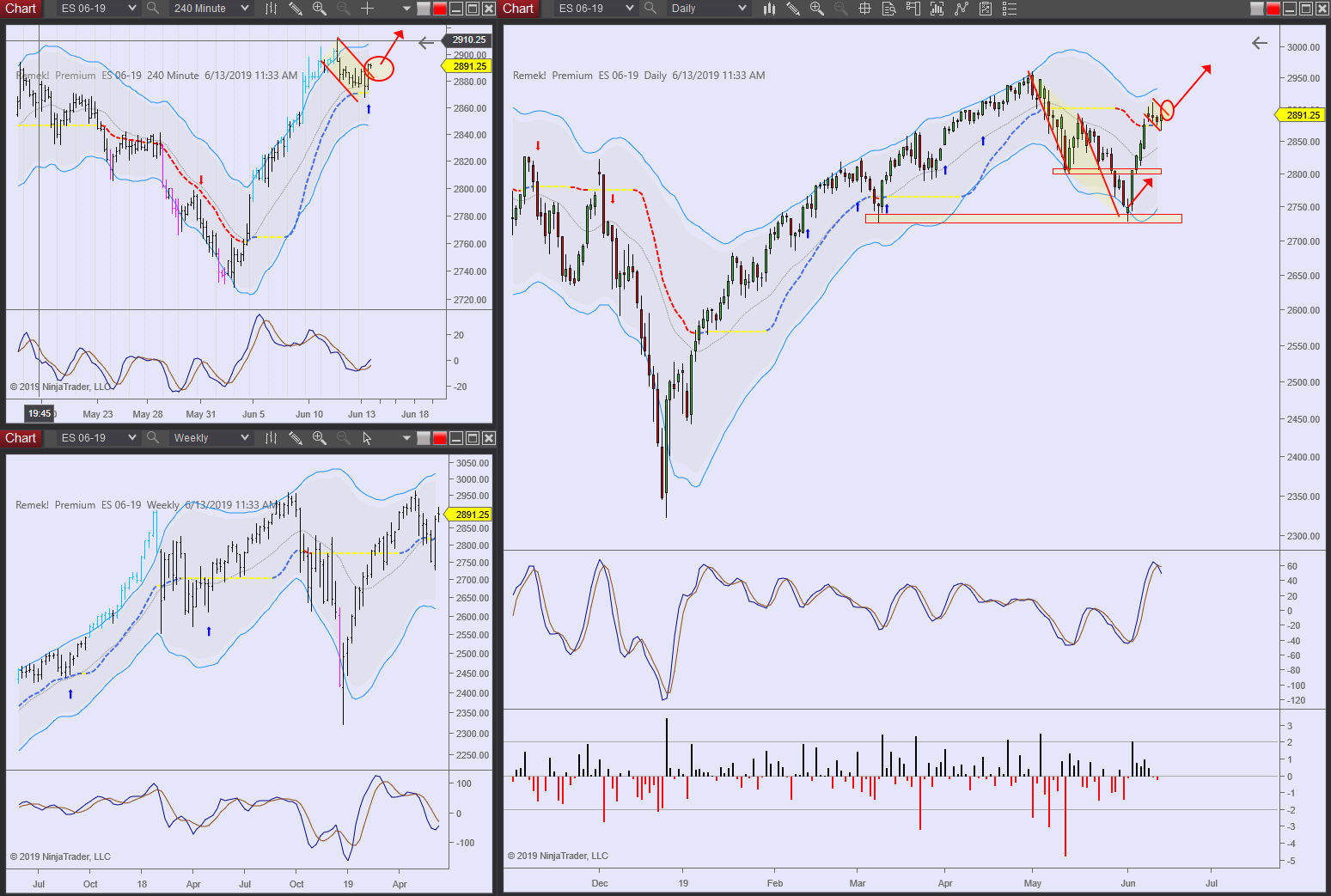

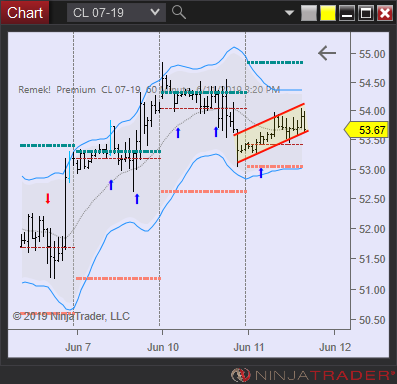

Commodities: CL: bullflag on 240min, see chart below.

Currencies: 6J: move completed, monitoring for consolidation above previous resistance in coming days

Financials: ZB: excellent bullish structure, monitoring for entry with momentum

FOR THE TRADING DAY OF thursday, 2019 06 20

Indexes:

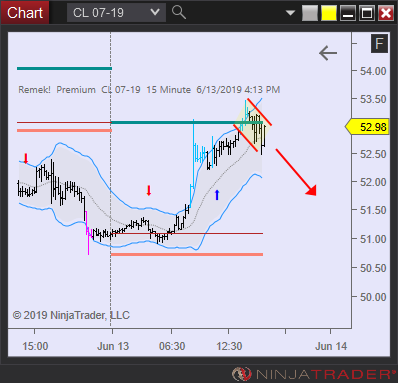

ES: see below: 1. post-FOMC context, 2. bullflag setting up 3. triggered overnight, managing position

Below: intraday chart: a chance to join what is likely to become a trending day. To the right: the larget context and plan for the coming days.

Pre-market update:

Currencies:

6J: 1. setting up 2. managing position 3. first target hit, risk-free

Financials:

ZB: bullish structure, room to go on weekly. The task is to find an entry. Watch for pullbacks on your timeframe.

FOR THE TRADING DAY OF WEDNESDAY, 2019 06 19

Post-FOMC update: ZB, 6J

FOMC at 2pm (ET): News.

Indexes: holding off. Expect volatility spike at/after 2pm ET.

Currencies: 6J Long on daily

Commodities: complex bearflag on CL daily. Wait for momentum.

FOR THE TRADING DAY OF TUESDAY, 2019 06 18

FED meeting on Wednesday: News.

3am (ET) update: Managing positions on ZB, 6J, see below.

Indexes: bullish setup on daily. But: FOMC on Wednesday, meaning price movement is likely to be limited before 2pm Wed.

Commodities: GC: what looks like a failure test on the daily. We’re not planning long trades for now. CL: looking for shorts, see daily structure.

Currencies: 6J: excellent bullish structure with support from weekly. On the lookout to go long with momentum.

FOR THE TRADING DAY OF friday, 2019 06 14

Be aware of the News.

3pm update: Move just about completed on 6A.

7.30am ET update: bearflag, potential measured move on DX. On the lookout for longs on currencies, see jpgs.

Our strategy continues to perform well.

Commodities: GC target reached. Taking a breather (see jgp). CL: short, see below. Indexes: consolidating above bullflag is a bullish sign. Monitoring

Indexes: beautiful long setup on the dialy. Note the new high on daily Remek!MACD, hinting at ‘a lot of pressure in the bottle’. A run to 3000 in the next few days would not suprise me. See chart. On small account, consider using MES, the new micro ES instrument.

Currencies: 6A bearflag.

Commodities: GC: long, managing position, see chart below.

4am ET update: current positions, see jpg.

Indexes: 240min bullflags, managing positions

GC: we’ve been talking about this for days

CL: took profits at close of yesterday at previous low

FOR THE TRADING DAY OF Wednedday, 2019 06 12

Remek! Premium weekly.

We’re slowly wrapping up for the day. Convincing Premium performance. This is the time to be on guard and stay humble. See you tomorrow!

3pm update:

1pm update:

11am update:

GC: behaving as expected (see yesterday’s analysis)

CL: behaving as expected (see yesterday’s jpg)

Indexes: in mean reversion mode, standing by

10.30 ET update:

Indexes: aiming at previous all time highs. Find pullbacks to join the rally. Be ready to handle surprises.

GC: waiting for pullback to go long, see below.

6A: intraday bearflag to join daily bearflag for a potentially powerful move.

6J: entered long on what is likely to be a failure test

FOR THE TRADING DAY OF monday, 2019 06 10

Indexes: bullish intraday, but we’ll wait some pullback first

Commodities: GC: waiting for pullback trade CL daily, see below

Currencies: 6B bearflag on daily

Financials: ZB looking to go long

2.30pm (ET) update. See email comments as well.

FOR THE TRADING DAY OF FRIDAY, 2019 06 07

1pm (ET) update:

Remek! Premium results of the past 3 weeks.

12noon update: Three very strong weeks with our Premium trades.

News: 8.30am, 10am (ET)

Indexes: bullish bias

Currencies: 6J bullflag on daily 6B: bearflag on daily

Commodities: GC: bullflag on daily chart

Financials: ZB look to go long on 240m breakout

11am ET update: busy and profitable morning. Indexes as expected. GC as expected. CL range-bound, 6J bullflag working. ZB good, but skipped

Indexes: trending day, excellent longs, see below

GC: good longs, target 1360 area

CL: range-bound, got out with minimal loss

6J: took intraday profit, bullflag on daily, will monitor Sunday night for secondary entry

FOR THE TRADING DAY OF THURSDAY, 2019 06 06

3.30pm ET update: CL: stopped out, Indexes: managing positions.

10am ET update: Indexes bullish, CL short, GC long, see below.

6am ET update:

Indexes: bullish bias, see below.

Currencies: 6B managing position, see below.

News: 8.30am ET

Indexes: bullflags on 240min. 6J: monitoring bullflag.

FOR THE TRADING DAY OF Wednesday, 2019 06 05

Room open at 8.30am ET, for a 60 min session. Questions welcome!

9.30am (ET) update:

ZB: bullflag. CL: managing short Indexes: intraday bullflags GC: bullflag, target 1360 area

Indexes: our mean reversion idea worked well yesterday. We’ll have to see if there’s more steam in the bulls in the coming days.

GC: rally in progress, do not chase price, wait for pullbacks. This was a breakout from a weekly bullflag, an expected and powerful move.

CL: managing short, expecting further weakness today.

Currencies: looking to go long on 6J, see charts below.

Financials: pullback in progress on ZB. Monitoring setup. See chart below.

FOR THE TRADING DAY OF TUESDAY, 2019 06 04

3.30pm (ET) update: Spot on, see post in the morning.

11.30am (ET): Managing trades. Risk-free on the indexes. Good chart reading today.

10am (ET) update:

Managing positions. Our prediction for the Indexes for today was spot on.

Indexes: expect mean reversion mode today. 2800 is likely to be retested, so you can look for pullback trades to the long side above 2765..

Currencies: short on 6B

Commodities: CL short

FOR THE TRADING DAY OF moNDAY, 2019 06 03

3am (ET), European open: