Remek! Premium

Actionable real-time market intelligence for short-term traders

Designed to remove the obstacles between you and successful trading.FOR THE TRADING DAY OF friday, 2019 08 02

News: 8.30am, 10am ET

Indexes: waiting for clues

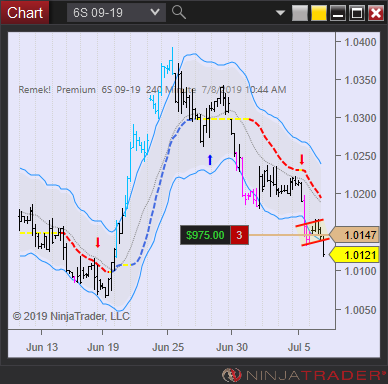

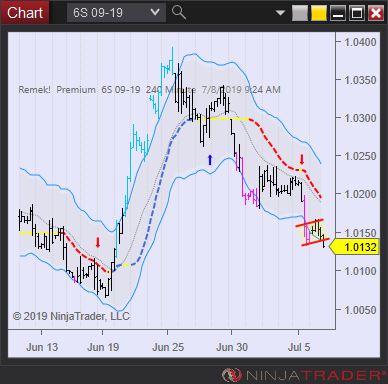

Currencies: 6J overextended on 240min, room to go on weekly, waiting for setup. 6S breaking out on daily

Financials: ZB: room to go to 165, waiting for pullback on 240min

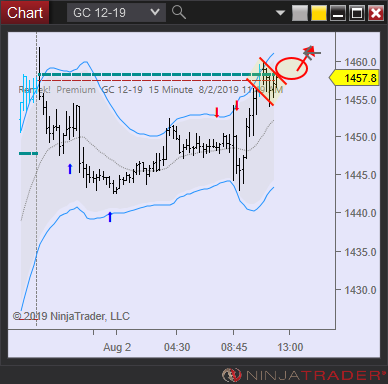

Commodities: SI, GC: accumulation (?), bullish breakout (?)

12noon ET update: Friday noon, locking in, wrapping up

FOR THE TRADING DAY OF THURSDAY, 2019 08 01

News: 8.30am, 10am ET

Indexes: ES, NQ intraday longs

Currencies: DX overextended on the daily, 6J long

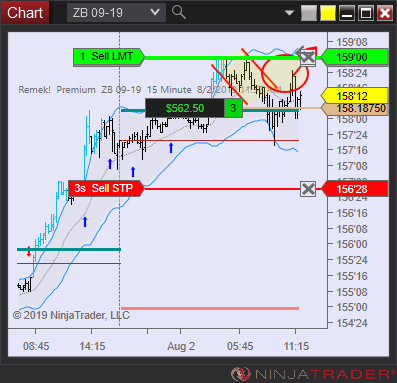

Financials: ZB long

4pm ET update: good trades on ZB, 6J, NQ. Will wait for pullback on ZB, 6J. Monitoring GC, SI for upside move.

11.30am ET update: getting paid

10.30am ET update:

6J Study: an important concept: using pattern failure to predict price movement: notice pattern failure on 240 chart. (bearflag failed, bullish momentum surfaced). This pattern failure told us to start looking for longs (and look for entry on LTF). Notice the strong counter-momentum intraday, upon the failure of the 240min pattern. Also notice how the LTF move is in synch with the bullflag on the daily (and the weekly as well, not shown.) This is a trade on the 240min, note the targets.Trade now risk free. Make sure you get paid.

FOR THE TRADING DAY OF wednesday, 2019 07 31

Indexes: FOMC at 2pm ET. Expect volatility. (We do not trade the indexes on FOMC days, not intraday.)

Financials: ZB long overnight

Commodities: GC: what looks like accumulation before next leg up above 1460, SI: room to go on weekly, monitoring both for setups

Currencies: looking for a short on 6S, 6B

2pm ET update:

12noon ET update:

FOR THE TRADING DAY OF tuesday, 2019 07 30

News 8.30am, 10am ET. FOMC starts today, with all its implications (expect limited price action up to 2pm Wednesday)

Indexes: range-bound price action expected today

Currencies: move on 6B done, waiting for setups

Commodities: GC: what looks like accumulation before next leg up above 1460, SI: room to go on weekly, monitoring both for setups

Financials: ZB long overnight

FOR THE TRADING DAY OF Monday, 2019 07 29

No News. But: FOMC on Wednesday, with all its implications (expect limited price action up to 2pm Wednesday)

Indexes: new highs are likely. Wed 2pm may serve as catalyst.

Currencies: 6B, 6S moving well, wait for next bearflag if not short yet.

Financials: ZB bullflag on weekly. Long setup on 240min.

3.30pm ET update:

12noon ET update:

8am ET update:

2019 07 28 9pm ET update:

FOR THE TRADING DAY OF friday, 2019 07 26

News at 8.30am ET. Expect this GDP data to be the catalyst today.

Indexes: bulls in control. 8.30am may be the trigger, but expect volatility.

Currencies: short setup on 6J 240min, 6B, 6E short intraday

Financials: ZB long on a weekly

Commodities: GC long intraday

12noon ET update:

FOR THE TRADING DAY OF thursday, 2019 07 25

News at 8.30am ET.

Indexes: aiming for new highs. Look for pullbacks.

Commodities: GC: bullflag on 240min.

Financials: ZB: bullflag on 240min

Currencies: bullish bias on 6J, 6S, waiting for setup

5pm ET update: another difficult, choppy mid-summer trading day. Bulls stay in control on the indexes.

FOR THE TRADING DAY OF wednesday, 2019 07 24

News at 10am, 10.30am (CL) ET.

Indexes: no change since yesterday. ES, NQ likely to reach new highs.

Currencies: DX breaking out on the weekly. This may mean we’ll start to have some setups, finally.

Financials: ZB long, both on the weekly, and also intraday

Commodities: GC long to previous high

4pm ET update: Indexes: as expected. CL short in progress, ZB long in progress.

12noon ET update: Indexes: long, CL monitoring for short.

10am ET update: Managing positions on: indexes, GC, ZB. See below.

FOR THE TRADING DAY OF Tuesday, 2019 07 23

News at 10am ET.

Indexes: strong pre-market action. May turn into a trend day.

Currencies: not too many good setups, see below

Financials: ZB: same move as yesterday. Bullflag on weekly.

Commodities: CL short, see below

FOR THE TRADING DAY OF MONDAY, 2019 07 22

No News.

Indexes: ES: at major support. A failure of (upcoming) bearflags on the 240min would indicate the bulls are in control, otherwise we may end up seeing a more substantial retreat (to 2900? 2850?). Monitoring.

Currencies: DX: bullflag on the weekly (see below), which may lead to a measured move (see daily). We’ll be watching for signs telling us that we’re wrong!

Commodities: GC: gave it all back on Friday. Monitoring. SI: lagging behind GC, which is near July 2016 levels, SI has a lot of catching up to do!

Financials: ZB: bullish structure on all three timeframes. Let’s see how we can translate that into concrete trades.

3.30pm ET update:

8am ET update: ZB: entry last night, managing trade (see below). Note that this trade is a pullback on the weekly, the daily and we entered on a pullback on the 240min. A perfect storm. Decide on which timeframe you’re trading it, and be consistent.

FOR THE TRADING DAY OF friday, 2019 07 19

No News.

11.30am ET update: CL short, indexes, GC consolidating, ZB: monitoring for long. Slowly wrapping up for the week. Premium equity curve since July 1, 2018.

Indexes: Bulls in control. Friday: sideways action is likely.

Currencies: bullish DX (see weekly below), monitoring

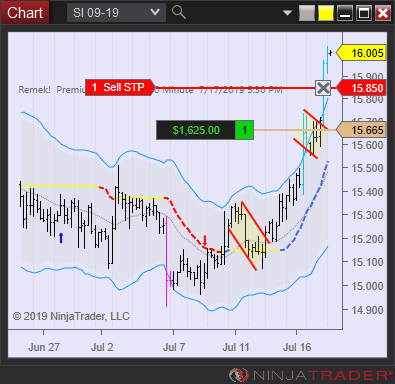

Commodities: GC 1460 area reached as expected. SI: target reached, see below. A day or two sideways consolidation is likely on both. This was the week of the silver, and we were on it from the beginning!

Financials: ZB: bullish.

General comment: a slow day expected, with consolidation on the indexes and commodities at these levels. Don’t get chopped up.

FOR THE TRADING DAY OF thursday, 2019 07 18

News at 8.30am.

Indexes: ES: a healthy pullback on the daily yesterday. Let’s see if the bulls take back control today.

Financials: ZB: bullish

Currencies: shorts expected on currencies (e.g. 6E) against the USD

Commodities: SI: wait for a pullback on the 240min. GC: 1460 expected

5pm ET update: a busy and profitable day. Our methodology works, even in the treacherous environments we’re in now.

8am ET update:

FOR THE TRADING DAY OF wEDNESDAY, 2019 07 17

News at 8.30am, 10.30am ET.

General observations: several setups, a bit more clarity than in previous days, including currencies. See details below.

Indexes: holding above support. We’re bullish until proven otherwise.

Currencies: 6J, watching for a long, see jgp. Potential shorts on other currencies against the USD, see DX chart below.

Commodities: SI long (see below), GC, CL less so.

Financials: ZB: long on 240min breakout, see HTF context below.

4pm ET update: Overnight positions below. The day included a loser on NQ. Back tomorrow.

10am ET update: a busy open, we’re doing good

8.30am ET update:

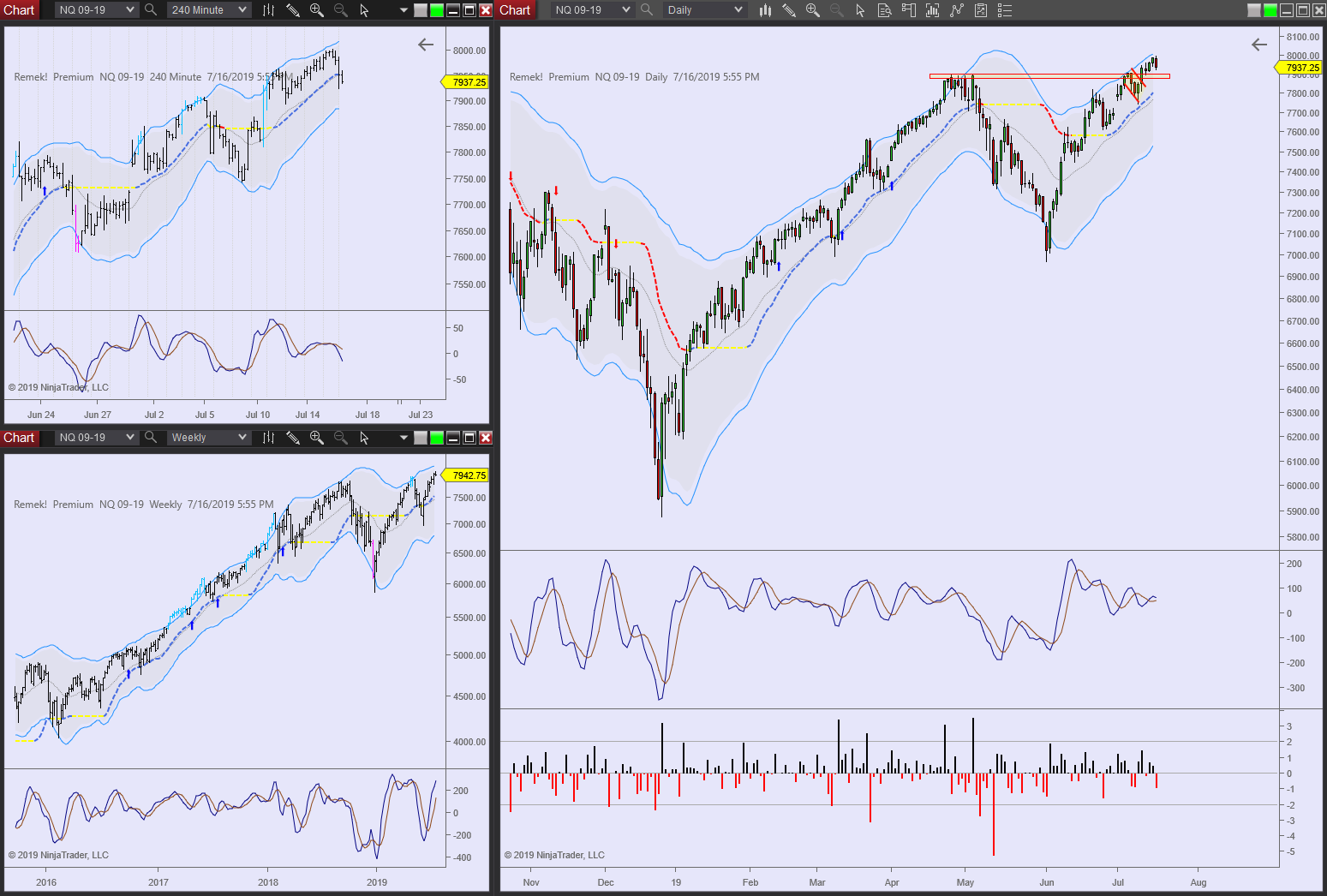

The long term view (Indexes): see the chart below: we might just be in a measured move on the weekly.

FOR THE TRADING DAY OF tuesday, 2019 07 16

News at 8.15am, 9.30am ET.

General observations: Slow price action, often no follow-through, characteristic of the mid-summer market, results in a difficult trading environment. It is crucial to preserve capital and be alert for opportunities at the same time. Consider scaling back (e.g. going in half-size) until clarity returns.

Indexes: slow, boring grind upwards should not distract you. This is still a bull market, until further (and obvious when it comes) notice.

Currencies: limited clarity on the DX chart below.

Commodities: stopped out on CL, ready to consider reentry. Bullish on SI, GC.

Financials: ZB what looks like a failure test. Advantage: clearly defined stop. Disadvantage: may require time to develop.

3.30pm ET update: another “no follow-through” day. SI worked, GC didn’t move, CL failed, 6C failed, 6E worked, 6B was missed (and not chased). A mixed bunch. To repeat: for mid-summer action (rather: non-action), and after a 6-week rally on the indexes back to all time highs and consolidating (aka sideways action), plus certain political and economic/trade related uncertanties, this is completely normal. Back tomorrow!

8.30am update: setups and positions

FOR THE TRADING DAY OF mONDAY, 2019 07 15

No major News.

Indexes consolidating above previous resistance. Bullish bias until proven wrong.

Currencies: Long on 6J,

Commodities: Long on SI.

1pm ET update:

8.30am ET update: Managing positions ES, NQ, SI, bullish setup on CL

FOR THE TRADING DAY OF friday, 2019 07 12

News at 8.30am ET.

General observations: Indexes consolidating above previous resistance. Expect a bullish breakout from this area. Bullish bias until proven wrong.

Currencies: Managing 6C, 6J. Difficult environment, little clarity in general.

Commodities: GC 1460 expected, the question is how we’ll get there. CL: consolidating above previous resistance.

4pm ET update: holding CL for next week. Risk-free and/or taking profits before the close of the week.

12noon ET update: Managing positions (6J, 6C)

FOR THE TRADING DAY OF thursday, 2019 07 11

News at 8.30am ET.

General remarks: FOMC behind us. A number of good trades today (CL, GC, indexes). Market (indexes) at all time highs. Do not expect another rally tomorrow, a consolidation at this level is more likely. Not much on currencies. If in overnight positions (CL, GC) trail your stops, make sure you get paid.

Indexes: no rush, will wait for setups, consolidation at this level is a bullish sign

Currencies: see 6J below: there are several clues in support of the breakout on the 240min. If you decide to do it, make sure you respect your stop on the 240min low (aka the low of today’s candle on the daily). Note the weekly structure, with the potential volatility expansion.

Commodities: good moves (and trades) on GC and CL, expect some consolidation.

4pm ET update: tight-range day, consolidation on the indexes, GC and CL. Back tomorrow.

7.30am ET update: intraday pullback on 6J (see 6J trade below). 6C: managing position. CL: monitoring for a potential next leg up.

Good read on CL:

FOR THE TRADING DAY OF Wednesday, 2019 07 10

News at 10.30am (CL). 2pm FOMC

General remarks: On FOMC days, I scale back or do not trade. The session is often less tradable than usual, as the market is waiting for the 2pm announcement.

Analysis:

GC has been consolidating in the 1400 area for 10 days or so, with decreasing volatility, breaking out of the 240min triangle today. If it stays above 1400, the next target area may easily be 1460. You may want to monitor this, and plan if and how you may want to participate if this move starts to materialize.

CL: breaking out of a week-long consolidation on the daily. A measured move may take us back to the 66 area. Note the preceeding momentum peak on the daily Remek!MACD, the momentum cross, and the strong RRR. How you may want to translate this into concrete action will depend on your account size, and trading timeframe. For us, as always, we’ll be focusing on the 240min for the setup, look to the daily for context, and finetune the entries (aka trigger) on the Precision Chart (e.g. 15min) intraday.

Note: to price-based triggers overnight, we often use stop entries, a technique worth considering.

9am ET update: managing positions from yesterday. Taking profits pre-FOMC, pre-Oil report.

CL: managing long position

Currencies: see DX chart below, bullflag on the weekly, with room to go (context for the coming days).

FOR THE TRADING DAY OF Tuesday, 2019 07 09

No major News.

3.30pm update: Good reading on the indexes (pattern failure leading to bullish move). Positioned long on CL and GC. Good short on 6B, 6E (from last night)

11.30am ET update on what became a busy morning. The main points:

- indexes on the move, potentially to all time highs

- potential move on CL to the 60 area (or more)

- GC intraday pullback trade

- managing two runners on 6B, 6E

7am ET:

Indexes considered bullish unless current pullback closes significantly below the 2950-2060 area. CL: monitoring for breakout on 240min (backed by daily) Currencies: managing runner(s).

FOR THE TRADING DAY OF Monday, 2019 07 08

No major News.

General observations: A quiet post-holiday Sunday open. Waiting for clues.

Indexes: ES consolidating above the 2960 area, a bullish indication.

Currencies: DX: bullish, expected to yield some shorts on currencies against the USD. 6E/6S: monitoring for short entry on 240min. 6C: trend continuation setup (waiting for trigger)

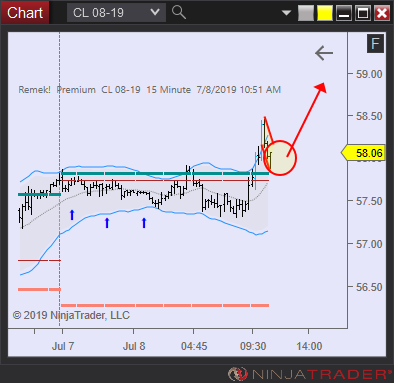

Commodities: CL: Monitoring for potential measured move.

4pm ET update: No follow-through in the afternoon.

11am ET update:

CL triggered (intraday entry into a daily setup). 6E, 6B, 6S triggered.

9am ET update:

FOR THE TRADING DAY OF FRIDAY, 2019 07 05

News at 8.30am ET.

General observations:

Bullish structures in several asset classes. Indexes overextended. “Holiday mood” Friday: we won’t force trades before the weekend.

Indexes: at all time highs. If long, trail it, if not, don’t chase it.

Currencies: DX bullish. Monitoring for entries on 6E (daily), 6J (240min/daily). Breakout on 6S.

Commodities: Monitoring bullish pressure on 240min SI, supported by daily structure

Financials: bullflag on ZB

12.30pm update: Example for trade management on today’s 6S and 6E trades. The rules: 1st target: 1R or previous pivot, whichever is closer. 2nd target: 1R. 3rd (open) target: runner, trailed behind pivots (often on tick charts) until stopped out. Make sure you define your own trade management rules and follow them consistently. Include a provision in your trading plan for “updates”, meaning you should regularly (say, once a month) review your plan and make results-based adjustments as needed. Use this table: https://www.remek.ca/system-metrics-calculator to size appropriately. Stick to the “Max. allowed risk per trade (% of account size) = cca 3% rule. Remember: your primary purpose as a trader is not ‘to make money no matter what risk’ but to stay in the game.

9am ET update: Managing 6S, 6E

See details below:

FOR THE TRADING DAY OF Wednesday, 2019 07 03

General observations: Our bullish bias on the indexes has been correct: we are at all time highs. Expect limited action today, due to the US holiday tomorrow. Of anything substantial, you’ll be notified in due course.

Indexes: New highs, move on limited volume, probably will be re-tested after the holiday.

Financials: ZB long, managing position.

Commodities: GC potential exhaustion on daily (with a potential pattern failure on 240min, see below)

2pm ET update:

Closing shop for the day. Note: the image below shows Remek! Premium’s performance between July 3, 2018 and July 3, 2019. Happy July 4th!

11am ET update:

FOR THE TRADING DAY OF TUESDAY, 2019 07 02

General observations: Expect limited price movement (range-bound action), lower than average volume and increased lack of follow-through leading up to the July 4th US holiday. We’re scaling back a bit this week.

Indexes: Expect consolidation, range-bound action. We expect new highs after the holiday.

Financials: ZB - bullish breakout (see below)

Commodities: Monitoring pullback on SI, see chart below.

4pm ET update: Good read on ZB, SI, NQ, see below.

FOR THE TRADING DAY OF Monday, 2019 07 01

General observations:

July 4th coming up, expect limited volume (which may manifest itself as increased unpredictability) on US markets. It’s okay to scale back, even stay out. Also, Canada Day in Canada today, expect Canadian investors to be at the cottage rather than at the computer screens today.

Indexes:

Large gap up. If you were lucky to be in, manage the trade. If not, do not regret. There will be ample opportunities to come our way. (We’re also managing a couple of longs, see below.)

Currencies:

Waiting for bearflag on DX, monitoring for long entries on 6E, 6S etc. (See below.)

Financials:

Waiting for ZB, see below.