Remek! Premium

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

New members: make sure you read the Remek! Premium Documentation.

FOR THE TRADING DAY OF monday, 2019 09 30

No major News release.

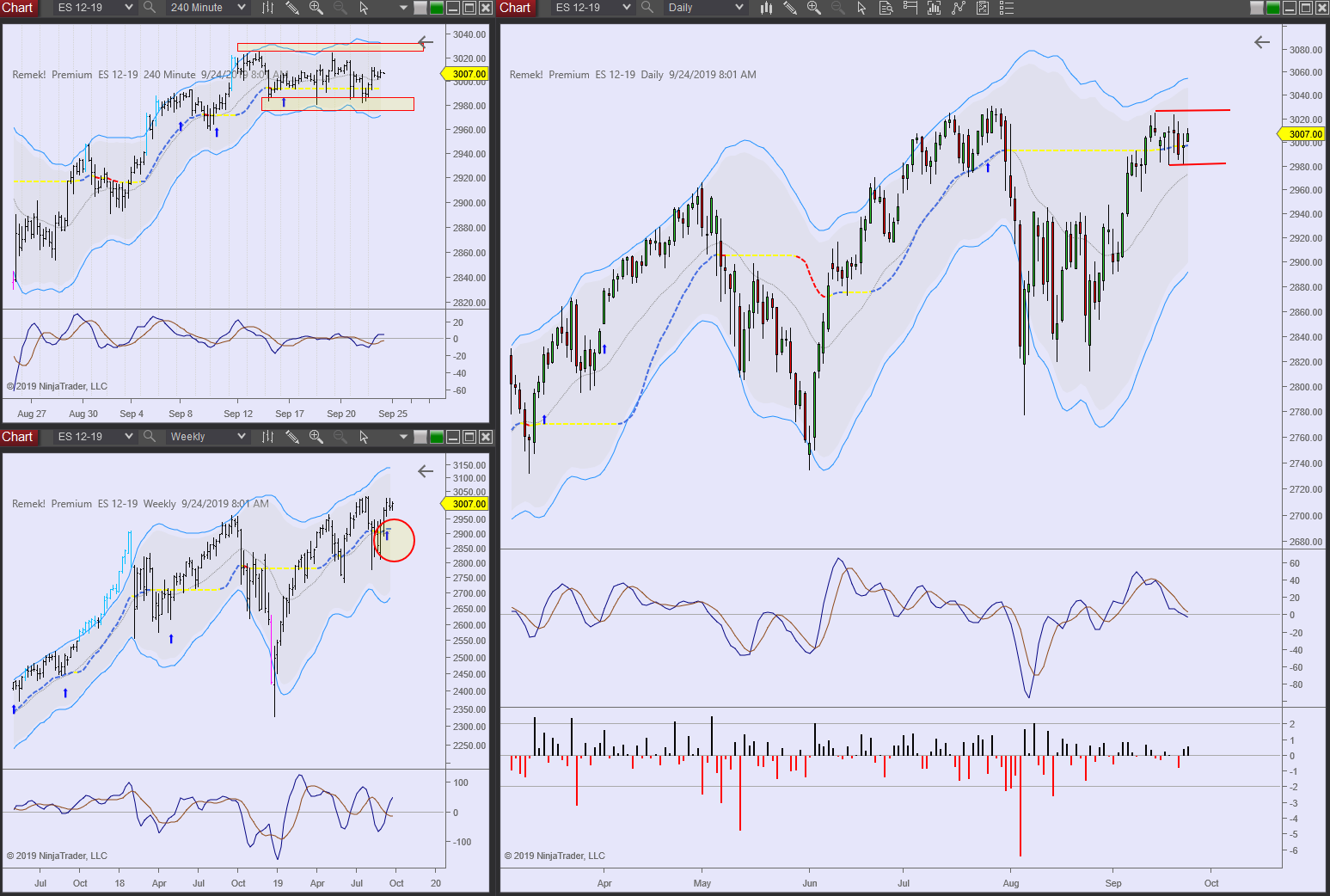

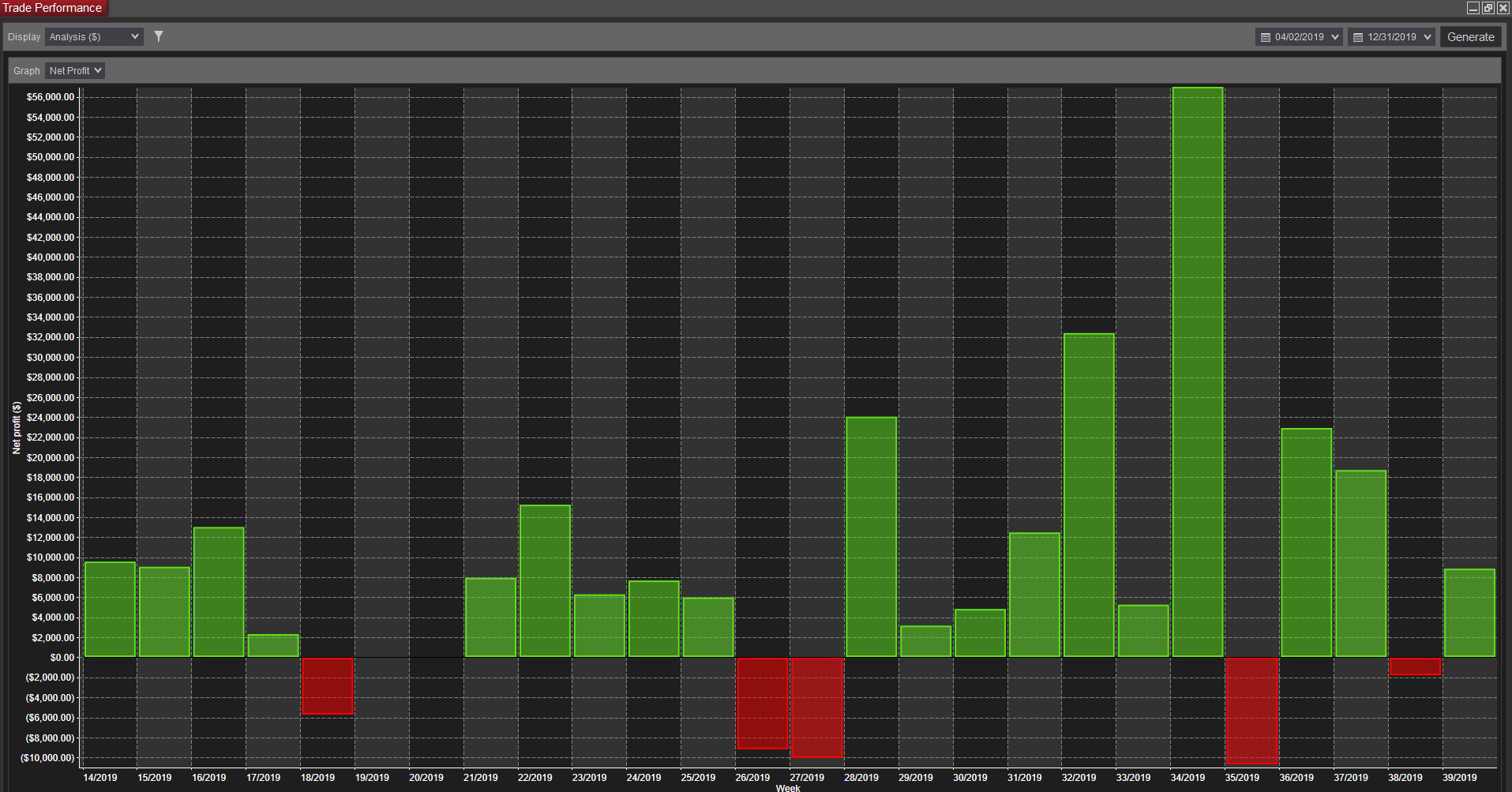

General comments: Our past two weeks were flat. We expected new highs on the indexes, which has not happened. (Note: it’s still just a bullflag on the daily, so we continue to be bullish until proven wrong.) We were also stopped out from a long on SI. All in all, our losers were compensated by a few good trades e.g. on currencies. Given the uncertainties (including political) in the US, we’ll wait for clarity on the indexes. On currencies, we’ve seen some good setups (e.g. 6E, 6J), ending a rather untradeable several weeks. Our method continues to be rock-solid (see jpg). Note: our focus is the 240min chart, with targets at 1R.

Indexes: no change since yesterday: what we see is a pullback on the daily; still, the many days we’ve spent in this consolidation zone is somewhat surprising (and may be related to the political events in the US). We continue to think independently, and focus on our technical patterns and technical analyses.

Commodities: complex consolidation, no clear setup on GC/SI. Long bias mid-term, no position at the moment.

Currencies: bullflag on the 240min DX (see below), part of a push to previous highs on the weekly. Mmonitoring for short setups on major currency pairs

Financials: technically an short anti on ZB, but short potiential is dissipating. Monitoring.

3.30pm ET update: Managing positions. All Phase 3: Risk-free.

12noon ET update:

7am ET update:

6B study: Timeframe conflict: although we have a short setup on the 240min chart, it goes against the bullish structure on the daily. So we’ll skip this short. (In situations like this, the higher timeframe tends to prevail.) See jgp.

10am ET update: ES/NQ intraday long triggered. 6J: short. 6E: managing runner.

Sunday 10pm update:

FOR THE TRADING DAY OF friday, 2019 09 27

News at 8.30am ET.

Indexes: no change since yesterday: what we see yesterday is a pullback on the daily; a move towards all time highs is likely.

Commodities: monitoring

Currencies: strength on DX, monitoring for corresponding shorts on 6A,

Financials: anti on ZB

FOR THE TRADING DAY OF thursday, 2019 09 26

News at 8.30am ET.

Indexes: what we see yesterday is a pullback on the daily; a move towards all time highs is likely.

Commodities: long-term bullish bias, monitoring

Currencies: with strength in DX, we have a bit more clarity. Shorts in progress on 6S, 6E. 6A expected to follow.

Financials:

FOR THE TRADING DAY OF wednesday, 2019 09 25

News at 10am ET.

Indexes: general environment: increased (political) uncertainty, waiting to see what yesterday’s candle means (see below), no trades planned before the open

Commodities: GC, SI bullflag on the 240min, expecting the trend to continue

Currencies: see DX below, expect corresponding short setups on major currency pairs

Financials: ZB short anti dissipates in strong bullish momentum with no clear setup; monitoring

10.30am ET update:

Note on 6J (see below): timeframe conflict between 240min and daily. HTF usually prevails. We usually prefer to wait for clarity or skip it if we’re busy elsewhere (like now on 6E).

1pm ET update:

9am ET update:

FOR THE TRADING DAY OF tuesday, 2019 09 24

No News.

Indexes: pressure to the upside (see below)

Commodities: GC, SI bullflags on 240min; GC you trade GC, be aware of the big picture (and no, 50% is NOT a fib). A retest of the 1450 area would be normal, and would not change our long-term bullish outlook. A clear break above the 1600 level without a revisit to 1450 is also possible. Manage your risk accordingly. (MGC is an option on smaller accounts.) SI has not recovered as much of the territory compared to 2011 as GC has, so it's relatively lagging behind GC. (Note: SI may be subject to different dynamics than GC, so we cannot expect that the two always behave in sync.) Good potential on SI, as it is - probably - heading to the 22 area.

Currencies: generally: confusion. 6J bullflag on 240min (warning: suboptimal environment on daily, see below), 6C bullish outlook on weekly, monitorint

Financials: ZB bullish, but no setup at this time

4pm ET update:

FOR THE TRADING DAY OF Monday, 2019 09 23

No News.

Indexes: pressure to the upside (see below)

Commodities: GC daily anti failing, monitoring weekly bullflag, SI anti dissipated, we’re bullish (this could be the start of a move lasting to the end of the year, with SI potientially heading back to the 22 area)

Currencies: 6E, 6A shorts setting up

Financials: ZB anti dissipated, bulls in control

2.30pm ET update: a good start of the week, we continue to read the markets reliably. Great work on SI/GC. Ready for more. Details below.

10am ET update:

7am ET update: SI risk-free, trailing runner, expecting a bullflag on the 240min.

6pm ET (Sunday) update:

FOR THE TRADING DAY OF friday, 2019 09 20

12noon ET update: a session where more than the usual number of setups are not cooperating much… it’s important to follow our methodology consistently in an environment in which major shifts can be expected (e.g. precious metals, financials) once that 3032 or so is reached on the ES. An environment with little clarity in currencies adds to the picture. We don’t control what the markets give us, we can only control our own behaviour.

Premium Room open at 9am ET. Click below to join us for a discussion, Q&A.

No News.

Indexes: pressure to the upside (see below)

Commodities: GC short anti dropped (see below), SI see notes below (this doesn’t change that I’m bullish on SI mid-term)

Currencies: watching for a breakout (breakdown) on 6E daily (see below)

Financials: ZB monitoring for an anti

Focusing on the indexes today.

FOR THE TRADING DAY OF thursday, 2019 09 19

News: 8.30am, 10.00am

Indexes: FOMC did not change the landscape, we expect indexes to reach new highs. In position.

Commodities: long CL, GC short anti dropped

Currencies: standing by

Financials: standing by

4pm ET update:

no change on the indexes, an eventless day, still targeting the previous all time highs.

No clear setups on currencies (see indecision on the DX below).

We’re monitoring a potential anti on ZB (see below), which we are very skeptical about due to the strength of consolidation bars. Nonetheless, monitoring ZB for a breakdown.

TF is lagging. If you trade it, consider a long position.

2.30pm ET update: a slow day on the indexes. GC: short stop entry, but never got filled.

FOR THE TRADING DAY OF WEDNESDAY, 2019 09 18

News: 8.30am, 10.30am (CL), 2pm (FOMC)

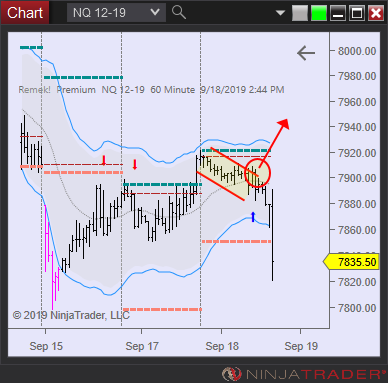

Note: standing by, no position planned on the indexes on FOMC day

Indexes: FOMC at 2pm, we continue to be bullish

Commodities: expecting CL to break higher. Bullish on precious metals..

Currencies: standing by

Financials: standing by

4pm ET update:

11am ET update:

FOR THE TRADING DAY OF tuesday, 2019 09 17

Note: we’re following our usual pre-FOMC routine today and tomorrow which is scaling back (both size and number of trades). Pre-FOMC days (Monday, Tuesday, Wednesday morning) tend to bring limited range and no follow-through on the indexes. After Wednesday 2pm we wait for the dust to settle before we engage with the market. We may participate in commodities and currencies.

News: 9.15am ET

Indexes: we’re bullish in general

Commodities: expecting CL to break higher. Bullish on precious metals..

Currencies: standing by

Financials: standing by

2pm ET update:

FOR THE TRADING DAY OF monday, 2019 09 16

General notes:

- the events in Saudi Arabia call for caution in the coming days, especially on CL

- the ES on the dialy timeframe continues to be bullish, and I expect further upside until the market tells me I’m wrong.

- FOMC on Wednesday: expect a slow first three days of the week

News: Saudi news on the weekend. No major news item today.

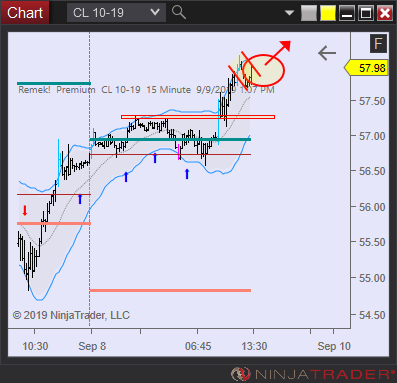

Indexes: previous high, practically, reached, waiting for clues

Commodities: the anti on SI was short-lived as expected (note: there was no corresponding setup on GC on Friday). Waiting for a setup to go long. CL: the current situation is nothing surprising based on our chart: we’ve been expecting an upside breakout for a week (see below). You can expect further upside, and position accordingly. Expect volitility.

Currencies: standing by

Financials: standing by

FOR THE TRADING DAY OF friday, 2019 09 13

General observation: An eventless week, in all, other than the indexes slowly grinding up, commodities/financials retreating after the big march, and currencies with no clear setup. We can’t force the market to do anything, only respond to what it does, which we do well.

News: 8.30am ET

Indexes: target: all time high. waiting for clarity on the 9.30am ET open

Commodities: short anti on GC/SI daily (against the longer term uptrend, plus it’s Friday, so I’ll skip it)

Currencies: no clear setup

Financials: ZB retreating, waiting for setup

FOR THE TRADING DAY OF thursday, 2019 09 12

REMEMBER TO ROLL OVER CONTRACTS.

News: 8.30am ET

Indexes: upside breakout in progress, target: all time high.

Commodities:

Currencies: 6C long

Financials:

FOR THE TRADING DAY OF Wednesday, 2019 09 11

News: 8.30am ET, 10.30am ET (CL)

Indexes: upside breakout likely

Commodities: CL long (overnight)

Currencies: long on 6C

Video: Revisiting Remek! Momentum (Pro/ProSTR) settings.

2pm update: Indexes moving as expected.

FOR THE TRADING DAY OF tuesday, 2019 09 10

News:

Indexes: ES, NQ upside breakout imminent

Commodities: CL long (overnight), SI consolidating

Currencies: long on 6C

9am ET update:

FOR THE TRADING DAY OF monday, 2019 09 09

News:

Indexes: ES, NQ likely to head to all time highs.

Commodities: CL monitoring for a bullish move, GC expecting a move to the 1600 area, waiting for clue, SI monitoring for a long entry

Currencies: 6E monitoring for a long

Financials:

3.30pm ET update: indexes, 6E sideways… holding positions, CL taking profits intraday

12noon update: CL is moving, indexes consolidating, 6E long triggered

FOR THE TRADING DAY OF friday, 2019 09 06

News: 8.30am

Indexes: ES, NQ likely to head to all time highs.

Commodities: CL monitoring for a breakout from this range (see below)

Currencies: DX trend intact on weekly. Indecision on daily. Stand by.

Financials:

Room open at 9am ET. Click to join. Pw: REMEKPREMIUM

FOR THE TRADING DAY OF thursday, 2019 09 05

News: 8.30am, 11am (CL) ET

Indexes: ES, NQ breakout has occurred. See two possible scenarios on 240min chart below.

Commodities: see SI study below

Currencies: reversals, no follow-throughs (6B, 6E, 6C

Financials:

10am ET update:

7am ET update:

FOR THE TRADING DAY OF Wednesday, 2019 09 04

News: 8.30am (we try not to be in a position 10min before and after; make up your own rule)

Indexes: ES, NQ an upside break is in the cards (see below)

Commodities: more upside to GC, SI (heading to 20), CL no clear setup,

Currencies: a difficult environment right now. Waiting for clues.

Financials: ZB consolidating, standing by

4pm ET update: a slow but profitable day; closing and/or managing positions. Sometimes markets just keep moving (grinding, rather) even after 4pm ET. When so, we lock in profits and go for a coffee.

12noon ET update:

8am ET update: indexes as expected (see below). This may turn into a trend day, monitoring.

FOR THE TRADING DAY OF TUESDAY, 2019 09 03

News: 10am ET

Indexes: pressing against upper edge of the channel (see below)

Commodities: GC, SI: managing longs

Currencies: DX rips, 6E/6C/6B drops against USD. Managing short on 6B. Be mindful of correlated risk

Financials: ZB consolidating, let it come back a bit on the weekly (see below)

11.30am ET update: locking in on GC, SI, done on 6B, holding ES

The charts that will guide us in the following days:

FOR THE TRADING DAY OF monday, 2019 09 02 labour day, markets closed.

Managing three open positions: GC, SI long, 6B short.