Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

Note: As part of the service, emails about setups may arrive in your inbox any time during the day. It is advised that you direct your Premium emails into a separate folder in your email program, so they do not interfere with your other activities during the day, allowing you to look at them at your convenience.

For the trading day of Tuesday, 2019 12 31

News at 10am ET.

Notes: last trading day of the year. Expect lower than usual volumes (nonetheless, substantial moves are still possible, exactly due to the low volume).

Indexes: healthy retracement (or start of something else?)

Commodities: GC/SI behaving as expected. You’ve known about this move.

Currencies: 6A wait for pullback, 6C likely to break above previous high,

Financials: ZB bullish

How to read Remek! Market Scanner Pro

RRR (Remek! Relative Return) = indicates an unusually big move on the timeframe selected. By default, it is set to “calculate on close of daily bar”, in which case it’ll tell you if the previous day produced a significant move. Watch for values less than -2 and greater than 2 (standard deviations). This is important because we prefer trading instruments with momentum. (Note: this is not necessarily the same as ‘looking at the chart and seeing a big bar”. RRR tells you how unusual and surprising yesterday’s move was, compared to how the instrument’s usual behaviour.)

Setup = 240min. Price is reverting towards the mean in the pullback channel. Time to start paying attention.

Signal = on the 240min timeframe (provides a glimpse into intraday dynamics, but above the weak hands’ noise). Price moving out of the pullback channel. This is the trigger. Whether we enter the trade at this point will further be qualified by additional (and individual) rules (see e.g. the post https://www.remek.ca/blog/2019/9/20/three-ways-to-enter-a-pullback-trade for details), as well as your additional risk or money management rules.

KScore (Remek! KeltnerScore, a new feature which will be rolled out in v2.5 of Remek! Momentum as well) = position of price within the daily Keltner Channel (1= at upper band, -1 = at lower band). Values near or beyond the upper Keltner are marked green. Values near or beyond the lower Keltner are marked red. Yellow values are neutral. This is important because we want to trade when momentum is present. Our preferred way to measure the presence of momentum is to measure how far price is from the Keltner midband. When price is stretched, we’ll start to look out for a pullback. We’ll look for trading opportunities as price moves out of that pullback, for a second leg.

The Remek! Market Scanner is our dashboard: it shows what we need to know in an objective, quantitative format. All our discretionary considerations rest on this objectivity, resulting in the quantitative, evidence-driven technical trading that we do.

For the trading day of Monday, 2019 12 30

News at 8.30am ET.

Notes: the start of another impartial holiday week (Markets will be closed on Wednesday.) Expect lower than usual volumes.

Indexes: continuing bullish pressure.

Commodities: GC/SI ready for the next leg up. (nothing new here: the weekly bullflag in action, something we’ve been aware of for many weeks.)

Currencies: continuing USD weekness, looking for longs on major pairs

Financials: bearish potential on daily expected to dissipate, long bias

Agriculturals: long on ZC

3pm ET update: 6C reaches target, bullflag on 240min SI, strong weekly GC, ES/NQ welcome mini-correction, 6J trailing runner. A busy day, considering where we are in the calendar. Wrapping up the decade in style. Also: long setup on ZB, see this: https://www.remek.ca/blog/2019/12/30/zb-study

10am ET update:

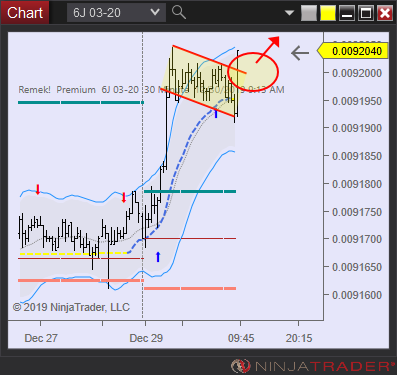

8am ET update: good bullish potential on CL (target 63 area), bullflag on 6J with a potential measured move. Watch for a bullish day on the indexes and a move to the upside on 6C. Textbook bullflag on SI.

For the trading day of Friday, 2019 12 27

News at 11am ET (CL)

General note: Indexes overextended. Potential signs of a beginning of flight to safety (ZB)

Indexes: above upper Keltner on both weekly and daily. Do not chase it.

Commodities: GC/SI consolidating after momentum move as expected. Monitoring for next leg up.

Currencies: 6J short setup, 6A long, 6C long breakout

Financials: ZB: signs of weekly bullflag taking control

Agriculturals: ZC long setup

A few additional notes to Remek! Premium subscribers at the end of the year:

The fact that you’ve signed up for and stick with this service is proof that you’re ready to face the task at hand in a professional manner. I commend you for that! This is a journey that takes time. The market is the toughest place. Still, trading, in its simplest form, is nothing but two things: a system with an edge + the ability to deploy that system with consistency. I have one year of data to show that what we do here has an edge. You add to that your own skill: adapt this system to your situation, test-drive it with you as the driver, then deploy it with confidence and discipline.

I’m planning to extend this service to other asset classes soon. Trading US futures on small accounts - even for seasoned traders - is asking for trouble, especially if required stops exceed 2% of the traded account’s size. A few losers in a row, which is completely normal and expected even for strategies with a sound edge, can have an adverse effect on the trader’s performance, something we want to avoid. So for smaller accounts, Forex or US stocks may make more sense, because they make more granular risk management techniques possible. Until new asset classes are introduced on this page, think micro future contracts on small accounts. (If you trade a small account, you’re not here to make money, you’re here to learn to trade! Which is worth much more than a few lucky strikes.)

I have to say this, because some of you have brought it up: if you want to trade smaller charts because ‘there stops are smaller’, you’ve got it backwards. You should trade smaller charts only if that’s where you have your edge, not because stops are smaller! Small charts is where all the novices trade, and they’re the ones who create the noise (aka random price action, which is untradable). That noise is exactly what we have to avoid. So we trade above that noise because

a) in that noise we, not being high-frequency traders, have no edge

b) we know where our own edge is and that’s where we have to be.

Therefore the 240min, with a keen eye on the dialy and, for wider context, the weekly.Bottom line, you now have the tools, add to that your skills. Any questions, just write. Mindful trading!

4pm ET update:

For the trading day of thursday, 2019 12 26

News at 8.30am ET.

General note: Expect limited volume today.

Indexes: above upper Keltner on both weekly and daily. Momentum waning on daily. A pullback would be healthy.

Commodities: GC/SI broke out on the weekly. Monitoring for pullbacks on LTF. Based on the weekly, this may be the start of a long bullish trend: we’ll just have to read the chart as it developes.

Currencies: 6J short setup, 6A long setup

Financials: ZB: bearflag on 240min, but bullflag on weekly. Monitoring.

Agriculturals: ZS, ZC long setups

11am ET update:

7am ET update: As expected, GC/SI weekly bullflag in full control.

For the trading day of tuesday, 2019 12 24

No News.

General note: Christmas eve, shortened session. Markets closed on Dec 25. Scaling back is okay.

Indexes: Caution advised, overextended.

Commodities: GC/SI breaking to the upside

Currencies: USD reestablishing strength, 6E short, 6J short, 6B short

Financials: ZB: bearflag on 240min, but bullflag on weekly

4pm ET update: Markets closed at 2pm, closed tomorrow. We wrote about ZB: weekly bullflag reasserting itself while the 240min bearflag fails: that is exactly what may be happening as we look at the close today. We’re cautiously confident in our data-driven observations and analyses, and will continue to act upon them while managing risk at all times. As to GC/SI, we kept a couple of runners for Friday.

9.30am ET update: GC, SI moving (no surprise, we’ve been expecting this). The bullflag on the weekly is reasserting itself. If this continues, we can expect ample opportunities to trade precious metals on the long side. Keep an eye on ZB: bullflag on the weekly, but short setup on the LTF. The weekly taking control would not be surprising. (And a bullish GC/SI/ZB would be an indication of flight to safety from equities.) As for us, we’ll just go with the flow.

For the trading day of Monday, 2019 12 23

News at 8.30am, 10.00am ET.

General note: holiday week, with markets closed and/or shortened midweek. Expect limited volatility and increased lack of follow-through.

Indexes: Risk-off mode, bullish session expected with notes above.

Commodities: GC/SI positioned to break to the upside, CL further upside expected

Currencies: USD reestablishing strength, 6C monitoring for long entry, 6E monitoring for short

Financials: interesting timeframe conflict on ZB: bearflag on 240min, but the weekly bullflag may be taking control.

Agriculturals: ZW monitoring a bullflag on 240min/daily, ZS bullflag on 240min/daily, ZC bullflag triggered

Cryptos: buy anti on BTC

5pm ET update:

2.30pm ET update:

8.30am ET update: BTC buy anti in progress. ZB/GC/SI signs of accumulation. ES/NQ long but be ready to cover your back. DX strength i.e. 6E short.

For the trading day of FRIDAY, 2019 12 20

News at 8.30am, 10.00am ET.

Indexes: Risk-off mode, bullish session expected.

Commodities: GC/SI positioned to break to the upside, CL further upside expected

Currencies: 6A long

Agriculturals: long on ZC, ZW

Remek! Market Scanner Pro (press F5 to refresh table)

RRR = indicates unusually big move the previous day. Watch for values less than -2 and greater than 2.

Setup = 240min. A trade is setting up, and price is within the pullback channel.

Signal = 240min. Price is moving out of the pullback channel, triggering a trade.

(Not all triggered setups will be taken, final decision to enter a trade will take into account risk management (1R), money management (2% rule), potential correlations and any other rules defined in our trade plan.)

2.30pm ET update: closing positions, except for a runner on SI

8am ET update:

For the trading day of thursday, 2019 12 19

News at 8.30am, 10.00am ET.

Indexes: At all time highs. Flattening out. Overextended.

Commodities: GC/SI positioned to break to the upside, CL long

Currencies: 6J short, 6A long

1pm ET update: stopped out of 6J. All other setups are working as expected. GC, SI, 6A, 6S, CL.

9.30am ET update:

ES: upside break likely, but due to the holiday, the volatility environment is likely to remain. Not an optimal trading condition (for us, trend traders)

6A: long setup

Agros: longs on ZW, ZC, ZS

9.30am ET update:

For the trading day of tuesday, 2019 12 17

News at 8.30am, 9.15am ET.

Indexes: at all time highs. Do not chase it.

Commodities: GC/SI positioned to break to the upside

Currencies: short anti on 6A, long on 6E/6S

Financials:

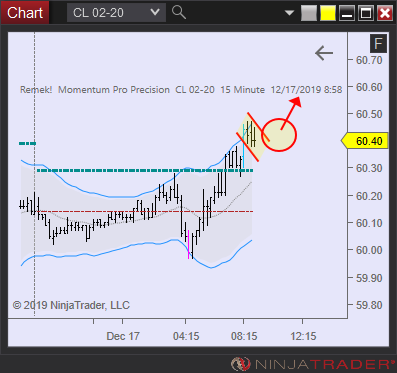

12noon ET update: good long on CL, 6S. 6A anti done.

6A STUDY - See first chart below for details:

1) we did a good anti overnight (see the anti here: https://www.remek.ca/remek-system-part-5-the-setups#anti). The anti was a short trade, and on the short term (our target is always a measure move with the anti, not more). With that, the anti is done.

2) And now, the same structure (the anti having run its course) is nothing but a complex bullflag. Isn't that beautiful? And now we'll be on the lookout for our usual momentum trade as price leaves the pullback channel (aka consolidation area).

An example of how to read price action and interpret it within our methodological framework.

9am ET update:

7am ET update:

For the trading day of monday, 2019 12 16

News at 9.45am ET.

Indexes: at all time highs. Do not chase it.

Commodities: GC/SI/CL monitoring for bullish breakout

Currencies: monitoring for a short on 6J, potential long on 6A

Financials: ZB monitoring for bullish breakout

12noon ET update:

For the trading day of friday, 2019 12 13

News at 8.30am ET.

Indexes: breakout as expected. Do not chase it.

Commodities: GC/SI still in limbo with a likely bullish resolution long-term, and a potential short breakout short term. CL bullish breakout expected (entered long with stop entry overnight).

Currencies: 6A target reached. 6B target reached with increased volatility due to macro event (UK elections)

For the trading day of thursday, 2019 12 12

News at 8.30am ET.

Indexes: bullish breakout expected (could happen overnight)

Commodities: bullish on CL, short term short potential seems to have dissipated on GC, SI

Currencies: 6B, 6S pushing up to targets, bullish potential on 6J

Financials: long potential on ZB

9am ET update:

9pm ET update:

For the trading day of Wednesday, 2019 12 11

News at 8.30am ET, 10.30am ET, 2pm ET (FOMC)

Note: expect volatility increase at 2pm. Bullish bias on the indexes. GC/SI: short term bearish (see setup with SI stop entry below), long term bullish. 6B, 6S longs in progress

5pm ET markat wrap: good reading of price action on currencies (6B, 6S, 6A), GC/SI today. Good analysis on indexes and ZB.

12noon ET update: GC/SI STUDY - On the lookout for higher prices in the coming days. Wait for the market to talk to us via pullbacks/consolidation areas: that's where we do business. 6J A reflection of USD weakness. Expect further strength. GC pattern failure in the works (lower prices out of bearflag rejected). Pattern failures and price rejections provide insight into the behavioural drivers of market participants and thus important clues for what may come next. Waiting for 2pm. Based on the morning price action on precious metals, a 1490 GC soon would not be surprising. Even greated potential on SI. We’ll follow the usual plan.

9am ET update:

Currencies: 6A, 6B, 6S a few good longs against the USD.

Indexes: Bullish bias on the indexes, but we’ll be standing by until after 2pm.

FOR THE TRADING DAY OF tuesday, 2019 12 10

No News. (FOMC meeting begins today.)

General note: FOMC meeting in progress. Expect limited follow-through as the market awaits the Wed 2pm news release (which is usually a catalyst for increased volatility.) Usual considerations apply: scale back Tuesday and Wednesday.

Indexes: see above

Currencies: 6B, 6S longs in progress/have triggered

Commodities: GC/SI monitoring for short-term breakdown. Weekly bullish structure intact for now.

FOR THE TRADING DAY OF Monday, 2019 12 09

No News.

General note: This is a more difficult than average end-of-year trading environment. We’re in a ten-year-old bull market that is starting to show some signs of fatigue. That said we continue to be cautiously bullish on the indexes. See details below. Also: FOMC this Wednesday! Usual considerations apply: scale back Tuesday and Wednesday. Expect volatility expansion at 2pm Wednesday.

Indexes: watching what will happen if previous high is reached. Watch out for a failure test. That said, further upside is likely, based on Friday’s convincing bullish rally. In that case, we’ll be on the lookout for the first pullback after the breakout (as you will know by now :) )

Currencies: 6B, 6A longs setting up

Commodities: SI broke down, same on GC likely. Consider short on 240min/daily on the breakdown of GC. (This does not contradict the fact that there is still a valid bullflag on the weekly, and that we’re long-term bullish on precious metals, at this point in time, based on information available now.) The weekly structure may take control in the long run, or the daily shorts may end up totally ruining the weekly chart’s bullish outlook. We’re witnessing, in real time, the sometimes rhyming and sometimes conflicting, but always beautiful dance of the various timeframes.)

12noon ET update: ZS - Short potential has dissipated. Removing Stop Entry. ES - A bullish consolidation that is likely to get resolved to the upside. Finetune on 15min if considering entry. 6S - Agressive entry based on the 15min chart.

FOR THE TRADING DAY OF friday, 2019 12 06

News at 8.30am ET.

General note: This is a more difficult than average trading environment. Preserve capital.

Indexes: on the sidelines for now

Currencies: continued weekness on USD, resulting long setups on 6E, 6A, or trades in progress 6B

Commodities: on the sidelines until momentum arises on GC/SI

12noon ET update: a strong vote of confidence (indexes) for the bull market on a Friday. DX: strength found. No more currency trades today. GC/SI: shorter-than-weekly longs in trouble, weekly not damaged yet. CL: a breakout that worked today. Done for the day, back Sunday night!

8.30am ET update: the jpgs for GC and 6C (one before one after the 8.30am news) demonstrate why we have the rule ‘no trades 10min before and after news releases’, and why NEWS is in the first row every day.

FOR THE TRADING DAY OF Thursday, 2019 12 05

News at 8.30am ET.

Note: major reversals on currencies (6C) and commodities (CL), increased uncertainty elsewhere (indexes, precious metals). Stand by for more clarity.

Indexes: standing by for clues, at this point it can go both ways

Commodities: GC bullflag on 240min, but judging from SI, bulls not out of the woods yet CL: what ‘weak long hands shaken out’ looks like

Currencies: 6B long performing well, 6C spectacular failure of short setup

4pm ET update: more of the same: no follow-through. The market needs a catalyst.

12noon ET update: some clarity emerges: weakness on the indexes, buyers on precious metals, strength on major currencies

8.30am ET update: setups agains the USD on 6J, 6A, 6S, 6E (correlated risk!). GC, SI held overnight. Waiting for fist pullback on 6C. Monitoring for weakness on ES/NQ.

FOR THE TRADING DAY OF wednesday, 2019 12 04

News at 10.30am ET (CL).

Indexes: monitoring if yesterday’s move leads to a further selloff or a quick recovery

Commodities: GC/SI: managing (overnight) longs. Wait for clean break on 240min if not long yet (see below), see SI note below

Currencies: 6B managing (overnight) long. Several setups against the USD: 6A setting up long on 240min, 6E: monitoring long potential (wait for breakout), 6S pressing into resistance

Financials: ZB monitoring 240min bullflag

1.30pm ET update: clear price rejection on 6C, CL. SI: pressure to retest the lows. A breaks and more selling pressure would cause substantial damage to the weekly chart. (We’ll have no trouble shorting it. Standing by.)

ES STUDY a) How trends fade and transition. b) And how the ice breaks. You can see how, the third time, the crowd ran for the door (irrationally, because nothing really changed in the world compared to the day before). Markets are, to a significant extent, a reflection of human psychology. As for us, I did tell you at the time 'not to go long on the indexes' (although it was very enticing to do so), and that the flight to safe havens (GC, ZB) has likely started. I surely did miss the breakdown on the ES, my focus was on GC, and it was either 'long on GC' or 'short the indexes'. I chose the first. All in all, we can't complain, a good start for the month, and we do have to pick our battles. Do remember this chart, this will happen again and again, regardless of timeframe or instrument. It shows it's not about some magic indicator or the latest gimmicky line on a chart. We make our money by understanding crowd behaviour.

6B STUDY See how price action within the pullback channel (red circle on daily) can have predictive value.

FOR THE TRADING DAY OF tuesday, 2019 12 03

No News.

Indexes: correction occurred in previous session, a second leg (measure move) into the 3100 zone likely

Commodities: GC/SI: managing longs

Currencies: 6B long triggered

Financials: ZB reversal may be a sign of ‘escape into safe havens’ (something we anticipated, see our GC/SI analysis)

4pm ET update: solid results today. Open positions: SI, 6B both risk-free.

12noon ET update: our methodology continues to yield excellent trades (and keeps us out of trouble). Holding overnight longs on GC, SI, 6B. See details below.

Currencies: USD weekness against most majors, resulting in failures of short setups on most major pairs. We’ll be on the lookout for long setups. See below. Anticipated move on 6B today gave us a good long.

ZB: another pattern failure, as a result of a flight to safety. GC, SI: weekly structures in control as predicted, (new users: see previous days), resulting in excellent longs today. On all three, we expect further opportunities to trade on the long side.

Indexes: a significant selloff today (see daily RRR reading). At this point, this can become the beginning of the end of the bull market, or a temporary relief of the bullish pressure leading to a buying opportunity. Price action will give us a clue.

7am ET update: ES, GC/SI, 6B as expected

FOR THE TRADING DAY OF Monday, 2019 12 02

News at 10am ET.

Indexes: overextended, correction expected

Commodities: GC/SI holds for now

Currencies: USD strength, resulting in short setups on majors (6A, 6J etc.), monitoring 6B for long. Do not chase 6J.

Financials:

4pm ET update:

6B - Still in time to participate in what looks like a long-term and substantial move (see 240min/daily).

ES - intraday bearflag, a measured move to the 3100 is projected from here

GC - long in progress

6B - long in progress

2pm ET update: GC STUDY - See charts below for details

For those who use Remek! Momentum: we now have the signal on the 15min chart. As the name suggests, it places an arrow on the chart when 'momentum' (i.e. accelerating price movement) surfaces on the market as calculated by the built-in algorithm. You can use the signal in a trading system, or you can enter manually. Note: the signal is only a crutch and has, as everything on financial markets, a probabilistic outcome. The signal helps us focus, but what really matters is understanding price action (what is happening now) and market structure (the road price travelled to get here), and the ever-changing interplay between timeframes. As to timeframes, think of them as simply groups of people with similar agendas, budgets and goals.

11am ET update:

indexes in welcome correction (3100 area on the ES)

GC, SI, 6B behaving as expected

short potential on 6A has dissipated

FOR THE TRADING DAY OF friday, 2019 11 29

Note: a short session today: expect limited volume and increased chance of ‘no follow-through’. It’s okay to stand by.

Indexes: at highs, standing back for now, a little correction would be healthy

Commodities: bullish on CL, waiting for setup

Currencies: USD strength, shorts setting up or in progress on several majors (6J, 6E), 6C short in progress, 6B monitoring for long

Financials: ZB consider long on further strength

Agriculturals: ZC as expected

Notes: a few potentially significant events happened today. Let’s review them:

GC/SI STUDY: We've been talking about the bullflag on the weekly GC/SI for weeks. See the daily chart: there's room to go. This is what "the train is leaving the station" looks like. Note: it's okay to scale in, start small, add on pullbacks as you trail stops. This, being a weekly structure may go on for weeks/months. Warning as always: no one knows the future. We're working with probabilities. Always cover your back, as you look ahead.

6B STUDY

Our complex bullflag waking up. See daily.

CL STUDY: A spectacular failure of a potentially bullish pattern. This is what "low volume day warnings" and "increased chance of no follow-throughs" look like. But: it also highlights why our 'price trigger/momentum' entry method works so well. We never got triggered, so we suffered no harm. See this post: https://www.remek.ca/blog/2019/9/20/three-ways-to-enter-a-pullback-trade.

ZB STUDY: Bullish structure. Make a plan to enter on further momentum. Or wait for first pullback after the breakout. Room to go on daily.

FOR THE TRADING DAY OF thursday, 2019 11 28

US Thanksgiving. Markets closed.

FOR THE TRADING DAY OF Wednesday, 2019 11 27

News at 8.30am, 9.45am, 10am, 10.30am ET.

Notes: last session before US Thanksgiving (markets closed tomorrow, short session on Friday). Expect low volume and limited follow-through. Manage open positions.

Indexes: at highs, standing back for now, a little correction would be healthy

Commodities: CL long, GC/SI have refused so far to break down

Currencies: 6E short, 6B long

Financials: ZB consider long on further upside strength

Agriculturals: ZS setting up for another short, ZW: a bullish breakout expected

Notes on GC: this could be a decisive moment in GC’s journey: if it refuses to break down from here (see 240min) and the 240min bearflag fails, that would indicate the bullflag on the weekly prevails. This could start a flood of new long entrants, as well as the re-entry of weak hands shaken out recently, leading, potentially, to a long lasting move to the upside (towards the highs of 2011). Potentially a wealth building opportunity, but expect also increased volatility. MGC and GLD are viable alternatives to GC. Similar scenario on SI. (The usual disclaimer and risk management rules apply.)

PS: a breakdown from here, however, would cause technical damage (from the bulls’ point of view) to the weekly chart, one which would probably take a long time to recover from. Also: clues on SI: this is NOT what an imminent breakdown looks like.

SI 2019 11 27