For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

For the trading day of thursday, 2020 04 30

News at 8.30am (ET).

Indexes: as expected, waiting for a pullback on the daily (and will it hold?)

Currencies: 6A completing a beautiful 1R run, 6J breaking out on the daily, 6B triggered on the 240min, 6C: see our analysis two days ago, 6E intraday long

Commodities: GC, SI on the move

Financials: ZB/ZN bullish pressure, expected to break to the upside, buy anti on ZN 240min

Cyptos: BTC as expected (see below)

12.30pm ET update: stopped out from GC :(, we just have to think ‘annually’

9.30am ET update: GC, SI back in the range, ZB/ZN advance, 6N setting up

For the trading day of wednesday, 2020 04 29

News at 8.30am, 10.30am (CL), 2pm. FOMC and GDP today. To new users: FOMC days are often characterized by limited range and no follow-through (aka random noise) before 2pm, so we usually do not trade the indexes on these days, although we may be managing existing risk-free positions.

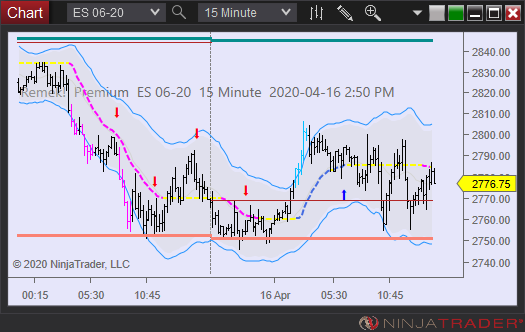

Indexes: breaking out to the upside, with a potential target in the 3000 area, see daily.

Currencies: 6A long in progress, 6J breaking out on the daily

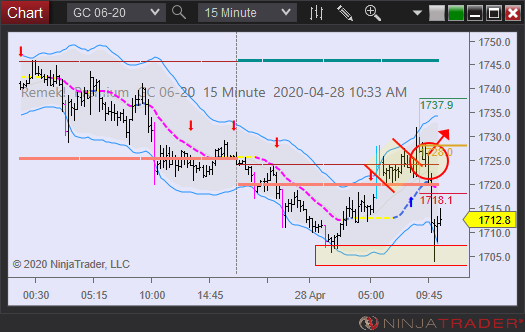

Commodities: GC, SI, we’re long, bullflags ready to move

Financials: ZB/ZN bullish pressure, expected to break to the upside, buy anti on ZN 240min

Cyptos: BTC long on 240min

4pm ET update: holding NQ, GC/SI on the move

1pm ET update: indexes advance pre-FOMC news release

For the trading day of tuesday, 2020 04 28

No News. FOMC and GDP on Wednesday.

Note: Remek! Market Scanner Pro now has a new column: Days. It shows the remaining days left from the current contract. We have also added a few agriculturals to expand our opportunities.

Indexes: could break to the upside overnight, but no clear setup

Currencies: 6A consolidation above old resistance on 240min a good entry into daily bullflag. 6J somewhat similar structure on 240min: pressure into resistence, 6C bullflag intact on 240min

Commodities: GC, SI not doing much, 2pm Wed could become the catalyst

Financials: ZB/ZN not doing much, 2pm Wed could become the catalyst

Cyptos: BTC long on 240min

1pm ET update: ZB, ZN working. GC stopped out and reentered on LTF failure test.

8am ET update: ES has broken out. 6J, 6A, 6C overnight moves, GC/SI, ZB, setting up. BTC long in progress.

For the trading day of Monday, 2020 04 27

No News. FOMC and GDP on Wednesday.

ROOM OPEN AT 9.30am ET. Click to join.

Note: the general extreme uncertainty due to the global crisis continues.

Indexes: given the troubles out there, the indexes should be collapsing. But we have a bullflag on the daily. My take is: I’m driven by the bullflag until I’m proven wrong. And if and when I am, I can’t feel bad about it.

Currencies: 6C, 6N long setting up

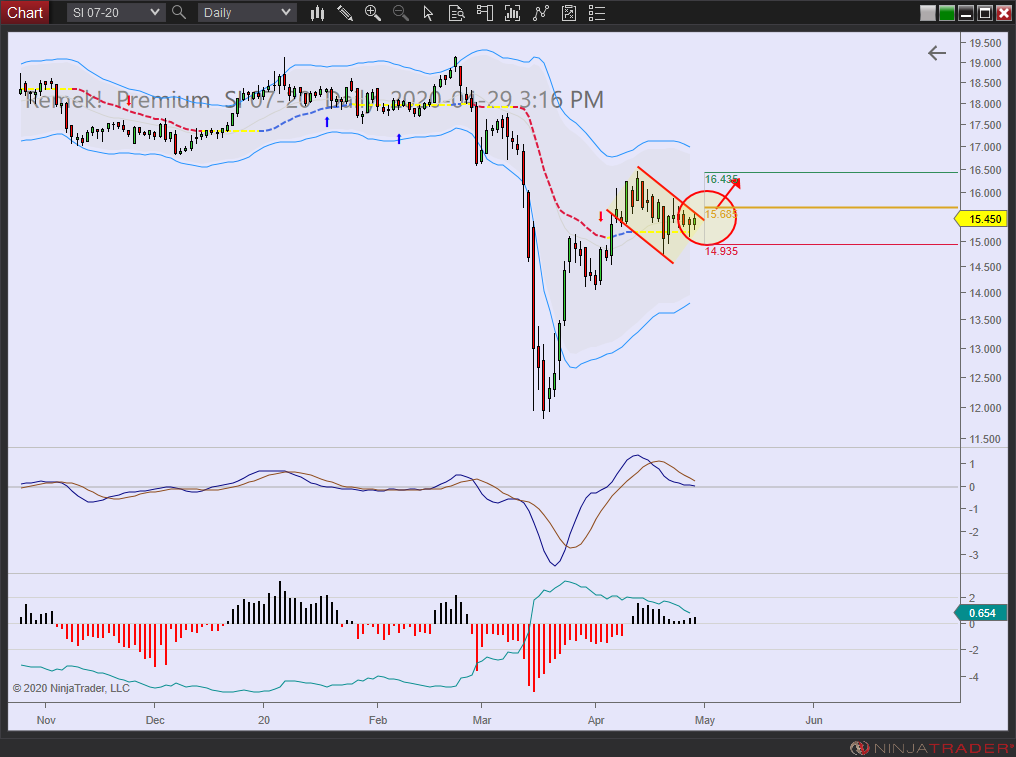

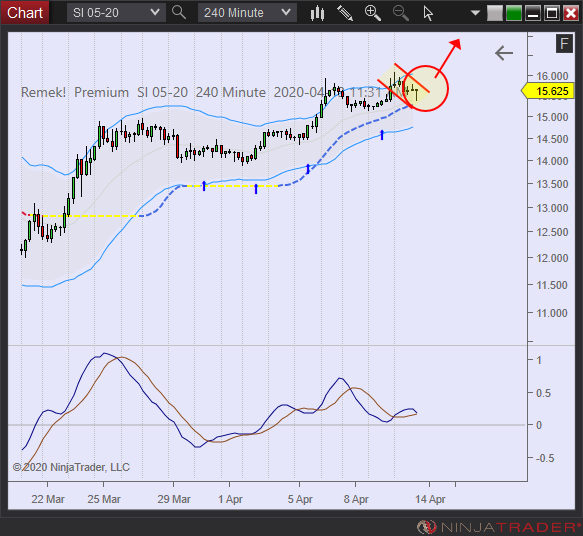

Commodities: GC, SI no change since Friday. CL emerging weakness indicates lows may be retested

Financials: ZB/ZN points to uncertainty around the generally bullish structure, on the sidelines for now

Cyptos: BTC long in progress (not mentioned in video, but still)

1pm ET update:

9.30am ET update: ES, 6A, 6J, BTC working

For the trading day of friday, 2020 04 24

News at 8.30am ET.

Note: apart from the general bullishness on GC, SI, ZB, ZN, not too many good setups overnight. Back in the morning!

Indexes: stuck in a range on daily

Currencies:

Commodities: GC, SI bullflags in progress on daily

Financials: ZB/ZN bullflags in progress on daily

4pm ET update: GC, SI giving us a hard time, but structure intact. ES breaks late in the session. 6J, 6A move. ZB/ZN no change. BTC hasn’t triggered.

7am ET update: long pre-open setups on SI, ES, 6A

For the trading day of thursday, 2020 04 23

News at 8.30, 9.45, 10am ET.

Indexes: bullish overnight structure following a trending day

Currencies:

Commodities: GC, SI bullflags in progress on daily

Financials: ZB/ZN bullflags in progress on daily

8.30am ET update: bullish bias on the ES, long on GC, SI

For the trading day of wednesday, 2020 04 22

News at 10am ET.

Indexes: on the lookout for a bearflag on the 240min

Currencies: 6C short

Commodities: GC, SI bullflags in progress on daily, CL tanks further

Financials: ZB/ZN bullflags in progress on daily

3pm ET update: GC, ES working well

10.30am ET update: bullflag on ZN, bullish bias on the ES, long on GC

For the trading day of tuesday, 2020 04 21

News at 10am ET.

Indexes: standing by with slightly bearish bias

Currencies: several shorts setting up or have triggered against the USD

Commodities: GC, SI bullflags in progress on daily

Financials: ZB/ZN bullflags in progress on daily

Cryptos:

8am ET update: currencies as expected, financials as expected. GC: stopped out

Indexes: a retest of all time highs in the cards. Bullish bias.

Currencies: volatility contraction on daily DX with bullish bias, bearish setup on all major pairs

Commodities: GC retested 1700 (see video a few days ago), bullflag on daily, similar structure on SI

Financials: ZB/ZN bullflag on daily

Cryptos: BTC monitoring for bullish breakout

1pm ET update:

9.30am ET update: weakness on the indexes, BTC no bullish breakout

For the trading day of friday, 2020 04 17

No News. Options expiry. (Tread carefully as markets move into the close.)

Indexes: bull won for now, it broke to the upside on the 6pm ET open

Currencies: volatility contraction on daily DX going into a Friday, ambiguous action and/or timeframe conflict on several pairs (e.g. 6C, 6A)

Commodities: GC bullish advance, but as mentioned yesterday, price at upper Keltner on weekly, so time for a little consolidation (around 1700, see daily chart), CL looking to short on a break on the daily

Financials: ZB/ZN bullflag on daily intact

Cryptos: BTC losing short trade as a result of pattern failure

Note: check out the new Forum at the top of this page. Let’s make this a vibrant community!

10.30am ET update: options expiry or not, a busy day and a good one. See below.

8.30am update: CL overnight short, ZB/ZN ready for long (see video 2:30), GC, SI pullback, monitoring for long

11pm update:

For the trading day of thursday, 2020 04 16

News 8.30am ET.

Indexes: weakness, may lead to bearish overnight session.

Currencies: 6A sell anti in progress

Commodities: GC, SI bullish advance continues, CL consolidation on previous support, a bearish sign

Financials: ZB/ZN bullish advance

Cryptos: BTC short in progress

3pm ET update: a good overnight GC, otherwise a day on which very little happened. Will be back for the next session!

1pm update: no follow-through on the ES, little movement elsewhere, long on ZB, short on ZS

8.45am ET update:

BTC, ES, main currency pairs: short potential dissipates, good moves overnight on GC, SI. ZB long

For the trading day of Wednesday, 2020 04 15

News 8.30am, 9.15am, 10.30 (CL) ET..

Indexes: target the 2900 area

Currencies: longs in progress on several major pairs against the USD

Commodities: GC, SI bullish advance, CL short 1R completed

Financials: ZN long in progress

2pm update: ZB, ZN working, weakness on ES, potential further downside on CL, bearflag on BTC

9.30am ET update:

- INDEXES INTRADAY GAME PLAN:

a) IF yesterday's low breaks decisively THEN look to go short on retest

b) IF yesterday's low holds decisively THEN standing by

- Strength on USD scraps longs on major pairs

- bullflag in progress on Financials. Watch last night’s video (7:25), then look at ZB below.

- monitoring potential failure test on CL

For the trading day of tuesday, 2020 04 14

No News.

Indexes: bullish advance to the 2900 area

Currencies: long setups on major pairs against the USD (6A, 6B, 6C, 6S), several have triggered (see heads-up yesterday)

Commodities: GC, SI: one of our best analyses recently (see past videos), CL short setting up, HG long breakout in progress (see yesterday’s post)

Financials: ZN long

10.30am ET update: ZN: intraday target reached. ES, 6S longs in progress. Good calls on GC, SI (see video)

9am ET update: several setups triggered on currencies. ES: expect bullish session. ZN long triggered. GC, SI bullish move continues (expect consolidation)

For the trading day of Monday, 2020 04 13

News at 8.30am ET.

Note: Easter Monday. Expect lower than usual volume.

Indexes: bullish advance to 2900 area in the cards

Currencies: long setups on major pairs against the USD (6A, 6B, 6C, 6S), some with imminent breakout potential

Commodities: short setting up on CL (note: a setup is not a trigger, not every setup or potential setup triggers.) GC convincingly cleared 1700. HG long breakout

Financials:

3pm ET update:

12pm ET update: GC on the move, SI long setting up, ZS short, 6B long, sell anti on BTC

10am ET update:

For the trading day of friday, 2020 04 10

Good Friday. Markets closed.

For the trading day of Thursday, 2020 04 09

News at 8.30am ET.

Note: Friday holiday. Expect lower than usual volumes in today’s session.

Indexes: bullish breakout and advance to 2900 likely

Currencies: 6A/6N long in progress

Commodities: GC, SI long in progress, CL long triggered on 240min

Financials: ZB/ZN long in progress

11am ET update: all instruments moved as expected with the exception of ZB, which is, however, still a valid setup at this time. We also dropped a 6J short, since it was doing nothing. Excellent calls on ES, GC, SI, 6A, 6N, CL. Only a few of today’s trades pays for Remek! Premium years ahead.

3.30pm ET update:

For the trading day of Wednesday, 2020 04 08

News at 10.30am ET (CL), 2pm ET (FOMC).

Indexes: watch for potentially market moving news release at 2pm ET. Bullish momentum waned in yesterday’s session. Bears may take control. Potential bearish move overnight, see 15min chart below.

Currencies: 6A/6N bullflag, 6C bullflag

Commodities: GC, SI bullflag, can the bulls retain control?

Financials:

4pm ET update: post-FOMC long on ES

12pm ET update: ES position will be closed by 2pm

For the trading day of tuesday, 2020 04 07

No News.

Indexes: consolidation expected after yesterday’s trend day

Currencies: 6S, 6E shorts setting up, 6C long setting up

Commodities: GC, SI bullish move accomplished, trailing risk-free runners

Financials: ZB/ZN bullflags - somewhat surprisingly - have not triggered yet, possibly because of the strong bullish action of the indexes yesterday

For the trading day of Monday, 2020 04 06

No News.

Indexes: bullish move may lead to a measured move to the upside next week

Currencies: 6S short setting up

Commodities: GC, SI bullish pressure building up (see below)

Financials: ZB/ZN long setting up

4pm ET update: holding GC, SI, ES longs into the close (all risk-free)

12.30pm ET update: good call on the ES

8am ET update: GC/SI triggered/triggering. 6S short setup

For the trading day of friday, 2020 04 03

News at 8.30am ET, 9.45am, 10am ET.

Indexes: slightly bearish tilt, be ready to short on a further breakdown

Currencies: 6B, 6J, 6C long setups (see below). Be mindful of correlation.

Commodities: GC, SI bullish pressure building up (see below)

Financials: ZB/ZN long

For the trading day of thursday, 2020 04 02

News at 8.30am ET.

Indexes: slightly bearish tilt, be ready to short on a further breakdown

Currencies: 6B, 6J, 6C long (see below). Be mindful of correlation.

Commodities: GC, SI what looks like bullish pressure building up (see below)

Financials: ZB/ZN long

10am ET update: watching precious metals, no momentum on currencies

9am ET update: no overnight triggers on currencies, weakness on indexes, long setups on treasuries

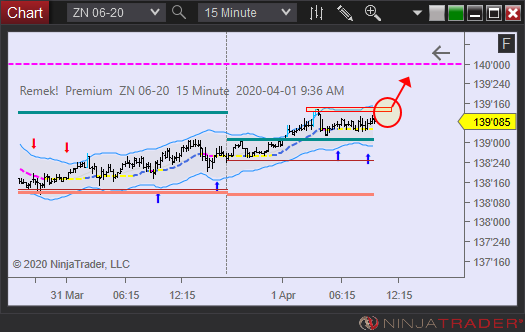

For the trading day of Wednesday, 2020 04 01

News at 10am ET, 10.30am ET (CL).

Indexes: tight range, no direction

Currencies: several long setups on major pairs: 6E, 6B, 6J, 6C (see below). Be mindful of correlation.

Commodities: GC, SI what looks like bullish pressure building up (see below)

Financials: ZB bullflag on 240min triggered (see below)

3.30pm ET update: short on NQ

12pm ET update: indecision on currencies, weakness on the indexes

9am ET update: pre-open weakness on the indexes, will monitor price action around the open. Long setups elsewhere (see Market Scanner), but no clear triggers. Standing by.