For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble: we will most likely lose our money. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. Without an edge, there is no point in risking a single dollar on the markets.

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

for the trading day of friday, 2020 07 31

News at 8.30am.

Indexes: ES gapped up, most likely to be heading to 3400. RTY has room to go.

Currencies: DX downside momentum continues, further long potential on major pairs: 6J, 6N etc.

Commodities: GC, SI expect consolidation here.

Financials: ZB/ZN upside breakout has occurred, first pullback in progress. Classic.

Agros: long setting up on ZW daily

9am update: bullish bias on the indexes prior to the session. DX consolidates. GC visits above 2000, SI no sign of weakness, long potential on ZW, ZS

for the trading day of thursday, 2020 07 30

News at 8.30am (GDP, Job numbers: most likely already priced in)

Note: FOMC done, indexes positioned to move higher. Good opportunities on currencies.

Indexes: ES most likely to be heading to 3400. RTY has room to go.

Currencies: DX downside momentum continues, further long potential on major pairs.

Commodities: GC, SI extreme moves, but likely not over yet. GC aiming at 2000. Do not chase it. Any pullback is likely a buying opportunity.

Financials: ZB/ZN working on an upside breakout.

Agros: long setting up on ZW daily

1pm update: good long on ZB, 6J moving, ES: lows tested

9.30am update: ZB on the move, ZW getting ready, GC likely to move towards the next round number

for the trading day of wednesday, 2020 07 29

News at 8.30am, 10.30am, 2pm (FOMC) ET.

Note: FOMC on Wednesday 2pm. No intraday trades on the indexes planned in the morning session. Focusing on long setups on currencies and HG.

Indexes: FOMC news release may be a catalyst.

Currencies: DX downside momentum continues, further long potential on major pairs.

Commodities: GC, SI extreme moves, but likely not over yet. GC aiming at 2000. Do not chase it. Any pullback is likely a buying opportunity.

Financials: ZB/ZN FOMC news release may be a catalyst.

4pm update: FOMC done, ES, HG, 6B bullish

9am update: further DX weakness expected. Focusing on longs on major pairs. 6B already moving. Monitoring HG, ZW.

for the trading day of tuesday, 2020 07 28

News at 10am ET.

Note: FOMC on Wednesday 2pm: markets tend to slow down leading up to the news release. Don’t get caught up in any sideways chop. Also: it’s very easy to lose focus in the mid-summer ‘lack of action, lack of volume’, whatever. Not this year: markets (indexes, currencies, metals) have been rich in opportunities lately, and we have to sieze those when they show up. There will be times again when nothing will present itself for days or a week. So focus!

Indexes: every indication points to a retest of the high. Rarely does an opportunity present itself with such high probabiliby on any market. The timeframe of this one is 240min or daily, like it or not. As always, micro contracts or ETFs (e.g. SPY) are alternatives.

Currencies: DX downside momentum continues, further long potential on major pairs.

Commodities: GC, SI no top in sight yet. Any consolidations tend to be fleeting. CL/HO: in my reading, ready to go up.

Financials: ZB/ZN sideways chop, don’t get caught.

Cryptos: further upside expected, but we need a good pullback on the 240min first.

3pm update: good action on 6B, continuation expected

8.30am update: expect limited volatility on the indexes leading up to the 2pm FOMC release on Wednesday. Bullish setups on 6B, 6E, ZB, ZN, HG

for the trading day of Monday, 2020 07 27

News at 8.30am.

Indexes: we have what looks like a pullback on the daily. The question is: is this the beginning of the final assault on the 3400? We’re bullish until proven wrong.

Currencies: DX downside momentum continues, further long potential on major pairs.

Commodities: GC, SI: you should be in these moves based everything we’ve done here.

Financials: ZB/ZN accumulation in progress, eventual bullish breakout is most likely outcome

Cryptos: we’re not in, but what is happening is in sync with what we said would happen (see July 16)

Agros: Long setting up on ZS

11am update: markets have cycles. Sometimes there’s nothing for a week. Now we are dealing with a good number of excellent opportunities.

9am update: flat overnight action on the indexes (which is bullish in my reading). Bullish potential on several major currency pairs (see e.g. 6N with previous high in Dec 2019). Bullflag on ZB.

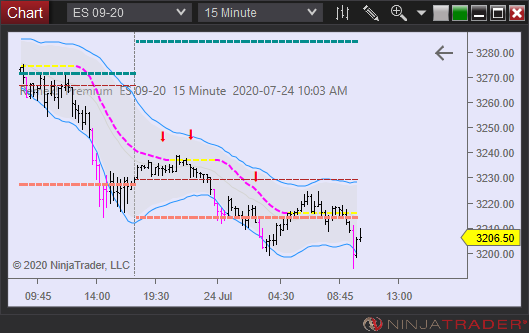

for the trading day of friday, 2020 07 24

News at 9.45am, 10am.

Indexes: selling pressure emerges (which is actually constructive, because one-sided markets are too vulnarable). We’ll have to see if that selling pressure gets absorbed before we act. Likely, it will be.

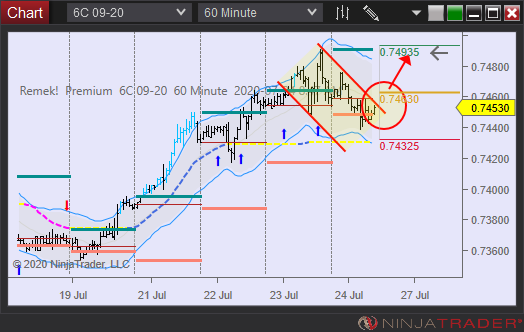

Currencies: DX downside momentum continues, longs in progress on 6J, 6B, long potential on other major pairs.

Commodities: GC, SI expect consolidation after this week’s performance.

Financials: ZB/ZN accumulation in progress, eventual bullish breakout is most likely outcome

Agros: long in progress on ZS

10.30am update:

8.30am update: expecting bullish session on the indexes if price stabilizes above yesterday’s close. GC grinding up at the Keltner with no pullback, expecting 1900 to break. Looking for long on currencies. 6J long in progress. Looking to go long on ZW and 6C, 6A, 6B.

for the trading day of thursday, 2020 07 23

News at 8.30am (potential market mover).

Indexes: ES working on 3400, persistent, low volatility grind. Reaching 3400 by Friday is possible.

Currencies: DX downside momentum developing, long setups on major pairs with potential long term trends.

Commodities: GC, SI extraordinary moves, expecting consolidation. CL/HO upside break likely, see bullflag on 240min CL

Financials: ZB/ZN lack of momentum but most likely: quiet accumulation

Cryptos: BTC: see our email alert yesterday, see the chart today.

4pm update:

10am update:

9am update: ES, metals, currencies consolidating, signs of a breakout on treasuries, ZW setting up for a long

for the trading day of wednesday, 2020 07 22

News at 10am, 10.30am ET (CL)

Indexes: ES working on 3400

Currencies: DX broke down, further downside expected. Expect long opportunities on major pairs.

Commodities: GC, SI extraordinary moves, wait for consolidation

Financials: ZB/ZN lack of momentum but most likely: quiet accumulation

4pm update:

12pm update: several good opportunities and triggers

8.30am update: markets in motion, as also shown by our scanner

for the trading day of tuesday, 2020 07 21

No News.

Note: good work and analyses on GC, SI, ES. Up next: currencies

Indexes: ES “expecting upside break”, we said yesterday. Now it’s behind us. Next: expecting a retest of the breakout level before heading up.

Currencies: DX breaking down slowly, 6A, 6E, 6N setting up. Good potential on weekly 6J

Commodities: GC, SI as expected, further upside likely

Financials: ZB/ZN lack of momentum

1pm update: good work on 6J, 6E

8am update: The observation - backed by data - that intraday traders, by default, miss the best moves because many of those occur overnight, is proven today: ES, 6A, 6N, CL, HO, BTC, SI all made big overnight moves. 6E, 6S, 6J haven't moved yet, and may be next.

As to today's session: do not chase markets, wait for a pause (consolidation, pullback, all the same thing). DX continues to slide. ES: the whole world is long, which should be a word of caution, and makes the ES like a chair with two legs: vulnarable to the slightest wind. We'll try and trail it to the previous high, while being aware of the risk.

for the trading day of monday, 2020 07 20

No News.

Note: typical mid-summer sideways action, difficult environment, do not overtrade (in size or frequency). Major software release this week, so no video today. Focus on GC, SI and the indexes, but be ready for a rough ride on all three. Micros or ETF are good alternatives.

Indexes: ES expecting upside break, but not expecting a straight line towards 3400

Currencies: DX breaking down but hesitating, therefore no easy trades on major pairs. Good potential on weekly 6J

Commodities: GC, SI excellent upside potential

Financials: ZB/ZN lack of momentum

for the trading day of friday, 2020 07 17

News at 8.30am.

Note: a quiet, relatively straight-forward evening. Long setups on several instruments.

Indexes: ES expecting upside break

Currencies: DX hesitating, looking for longs on 6A, 6B

Commodities: GC see jgp

Financials: ZB/ZN slowly but surely setting up longs

3pm update: ES back at 3220, GC moves as expected, 6A, 6E longs triggered, ZB retreats but HTF structure intact. DX breakout on daily expected, we’ll be on the lookout for long opportunities on major pairs! (e.g. 6C hastn’t moved yet)

8.30am update: bullish action on several markets

for the trading day of thursday, 2020 07 16

News at 8.30am, 10.00am

Indexes: ES bulls in firm control, upside gap closed, further upside expected

Currencies: DX hesitating, looking for longs on 6J, 6C

Commodities: GC long about to trigger

Financials: lack of momentum

Agros: excellent work on ZW, monitoring for bullflag

Cryptos: BTC expecting bullish breakout

10.30am update: what turns out to be a great morning session, with several great - and relatively speaking: easy to execute - opportunities. Which one(s) did you take?

8.30am update: Eventless overnight session with bullish structures on ES, GC, 6E.

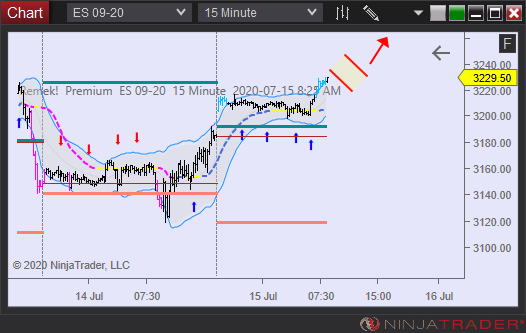

for the trading day of wednesday, 2020 07 15

News at 9.15am, 10.30am (CL)

Notes: there’s a lot happening here, pay attention in the coming days! Read below, and watch the video!

Indexes: ES 3020 behind us, bulls in firm control, upside gap on the 6pm open

Currencies: DX momentum slowly appearing, good entries on 6E, 6A, 6B

Commodities: GC long setup, SI long triggered

Financials: lack of momentum (not surprising in view of the bullish moves in risk assets)

4pm update:

12.30pm update: ES closes gap. Good long on ZW. CL STUDY - See chart for details. One of the advantages of using a 240min (or similar) chart: long tails often indicate "cleaning up the stops" of the little-chart-traders. A tail like this is often a hint of what the market may be up to next. We never know anything for sure, all we can do is stack up evidence. What we know: a) we have a long tail (actually: two, plus a pretty good green bar three bars back) at this point, which may be a sign of accumulation, and b) we're pushing into a breakout area. Enough to be on the lookout for an upside breakout.

10am update:

8.30am update: overnight positions working well. Monitoring CL/HO for a breakout. DX broke down: look for longs on major pairs on your timeframe. Short setup on ZS.

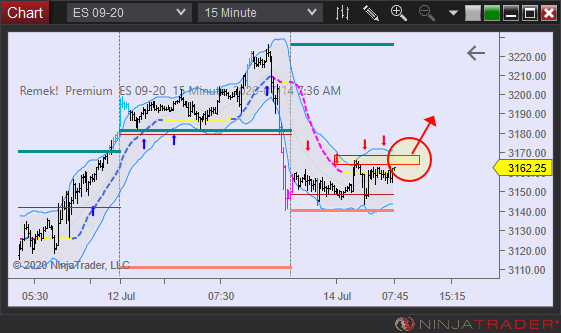

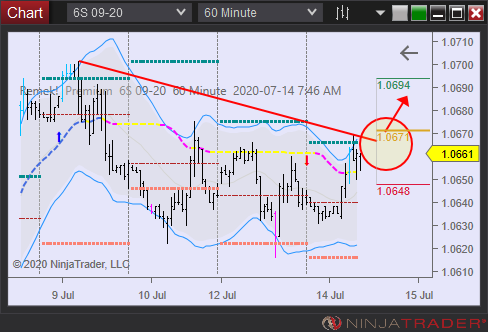

for the trading day of tuesday, 2020 07 14

News at 8.30am.

Indexes: 3020 reached, see video for details

Currencies: DX no momentum, on the lookout for long on 6E, 6S

Commodities: GC consolidating

Financials: ZB anti failing, see analysis in video

4pm update: “With the close approaching, an upside breakout and a late rally becomes more likely.” - we wrote at 2.14pm

1pm update:

9.30am update:

8am update:

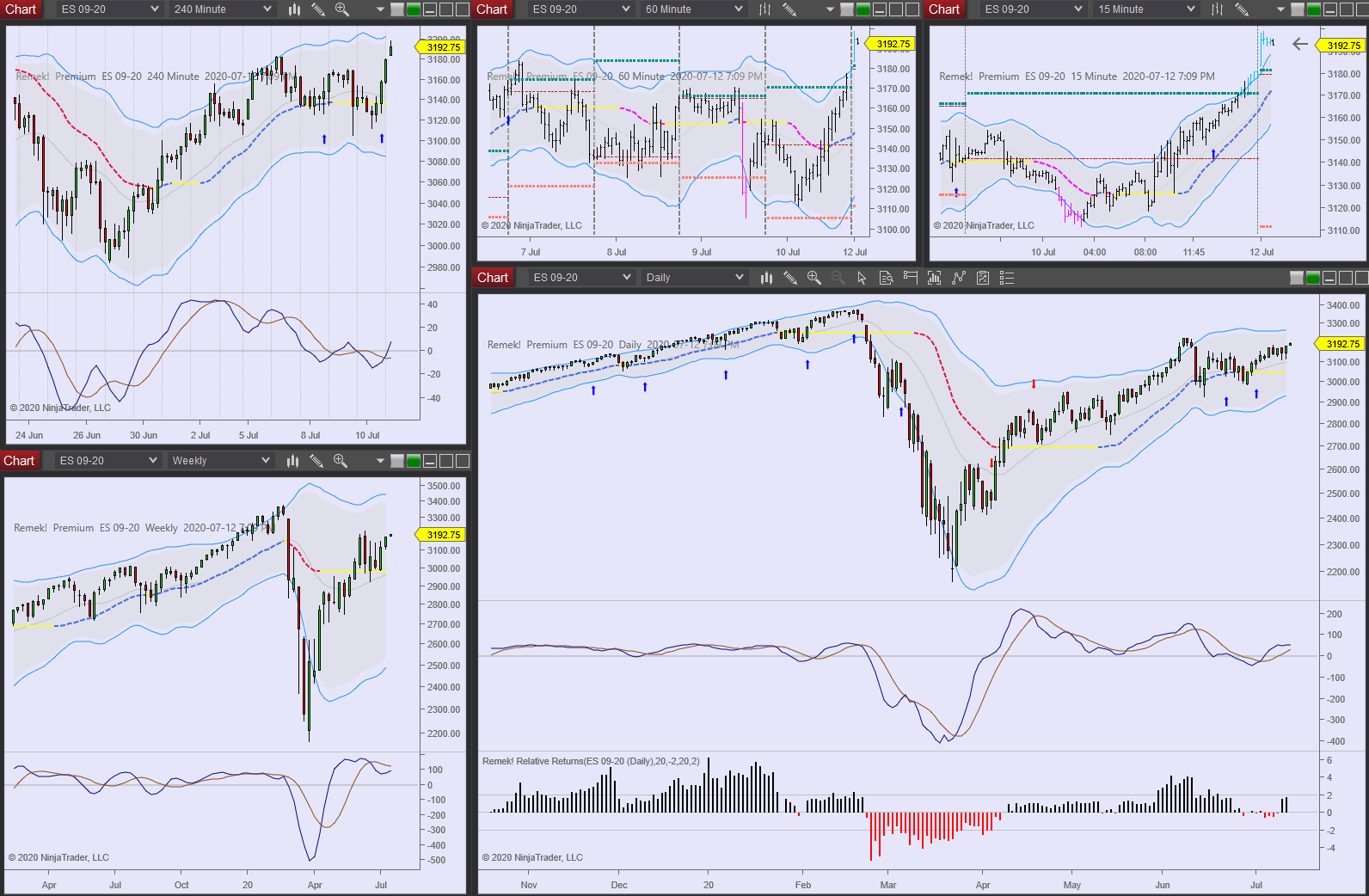

for the trading day of monday, 2020 07 13

No News.

Note: I misspoke at the end of the video: we are short on DX, therefore on the lookout for or already long on the major pairs, of course.

Indexes: on fire, 3020 on the ES within walking distance

Currencies: DX weakness, on the lookout for longs on major pairs

Commodities: GC expecting an advance and stabilization above 1800. CL/HO bullish setup on daily

Financials: ZB/ZN short antis forming, monitoring (this anti can easily fail - treasuries may rally if the ES reaches the all time high and puts in a failure test - so we will not take it

Notes: Market on fire after Friday's explosion into the close. 3020 walking distance, with 3400 ever more likely to be hit as well. That said, surprises are guaranteed, especially since this market is very one-sided, and thus vulnarable. Make sure you do NOT chase this (if you're not in yet), however enticing. We only enter on pullbacks. Be ready for next week!

4pm update: 3220 reached on the ES. SI on a roll. ZB anti failing (as expected).

for the trading day of friday, 2020 07 10

News at 8.30am ET.

Indexes: ES bullish bias intact, but lack of momentum

Currencies: DX reversal of weakness, longs on major pairs lack momentum or have failed

Commodities: GC holding on to 1800

Financials: ZB/ZN expecting pullback after breakout

4pm update:

9am update: longs setting up on currencies. Expecting a bullish session on indexes. Setup on GC.

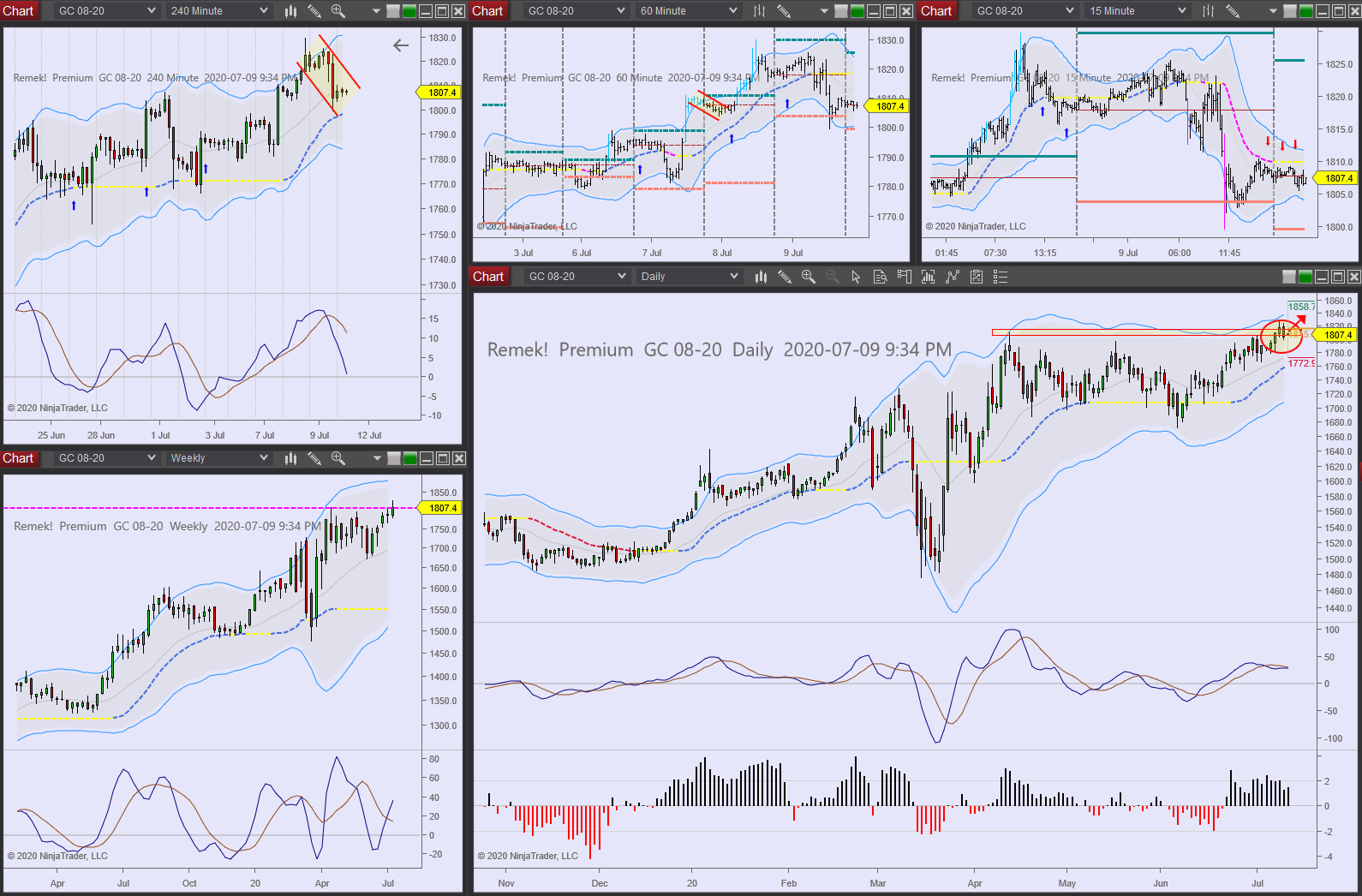

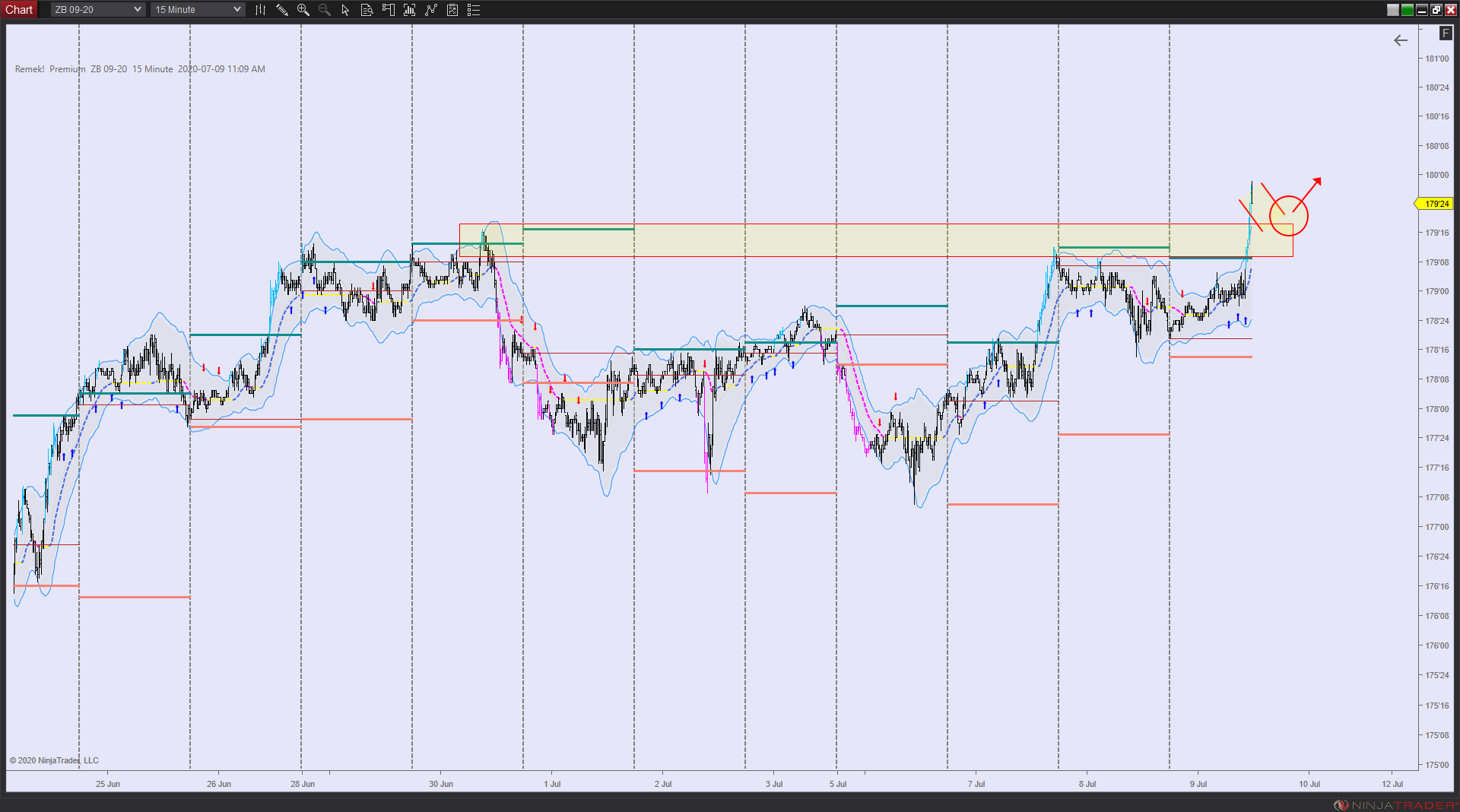

for the trading day of thursday, 2020 07 09

News at 8.30am ET.

Indexes: ES bulls in control

Currencies: DX weakness continues, long on major pairs 6E, 6S, 6B etc. in progress

Commodities: GC a break above 1800 is now behind us, further mid-term bullish potential.

Financials: ZB back at the high of the range, likely next: breakout

Cryptos: BTC another long setting up on the 240min

Agriculturals: excellent bullflags on ZC, ZS

4pm update: good work on grains and treasuries, GC holds on to 1800, random intraday action on indexes, intraday reversal on DX, price action possibly driven by the 8.30am job report, but no material change in the bigger picture.

12.30pm update: tumultuous morning following the 8.30am job report. On the indexes, we’re monitoring if this will give us merely a big bottom tail on the daily, or is the start of something bigger. In the first case, be on guard for a possible late-in-the-session rally. GC holding at 1800, ZB/ZN break to the upside as expected. Currencies get a hit, but most likely just temporarily.

8am morning brief: SI, HG at yearly highs. HO, ZN, YM, ZS, BTC longs setting up. ZC triggered overnight

for the trading day of wednesday, 2020 07 08

News at 10.30am ET (CL/HO)

Indexes: ES timeframe conflict between 240min/60min. See video for details.

Currencies: DX weakness continues, setups on major pairs 6E, 6S, 6B etc.

Commodities: GC a break above 1800 is now behind us, further mid-term bullish potential.

Financials: ZB back at the high of the range, likelly next: breakout

8.30am morning brief: ES: on the lookout for bullish move upon the open. GC measured move potential. 6E and other major pairs: longs setting up

for the trading day of tuesday, 2020 07 07

No News.

Notes: ES, HG Monday’s 1R targets reached. (see below)

Indexes:

Currencies: DX daily bearflag starting to move. Major pair taking a pause.

Commodities: GC a break above 1800 is expected

Financials: ZB failure test at the low of the range, moving up

10am update: excellent readings on GC, HG, ES

7.30am morning brief: constructive bullish overnight action on HO, ES. Note: wait for bullflag on LTF (e.g. 15min) if trading smaller than 240min timeframe. Correct stop is below 240min pivot. Potential failure test on 6J. Bullish intraday potential on Treasuries. Overnight pullbacks on some currencies, confirming bullish potential in today’s session. Expecting a bullish intraday setup on GC. Long setup on BTC.

for the trading day of Monday, 2020 07 06

No News.

Indexes: ES likely heading to 3200

Currencies: DX daily bearflag starting to move. Will be looking for long setups on major pairs, e.g. 6E, 6A, 6N (see below)

Commodities: GC/SI re-traded area, likely bullish move next. HG bullflag on 240min (see below)

Financials: ZB/ZN back to sideways action, with a bullish bias

12pm update: HG previous high reached, HO target reached

for the trading day of friday, 2020 07 03

No News. Markets close at 1pm ET.

Happy Independence Day to our customers in the USA!

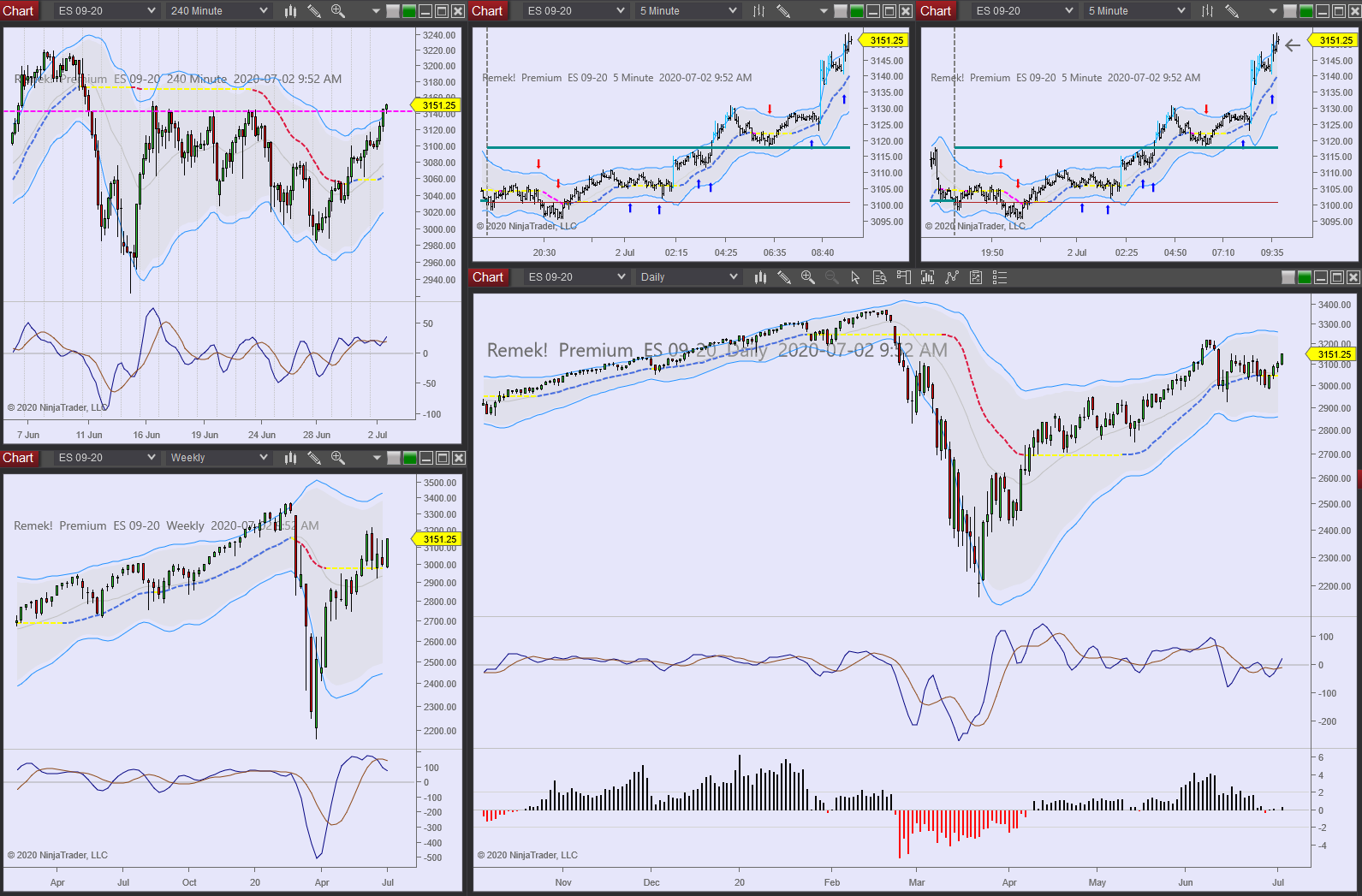

for the trading day of thursday, 2020 07 02

News at 10.30am.

Note: expect lower than usual volumes (which can sometimes be conducive to good moves, as we saw in the first two days of this week)

Indexes: ES likely heading to 3200

Currencies: DX daily bearflag starting to move. Will be looking for long setups on major pairs, e.g. 6E, 6A, 6N

Commodities: GC/SI re-traded area, likely bullish move next HG: likely a “grind along the Keltner”, a pattern characterized by a lack of pullbacks (see jpg below)

Financials: ZB/ZN back to sideways action

3pm update: CME Holiday Schedule

10am update: Moves as expected

for the trading day of Wednesday, 2020 07 01

News at 10am, 10.30am (CL/HO), 2pm (FOMC)

Note: Canada Day. Also: expect lower than usual volumes (which can sometimes be conducive to good moves, as we saw in the first two days of this week)

Indexes: spot-on analysis so far this week, positioned for more upside

Currencies: DX daily bearflag starting to move. Will be looking for long setups on major pairs, e.g. 6S

Commodities: CL, GC/SI good analysis so far this week. GC: expect consolidation at this level. HG breakout triggered

Financials: ZB/ZN: with cash going elsewhere, taking a breather at this level

4pm update: not much of a rally into the close today on the ES, but that’s okay. Good work on HG, 6N. Back tomorrow!

11am update: ES: bullish accumulation, but no follow-through so far. 6N: good long