For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Join our Remek! Discord Channel! Discuss trade ideas with the community in real time!

Remek! Premium

Actionable market insight for technically motivated directional traders

-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We also post updates as necessary during the day (see 'intraday' folder).

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

What do "technically motivated" and "directional" mean?

Technically motivated traders make trading/investing decisions based on what price has done in the past. We, as technically motivated traders, do not normally include macroeconomic or fundamental factors (e.g. a given company's financials) into our thinking. We hold the view that patterns can be uncovered in price behaviour alone that have predictive value.

Directional traders expect price to move up or down. For directional traders to make money, price needs to move. Note: there are non-directional trading styles as well, although those are beyond the scope of our focus on these pages.

-

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future, the yet unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

Please note: instead of the live trade rooms, we’ll upload one video about an important aspect of successful trading weekly or as warranted, solely for Premium subscribers. Send in your comments or questions you’d like to be covered in this new video series. Put “Premium videos” in the subject line. Thanks!

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

US Futures at a glance

fOR THE TRADING DAY OF THURSDAY, 2023 08 31

News at 8.30am, 10am ET.

Indexes: Reason to be long.

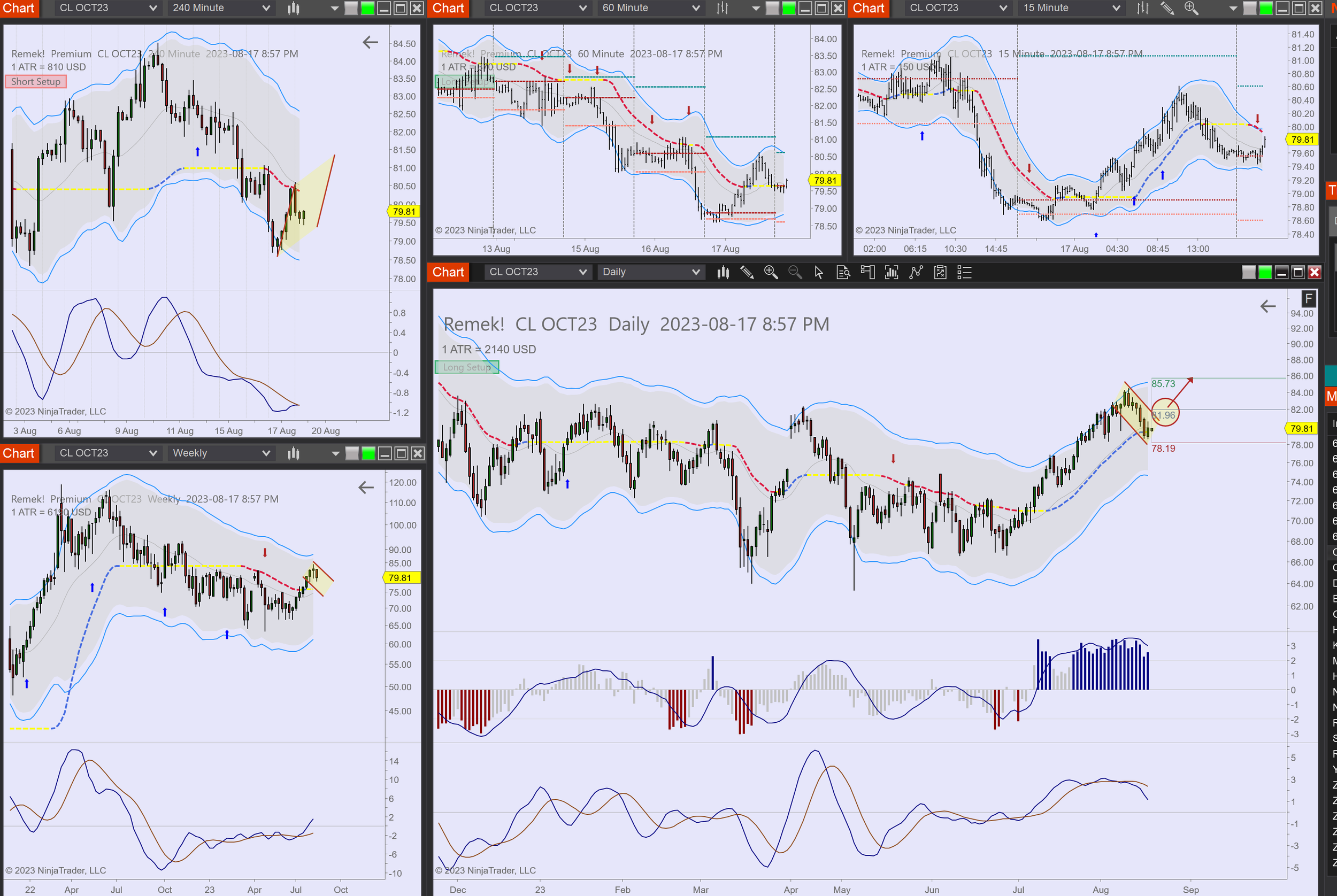

Currencies: DX bullflag, look for shorts on major pairs (6E, 6A)

Commodities: 1Rs on GC and SI, monitoring energies for further longs, NG most likely building a base

Financials: standing by

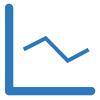

Agriculturals: ZS bullflag worth watching

fOR THE TRADING DAY OF wednesday, 2023 08 30

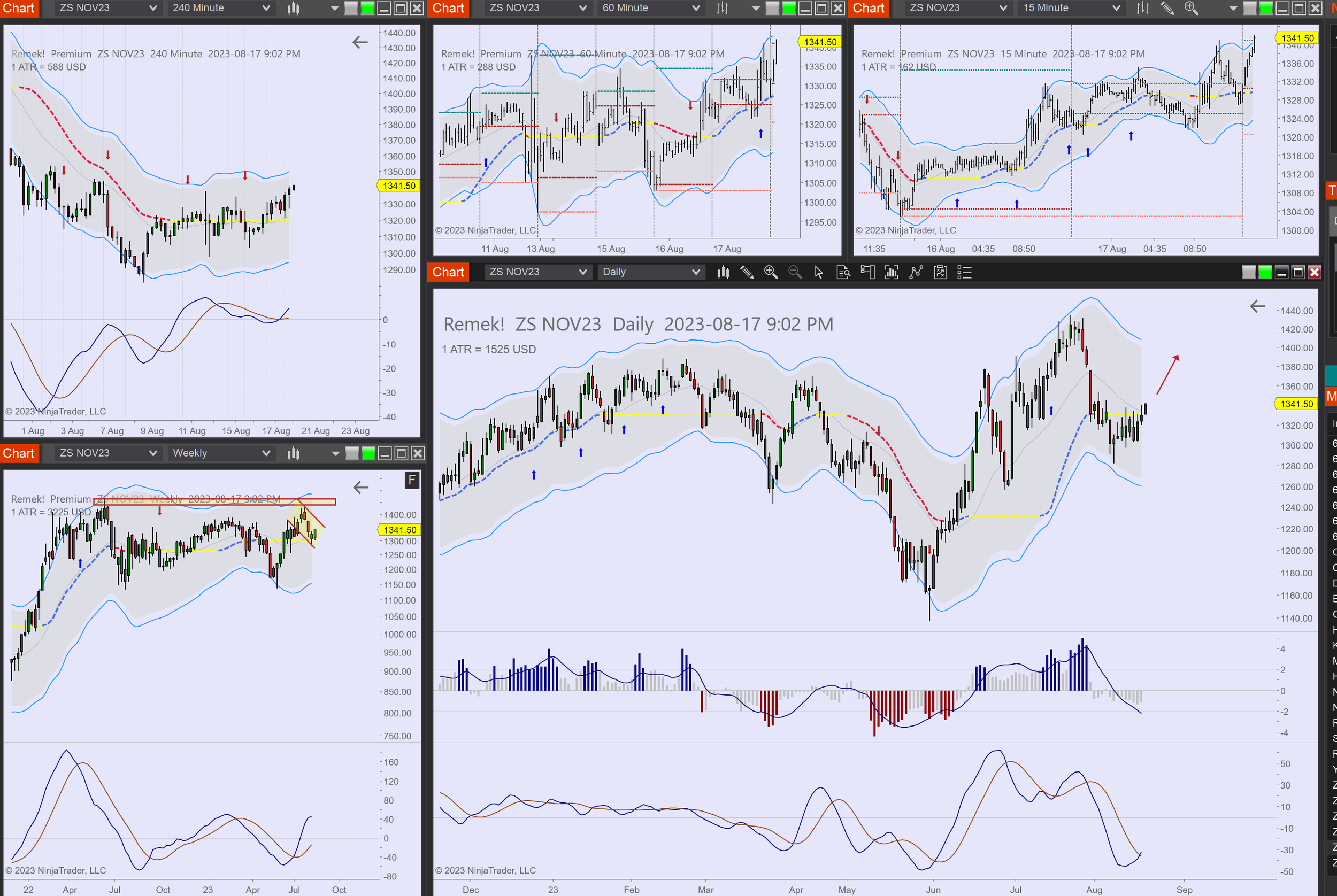

News at 8.30am, 10.30am (CL) ET.

Indexes: “clues arriving that the bear may be failing aka the bulls re-gaining control. Be alert.”, we said last night. See chart today. Be ready to participate in further longs.

Currencies: DX strength, but few good opportunities on major pairs, perhaps 6B looks good for a short. MBT moves in tandem with indexes

Commodities: monitoring energies for further longs, GC moves up, SI moves up, more longs expected.

Financials: standing by

Agriculturals: ZS bullflag worth watching

fOR THE TRADING DAY OF TUESDAY, 2023 08 29

News at 10am.

Indexes: clues arriving that the bear may be failing aka the bulls re-gaining control. Be alert.

Currencies: DX strength, but few good opportunities on major pairs, standing by

Commodities: monitoring energies for further longs, GC moves up, SI readies for next move up

Financials: standing by

Agriculturals: ZS bullflag worth watching

fOR THE TRADING DAY OF MONDAY, 2023 08 28

Note: 1R on ZS. Otherwise no new information, no video necessary. Make sure you’re monitoring CL/HO/RB. And check the blog and the Forum for new material if you haven’t yet.

No News.

Indexes: waiting for clues

Currencies: DX strength, but few good opportunities on major pairs

Commodities: (relatively) easy conditions continue on energies. SI rips, bullflag on GC (think correlation!)

Financials: standing by

Agriculturals: ZL long setup, ZS 1R.

fOR THE TRADING DAY OF FRIDAY, 2023 08 25

News at 10.00am ET

Note: we’re busy. Focus!

Indexes: strong indication that the bulls are not in control. Ready to short on daily upon trigger. Note: no guarantees in trading.

Currencies: DX strength, opportunities in progress or emerging on major pairs on the short side

Commodities: (relatively) easy conditions continue on energies (if you’re not participating, ask why). SI rips, bullflag on GC (think correlation!)

Financials: standing by

Agriculturals: ZL long setup, ZS has triggered.

fOR THE TRADING DAY OF THURSDAY, 2023 08 24

News at 8.30am ET

Note: No video tonight. Look at the ES and NQ, and see our discussions on the past 2 days.

Indexes: strong indication on the ES and NQ the bulls are re-taking control. Have a plan to participate based on your timeframe. If this gets going, think big, the all time highs will likely be attacked

Currencies: standing by

Commodities: standing by

Financials: standing by

Agriculturals: ZL gap closed, momentum re-emerging: watching for a long trigger

fOR THE TRADING DAY OF WEDNESDAY, 2023 08 23

News at 8.30am ET

Indexes: have no problem shorting if that’s what’s next.

Currencies: DX moving up. Looking for viable setups on major pairs. Not too many right now.

Commodities: monitoring energies for further longs

Financials: standing by

Agriculturals: upgap on ZL

fOR THE TRADING DAY OF TUESDAY, 2023 08 22

News at 10am ET

Indexes: expected mean reversion in progress.

Currencies: DX bullflag. Not too many good setups on major pairs.

Commodities: monitoring energies for further longs

Financials: “monitoring for bearflag to trigger to the downside” was yesterday. Today: bearflag has triggered.

Agriculturals: standing by

fOR THE TRADING DAY OF MONDAY, 2023 08 21

No News.

Indexes: monitoring if the expected mean reversion move on the dialy will turn out to be the beginning of the bullflag on the weekly.

Currencies: DX strength continues, but sub-optimal opportunities on major pairs (the way I see it)

Commodities: energies continue to offer the best opportunities!

Financials: monitoring for bearflag to trigger to the downside

Agriculturals: ZL hits previous pivot (good reading), ZS upgap, monitoring for long

fOR THE TRADING DAY OF FRIDAY, 2023 08 18

No News.

Indexes: the bullflags we had have been destroyed. The question is: what’s next. Thinking that necessarily a bear market is a mistake. Most likely what’s next is a range-bound market on the daily. We’re watching for opportunities to trade as soon as we have a clue where that range might be.

Currencies: standing by

Commodities: energies working on the next long setups

Financials: standing by

Agriculturals: watching ZS for a long.

fOR THE TRADING DAY OF THURSDAY, 2023 08 17

News at 8.30am

Note: VERY LITTLE HAPPENING. This will change. Until then: patience! No video necessary tonight.

Indexes: standing by (we do have a plan: ES hits 4600, we start being interested)

Currencies: slides on many major pairs, e.g. 6E

Commodities: standing by

Financials: standing by

Agriculturals: ZL long, and more upside expected.

fOR THE TRADING DAY OF WEDNESDAY, 2023 08 16

News at 8.30am, 9.15am ET

Note: little happening. Typical for August. Do not get chopped up. Good time to do background work: backtesting, learning, etc.

Indexes: standing by (we do have a plan: ES hits 4600, we start being interested)

Currencies: slides on many major pairs, difficult to participate

Commodities: standing by (CT flat)

Financials: standing by

Agriculturals: ZL long setup

fOR THE TRADING DAY OF TUESDAY, 2023 08 15

News at 8.30am ET

Note: if you trade the indexes, pay attention!

Indexes: an upside break is likely

Currencies: monitoring for short on 6E, 6A, long on MBT. Expect cross-currents, not an easy environment.

Commodities: CT long triggered, excellent long setups on energies

Financials: standing by

Agriculturals: standing by

fOR THE TRADING DAY OF MONDAY, 2023 08 14

No News.

Note: little happening, no video necessary. The game plan on the indexes is the same: waiting for 4600 on the ES to be hit, after which we’ll consider some trades. Watching the YM for clues.

Indexes: little is happening, waiting for clues.

Currencies: monitoring for short on 6E, 6A, long on MBT

Commodities: CT long triggered, but not looking good

Financials: standing by

Agriculturals: standing by

fOR THE TRADING DAY OF FRIDAY, 2023 08 11

News at 8.30am ET (expected catalyst)

Indexes: bullflag on YM, which may be the clue. 8.30am news may be the catalyst to the upside.

Currencies: monitoring for short on 6E, long on MBT

Commodities: CT bullflag

Financials: standing by

Agriculturals: standing by

fOR THE TRADING DAY OF THURSDAY, 2023 08 10

News at 8.30am ET (expected catalyst)

Indexes: bullflag on YM, which may be the clue. 8.30am news may be the catalyst to the upside.

Currencies: shorts shaky on 6A, 6N, long on MBT

Commodities: CT bullflag, good analyses on energies

Financials: Standing by

Agriculturals: standing by

fOR THE TRADING DAY OF Wednesday, 2023 08 09

News at 10.30am ET (CL)

Indexes: bullflag on YM, which may be the clue. Standing by, watching trigger area.

Currencies: shorts shaky on 6A, 6N, long on MBT

Commodities: CT bullflag, NG moving up, further long opportunities on energies, esp. CL

Financials: Standing by

Agriculturals: 1R on ZS done, standing by

fOR THE TRADING DAY OF tuesday, 2023 08 08

News at 8.30am ET

Indexes: bullflag on YM, which may be the clue. Standing by.

Currencies: DX strength expected, looking for shorts on 6A, 6N

Commodities: CT bullflag, NG moving up, further long opportunities on energies, esp. CL

Financials: price rejection on weekly? Standing by

Agriculturals: 1R on ZS

fOR THE TRADING DAY OF MONDAY, 2023 08 07

No News.

Indexes: likely exhaustion, expecting a move up

Currencies: DX strength expected

Commodities: lessons and further long opportunities on energies (see video)

Financials: dramatic reversal on Friday, keeping an eye on this!

Agriculturals: bearflag on ZS

fOR THE TRADING DAY OF friday, 2023 08 04

News at 8.30am ET (potential catalyst)

Indexes: expecting a move up

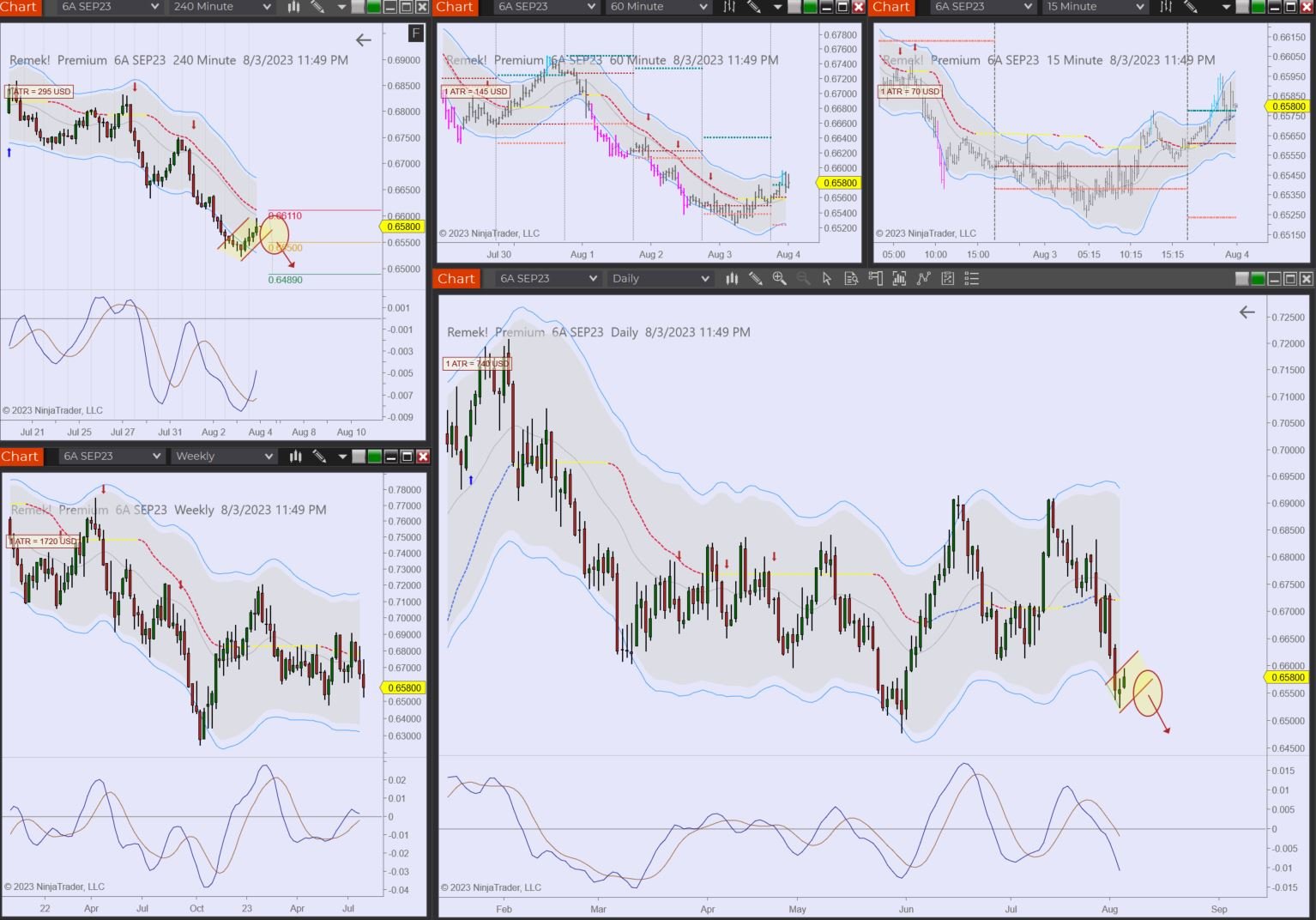

Currencies: DX strength. Monitoring 6A

Commodities: lessons on energies

Financials: standing by

Agriculturals: confusion, staying out

fOR THE TRADING DAY OF THURSDAY, 2023 08 03

News at 8.30am ET

Note: sorry for the audio problems. I’ll need to get some new gear on Amazon. Thank you for your patience…

Indexes: a little reset, you may been stopped out with a profit on the daily. Monitoring for next leg up. Potential failure test on YM.

Currencies: DX strength likely to continue. 1R on 6A/6N. (6E a bit confusing, but expected to move down). 6J expected to break out short.

Commodities: energies reset (which is healthy). Staying out on metals.

Financials: shorts on ZB (but did not partitipate)

Agriculturals: confusion, staying out

fOR THE TRADING DAY OF WEDNESDAY, 2023 08 02

News at 8.30am ET, 10.30am (CL)

Note: I apologize, but I’m having audio problems tonight. The job is the same, excellent environment to make money on the indexes and energies. Lesson on the ES: I put the stop on the 240min chart within the bottom tail on purpose (to avoid slippage if we do get stopped out). I enclose the video, but please mute it. Hopefully the task is clear!

Indexes: no new information, the job is clear

Currencies: DX strength likely to continue. Monitoring 6A for a short. (6E a bit confusing)

Commodities: energies slide along the Keltner, SI expecting an upside move

Financials: standing by

Agriculturals: standing by

fOR THE TRADING DAY OF tuesday, 2023 08 01

Note: very little new, so no video necessary. Make the best of the longs on the indexes (another breakout imminent) and energies (sliding along the Keltner). A short on 6E (see strength on the DX).

News at 10am ET

Indexes: further upside break likely to be imminent.

Currencies: DX strength continues. Monitoring 6E for a short.

Commodities: energies slide along the Keltner, CT off the list, watching GC, SI for upside move

Financials: standing by

Agriculturals: standing by

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.