For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Remek! Premium

Actionable market insight for technically motivated directional traders

-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We also post updates as necessary during the day (see 'intraday' folder).

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

What do "technically motivated" and "directional" mean?

Technically motivated traders make trading/investing decisions based on what price has done in the past. We, as technically motivated traders, do not normally include macroeconomic or fundamental factors (e.g. a given company's financials) into our thinking. We hold the view that patterns can be uncovered in price behaviour alone that have predictive value.

Directional traders expect price to move up or down. For directional traders to make money, price needs to move. Note: there are non-directional trading styles as well, although those are beyond the scope of our focus on these pages.

-

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future, the yet unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

Please note: instead of the live trade rooms, we’ll upload one video about an important aspect of successful trading weekly or as warranted, solely for Premium subscribers. Send in your comments or questions you’d like to be covered in this new video series. Put “Premium videos” in the subject line. Thanks!

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

All times Eastern Time.

US Futures at a glance

Note: IB 1 = inside bar (daily), IB 2 = two consecutive inside bars. Data supplied by Remek! Inside Bar.

FOR THE TRADING DAY OF friday, 2024 06 28

News at 8.30am EDT

Time to act.

Indexes: all four on the move!

Currencies: standing by

Commodities: Long in progress on CL weekly. RB 1R. GC potential measured move. Watch SI!

Financials: monitoring ZN

Agriculturals: standing by

FOR THE TRADING DAY OF thursday, 2024 06 27

News at 8.30am EDT

No change since yesterday, no video necessary.

Indexes: little new information, dull mid-summer action

Currencies: standing by.

Commodities: Long in progress on CL weekly. RB long on 240min.

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF Wednesday, 2024 06 26

News at 10am, 10.30am EDT (CL)

Indexes: reason to be on NQ, monitoring for longs to emerge on ES, YM, RTY.

Currencies: standing by.

Commodities: Long in progress on CL weekly. RB triggering.

Financials: monitoring for long on ZN

Agriculturals: standing by

FOR THE TRADING DAY OF tuesday, 2024 06 25

News at 10am EDT.

Indexes: monitoring for longs to emerge on ES, YM, RTY.

Currencies: 6S could wake up.

Commodities: monitoring SI. Long in progress on CL weekly. RB triggering.

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF monday, 2024 06 24

News.

Indexes: looking for longs on ES, YM, RTY.

Currencies: 6S could wake up.

Commodities: monitoring for clues on GC, SI. Long setup on CL weekly.

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF friday, 2024 06 21

News at 10am EDT.

NOTE: quadruple witching day!

Indexes: NQ potential anti. YM, RTY expected to catch up.

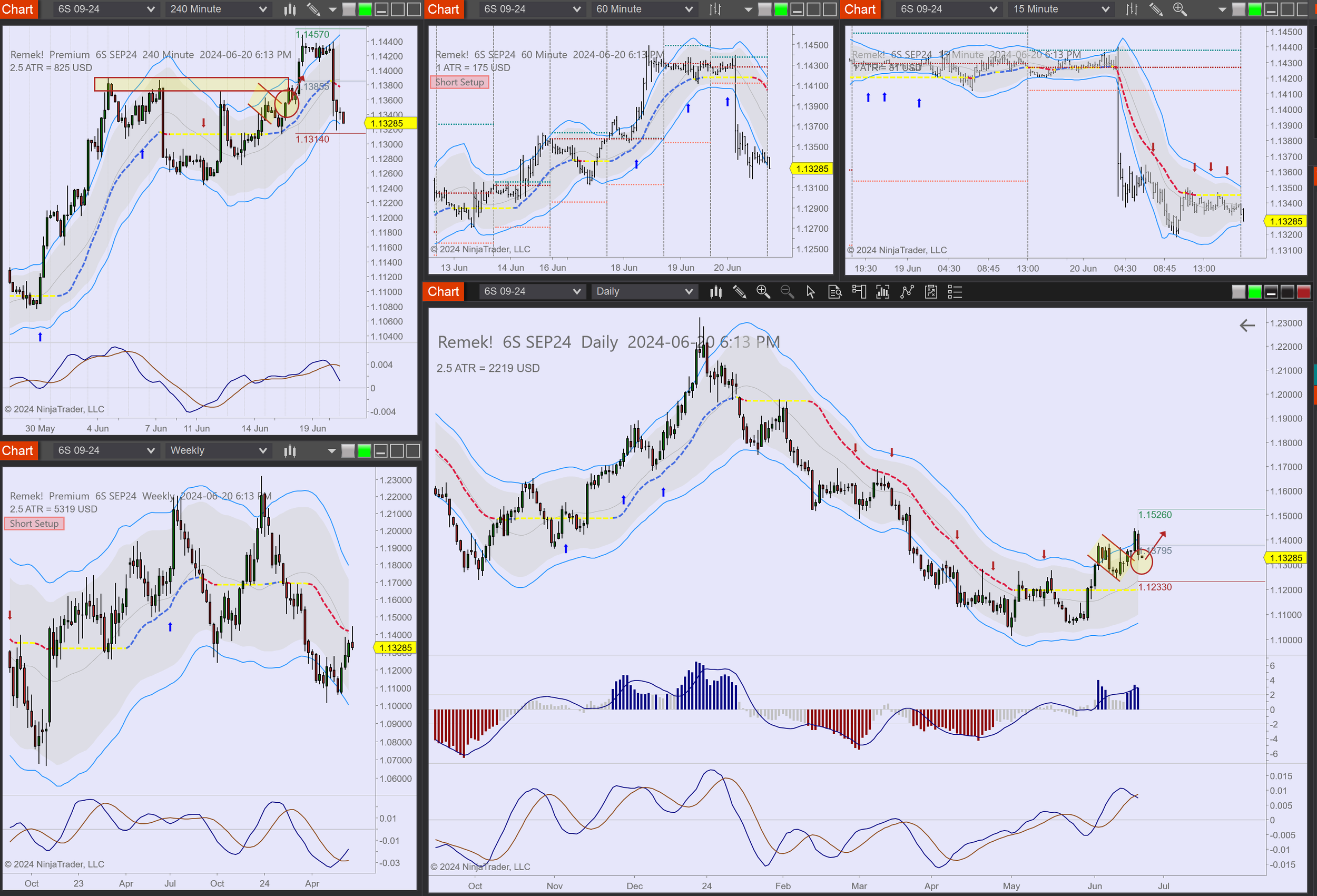

Currencies: 6S 1R in progress. Monitoring 6A

Commodities: reason to be long on GC, SI

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF thursday, 2024 06 20

News at 8.30am EDT, 11am (CL)

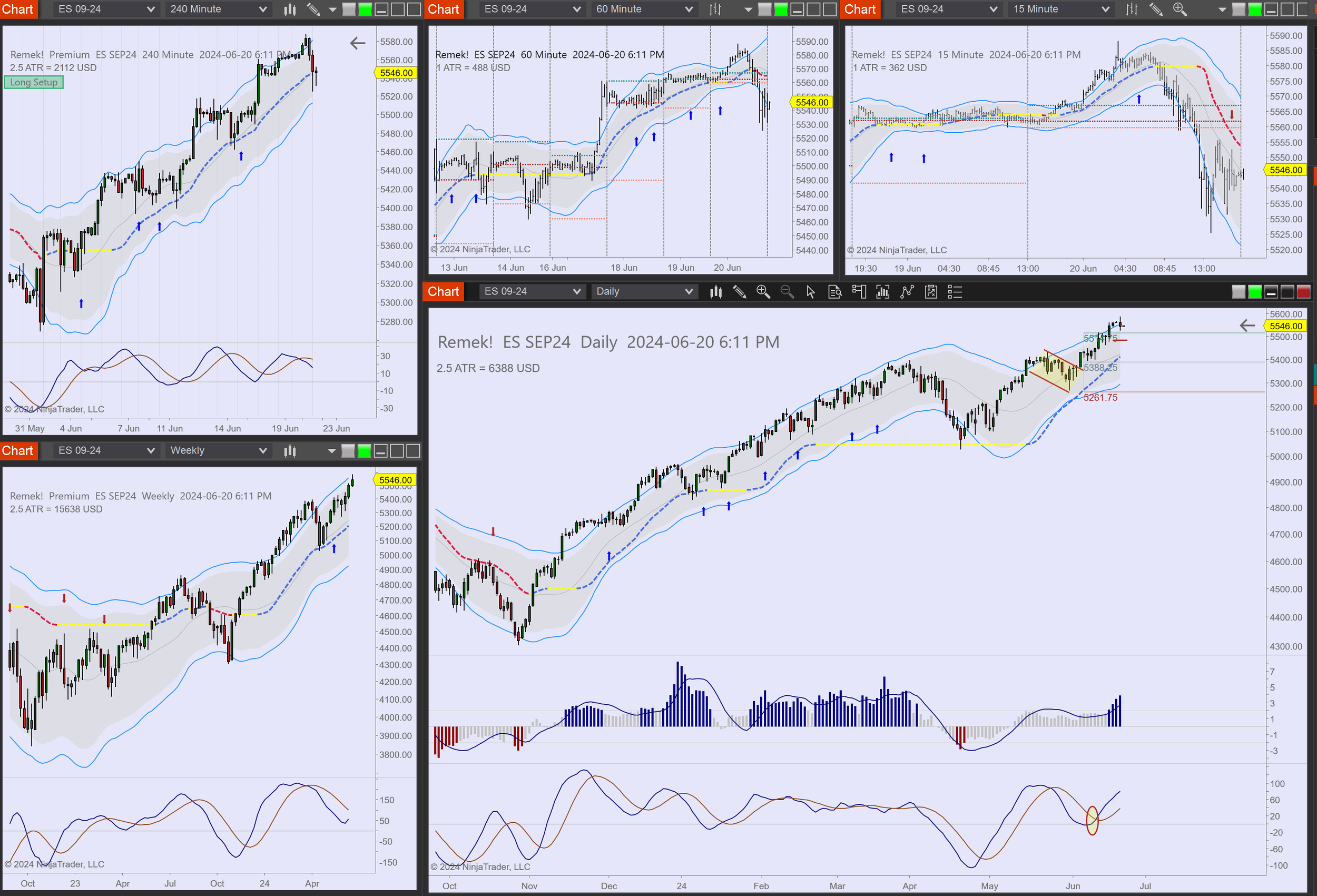

Indexes: ES, NQ slide along the Keltner. YM, RTY expected to catch up.

Currencies: 6S 1R in progress

Commodities: DO NOT FORGET SILVER!

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF Wednesday, 2024 06 19

US HOLIDAY. MARKETS CLOSED.

FOR THE TRADING DAY OF tuesday, 2024 06 18

News at 8.30am EDT

Indexes: ES, NQ slide along the Keltner. YM, RTY expected to catch up.

Currencies: 6S triggering

Commodities: Monitoring CL for a long.

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF Monday, 2024 06 17

News.

Indexes: new longs triggering on ES, NQ. Watching YM and RTY for clues.

Currencies: 6S long setup. 6J may be putting in a bottom.

Commodities: Monitoring CL for a long.

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF friday, 2024 06 14

No News.

Indexes: great longs completed, 1R, 2Rs

Currencies: long on MBT (long term)

Commodities: GC short setup

Financials: standing by

Agriculturals: standing by

Remek! Premium Extra

FOR THE TRADING DAY OF thursday, 2024 06 13

News at 8.30am EDT.

Indexes: great longs completed, 1R, 2Rs

Currencies: long on MBT (long term)

Commodities: GC short setup

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF wednesday, 2024 06 12

News. FOMC at 2pm. Expect a catalyst.

Indexes: reason to be long. Mind the 2pm “dust”.

Currencies: long on MBT (long term)

Commodities: standing by

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF tuesday, 2024 06 11

No News. But: FOMC on Wednesday! Tuesdays prior to FOMC tend to be quiet and choppy.

Indexes: YM 1R, ES, NQ long setups

Currencies: long on MBT

Commodities: CL may be turning

Financials: standing by

Agriculturals: long setup on ZC

FOR THE TRADING DAY OF monday, 2024 06 10

News.

Indexes: YM 1R, ES, NQ long setups

Currencies: long on MBT

Commodities: standing by

Financials: standing by

Agriculturals: long setup on ZC

FOR THE TRADING DAY OF friday, 2024 06 07

Not much new, no video necessary today.

News at 8.30am EDT

Indexes: ES measured move done, flat. NQ long on daily, stop in place

Currencies: long on MBT/BTC, monitoring 6A, 6E, 6S as discussed

Commodities: standing by

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF thursday, 2024 06 06

Note: Make sure you watch yesterday’s video, today’s video.

News at 8.30am EDT

Indexes: ES, NQ, YM: long

Currencies: long on MBT/BTC, long setups on 6E, 6A, long in progresss on 6N, setup is setting up on 6S

Commodities: standing by

Financials: standing by

Agriculturals: standing by

FOR THE TRADING DAY OF Wednesday, 2024 06 05

News at 10.30am EDT (CL)

Indexes: ES, NQ, YM: be long or look to be long

Currencies: long on MBT/BTC, long setups on 6E, 6A, long in progresss on 6N, setup is setting up on 6S

Commodities: standing by

Financials: standing by

Agriculturals: standing by

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.