Now, to be clear, we’re not talking about putting your money in index funds for 20 years. That is certainly one way to become profitable, since you’ll be most likely pocketing the baseline shift, which is, depending on how you calculate it, around 7-8% per annum on the US markets based on the lookback period of 1890 to today, some 130 years. So one thing you should certainly be doing is stack away some of your capital in long term index funds.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Let’s call that long-term investing. Good! Now let’s move on to more short-term strategies to profit from the markets, which we usually call trading (although note: the only difference between investing and trading is the timeframe.) (Also note: if you can’t figure out how to make more than 7-8% per annum by the hard work of trading, then it’s obviously a better idea to just put your money in the index funds, and be content with 7-8%.)

With all the above said, what if you want to make more than the 7-8% per annum you can make by doing nothing? Well, you can trade, of course, meaning you can get in and get out of positions as opposed to sit on them long term. Now there is a strong view that markets are “efficient”, meaning “you can’t beat the market”, which means the most you can make is the baseline shift. There are traders, though, who beg to differ: they hold the view - and we have data that they might just be right - that it is possible to uncover patterns in price action that can be exploited consistently for profit. OK, fine, so why is everybody not doing it?

There are surely many reasons, which would each deserve their own separete blog post, but probably it all comes down to some type of financial darwinism, meaning the markets are very competitive, and those that constantly adapt best will, most likely, end up with others’ money.

But before all this gets too theoretical and complex, let’s try to simplify trading into a managable process. Let us show you how we do this:

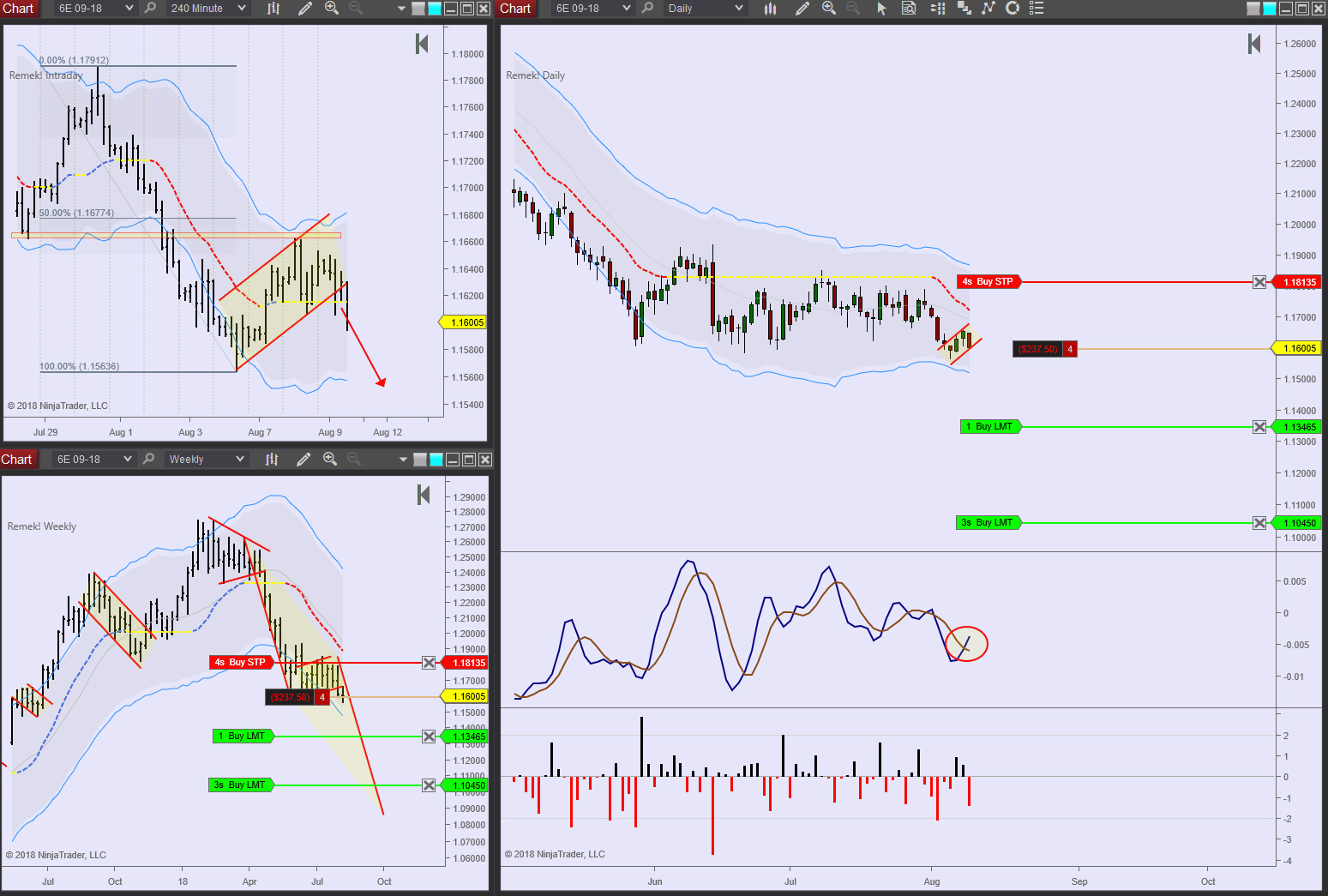

First we identify the opportunity: this means a situation on a given market that fits into what we look for based on our methodology (which, remember, we have tested a million times and we know it works.) How we do this doesn’t matter, as long as it works for us. As for us, we use our beautiful software and add to it our 15 years of daily trading experience. We challenge you to beat that combination! By the way, here’s our latest analyses, which we share with our Premium subscribers before each open. (We discuss about 7-8 markets. Look at your charts now, and count those on which we were wrong. Hint: none)

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

2. OK, so we identify patterns on our charts, we can interpret price action, and project with pretty good accuracy what is most likely to happen next. Which means, since we are directional traders, where price will be tomorrow. So far so good, a nice intellectual exercise. But it’s not money yet. To make money from this knowledge, we need to move to the next step, we need to learn something else: we need to structure a trade based on the opportunity identified on Step 1. Structuring the trade involves figuring out how we can make money from the emerging opportunity so that our risk is kept within our pre-defined tolerance level, and so that we never bet the farm. In this stage too, we are greatly helped by our own software, which automatically protects us from excessive risk, and which we first designed for ourselves, and which we started to share with the world a few years ago. (Warning: getting to know our software intimately can be a life-changing experience.)

If you’re interested in making more than the baseline shift, why not check out our products, our Premium membership and our intensive trading course? They might just be what you’ve been looking for!

Mindful trading!