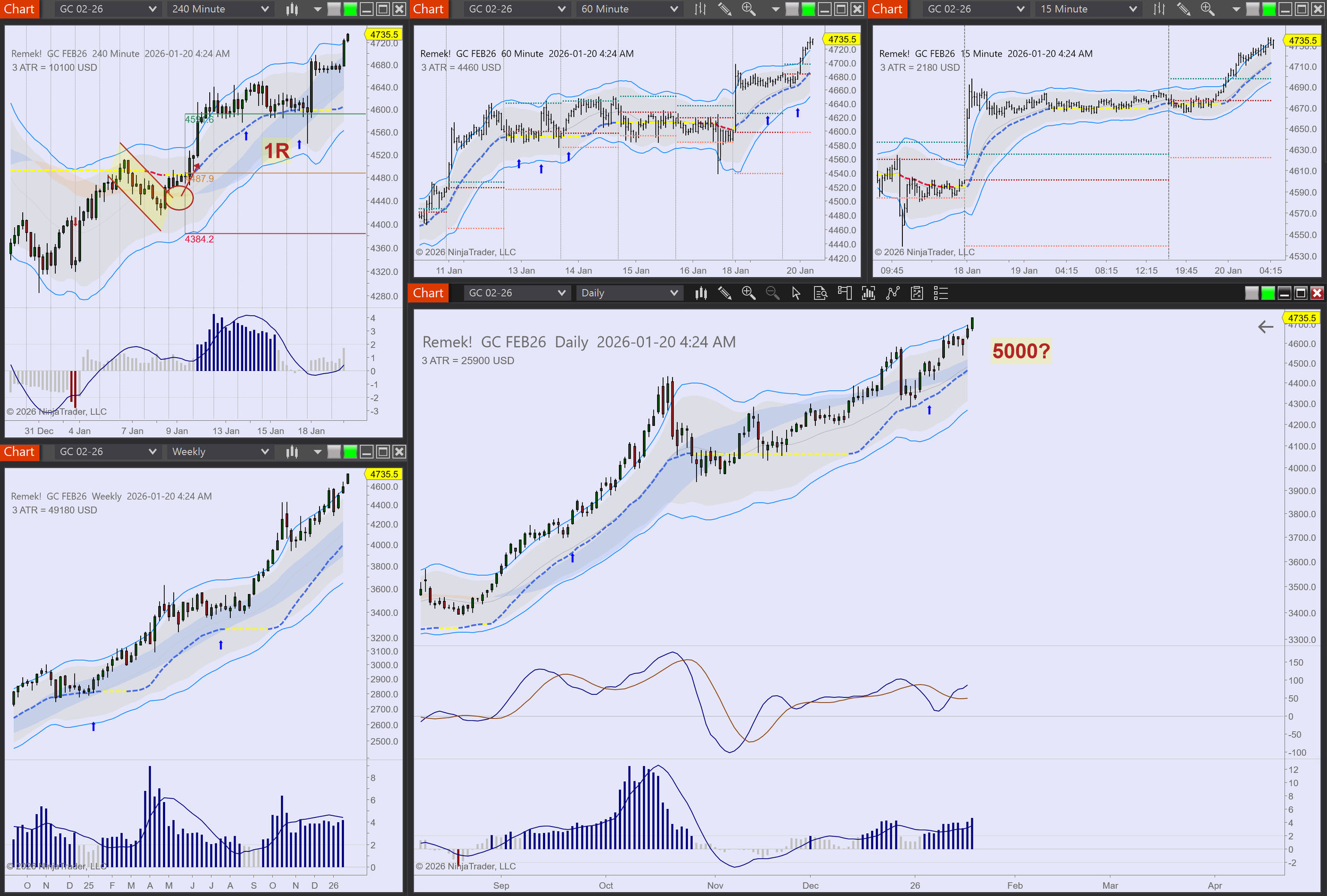

Check out our bonus Premium video of today as we discuss our current charts and what to do and what not to do in this environment! Want to become a pro? Join us daily!

Remek! Premium 2026 02 05 - For educational purposes only. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Also of note

Trading stocks, ETFs?