REMEK! Momentum - Documentation

Part 11 Technical specifications

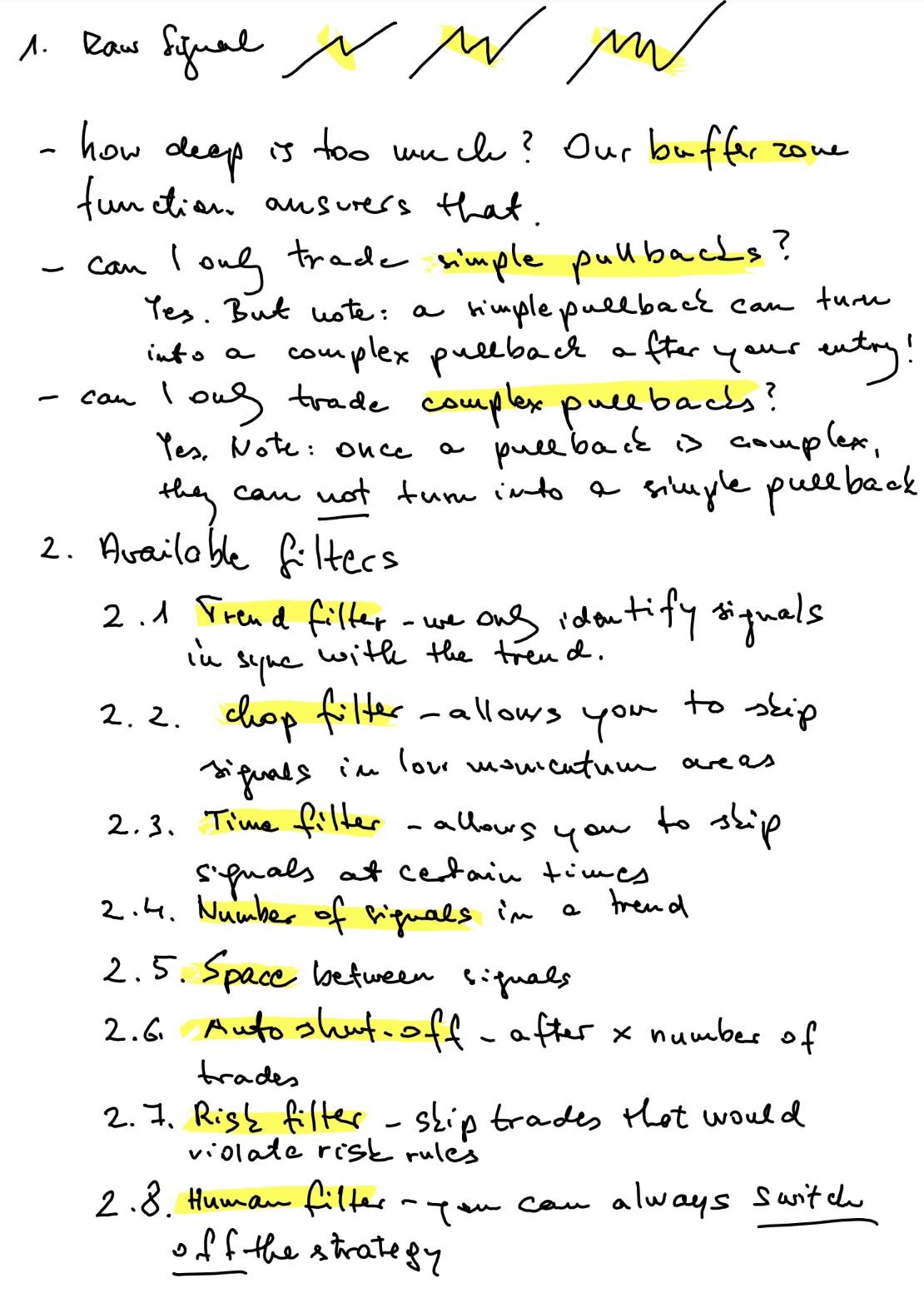

Trend filter:

The trend filter has four settings. The trend may be determined by using

Keltner breakouts: When using Keltner breakouts the trend filter is long after a long breakout (meaning price steps outside the upper Keltner) and until the next short breakout. The trend filter is short after a short breakout (meaning prices steps below the lower Keltner) and until the next long breakout.

The Remek! Coral Filter or the Remek! ADXVMA: The Remek! Coral Filter and the Remek! ADXVMA both have two trend states: long, short. While their mathimatical formulas are slightly different, both provide useful information to the main algorithm as it calculates our with-trend signals.

Remek! Composite: Our proprietary trend definition

Chop filter

The chop filter measures the vertical distance between the slow trigger and the slow trigger average, and compares it to the pre-defined minimum distance required for trade signals. The Chop Filter filters out signals in markets a) likely to be flat, b) lacking momentum c) and/or choppy, and thus highly random.

Setup bars

Setup bars are bars for which all preliminary proprietary conditions required have come true, but where the last condition, the re-emergence of momentum, which is used for the entry, has not yet arrived.

Setup bars can be painted for easy identification, alerting the user that there may be a trade signal coming if and when the last condition, the re-emergence of momentum, arrives.

Remek! Momentum chop filter rules

Simple setup bars vs complex setup bars

Setup bars are either classified as simple setup bars or complex setup bars depending on their position within the pullback channel and using a proprietary classification method.

Signals

The direction of signals are always in sync with the direction of the selected trend filter.

A long signal occurs when

- the prior bar is a long setup bar,

- the selected trend filter is long, and

- momentum in the direction of the trend, as defined by our propriatary algorithm, has re-emerged.

A short signal occurs when

- the prior bar is a short setup bar,

- the selected trend filter is short

- momentum in the direction of the trend, as defined by our propriatary algorithm, has re-emerged.

The chop filter does not check if the chop filter condition is true for the signal bar or not. Instead it checks the preceeding setup bar’s condition. This means that a signal bar will only appear if the previous bar was not classified by the chop filter as a chop bar.

Note: in our own trading, especially within Remek! Premium, we often wait for a price trigger upon the arrival of the signal. Whether to use a price trigger to enter is a discretionary decision, and one that we often apply. Definition: Price trigger = Close(0) >< High/Low(x), i.e. the close of the current bar exceeds the high (for long entries) or the low (for short entries of bar x, where x = one/two/three bars in the past.

Display Options

The display options and all fields that come beneath the display options in the indicator dialogue box have no impact on how the indicators and signals are calculated. In other words, we can define a) what we display on the chart and b) how we calculate the signals independently from each other. This is a unique feature that greatly improves the usability of the product, since the visual look of the chart can be e.g. kept simple while keeping the mathematical calculations running in the background as complex as needed.

Note that signals will be counted when counting the maximum number of allowable signals and when checking for the required minimum distance between two consecutive signals, even when those signals are chosen not to be displayed visually on the chart. Note also that the signal count includes both simple and complex signals.

Proprietary programming technology

Remek! Momentum PRO STR and PRO STR BT are lightning-fast, thanks to their proprietary, “direct-deployment” programming technology. Even with long lookback periods signals and chart elements will appear instantaneously. Loading times should be about 100 times faster compared to traditional, non-Remek! programming methods.

Accessing the indicator from a strategy

When the indicator is called from a strategy, input parameters can be defined as needed, as all outputs can be directly accessed by a strategy.

Market Analyzer Columns

The Remek! Momentum Pro indicator includes two market analyzer columns, designed to show trade setups and trade signals quickly and automatically in Remek! Market Scanner Pro, even across hundreds of instruments:

- RemekMProSetups (returns +2 for an extreme long setup, +1 for a standard long setup, -2 for an extreme short setup, -1 for a standard short setup, 0 for no setup)

- RemekMProSignals (returns +2 for an extreme long signal, +1 for a standard long signal, -2 for an extreme short signal, -1 for a standard short signal, 0 for no signal)

When using the market analyzer columns, make sure that sufficient historical data (min. 50 days recommended) is available, otherwise the correct output cannot be calculated.

Three other columns are also available in Remek! Market Scanner’s Pro version:

Days: number of days remaining before contract rollover. Highlighted in yellow if rollover is within 3 days.

RRR: Remek! Relative Returns, run on a daily chart to identify unusual moves.

KScore: position of price within Remek! Keltner. Highlighted in green when price is outside the upper Keltner on the daily, and in red when price is below the lower Keltner on the daily. This indicates the instrument is on the move. This position also often preceeds a pullback.

Buffer zone

In the new version, we use the price penetration into the opposite buffer zone as a filter to suppress sub-par setups and triggers. See the buffer zone video for details.

Exhaustion filter

Introduced in v4.0, the Exhaustion zone filter will suppress long/short signals after an exhaustion event. The filter switches itself off automatically - thereby allowing signals again - when two conditions become true: a) a candle closes above the exhaustion high and b) that close is within the standard Keltner Channel (within 2.5ATR by default). See image for details.

Appendix: Order handling in NT8

It is important to understand NT8’s order handling process, and understand what is within and what is beyond the control of your Remek! software. Read the following technical writeup.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.