REMEK! MOMENTUM PRO STR BT/x TECHNICAL REFERENCE: SETTINGS

Chart label: settings define what text is displayed at the top of the chart.

Alert Message: Settings to customize the setup and signal messages on the chart.

Strategy Buttons: Settings to customize the colour of the strategy buttons.

Coral Filter/ADXVMA: Two customized Remek! trend definition filters that provide input for the PRO STR/BT/BTX algorithms.

Further Strategy Settings: These are NT8 strategy settings. Refer to NT8’s documentation for details.

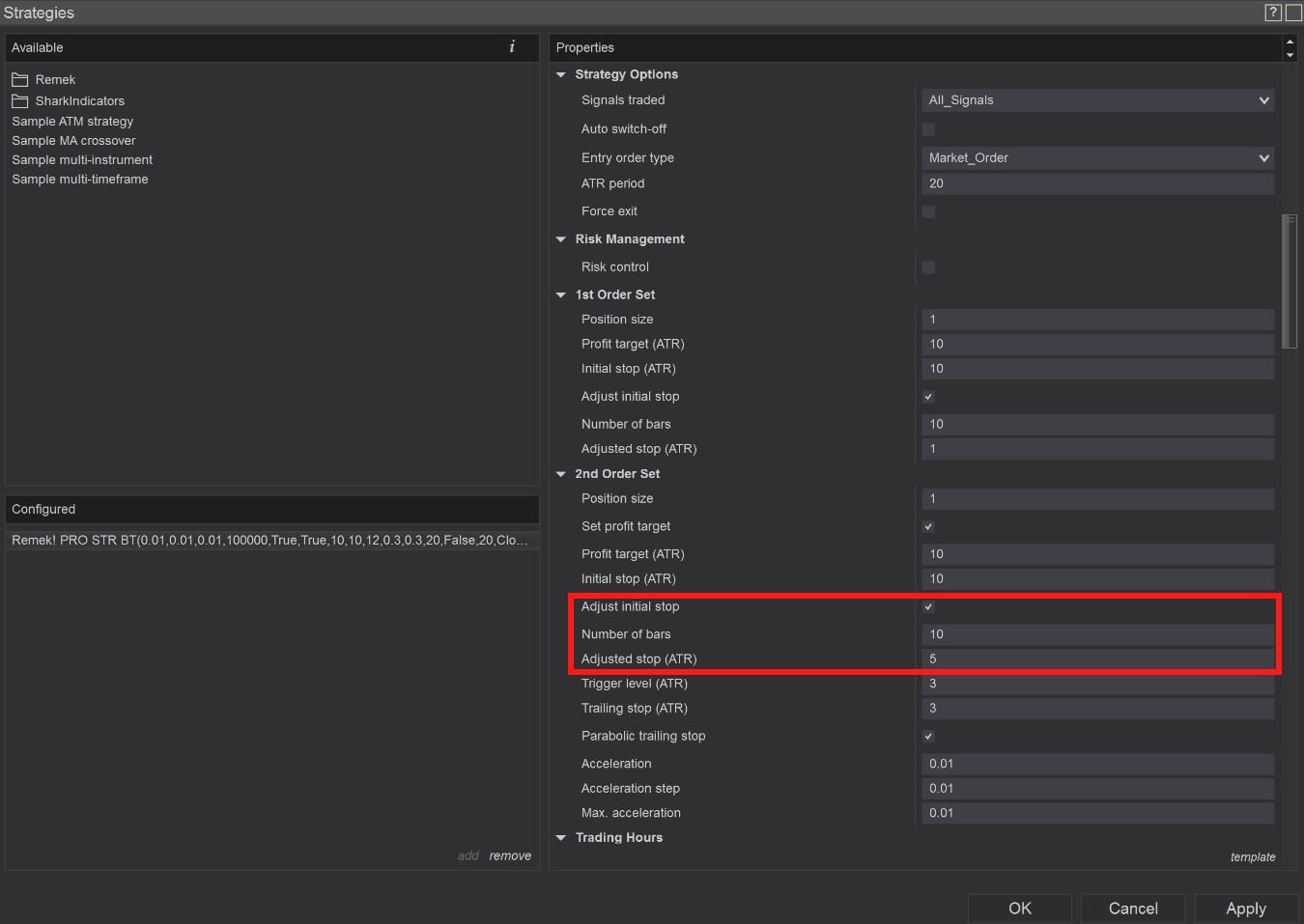

New in v3.90: “Adjust initial stop” functionality for Order Set 1 and Order Set 2.

What's new in BT/BTX v3.90 - Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.