May 13:

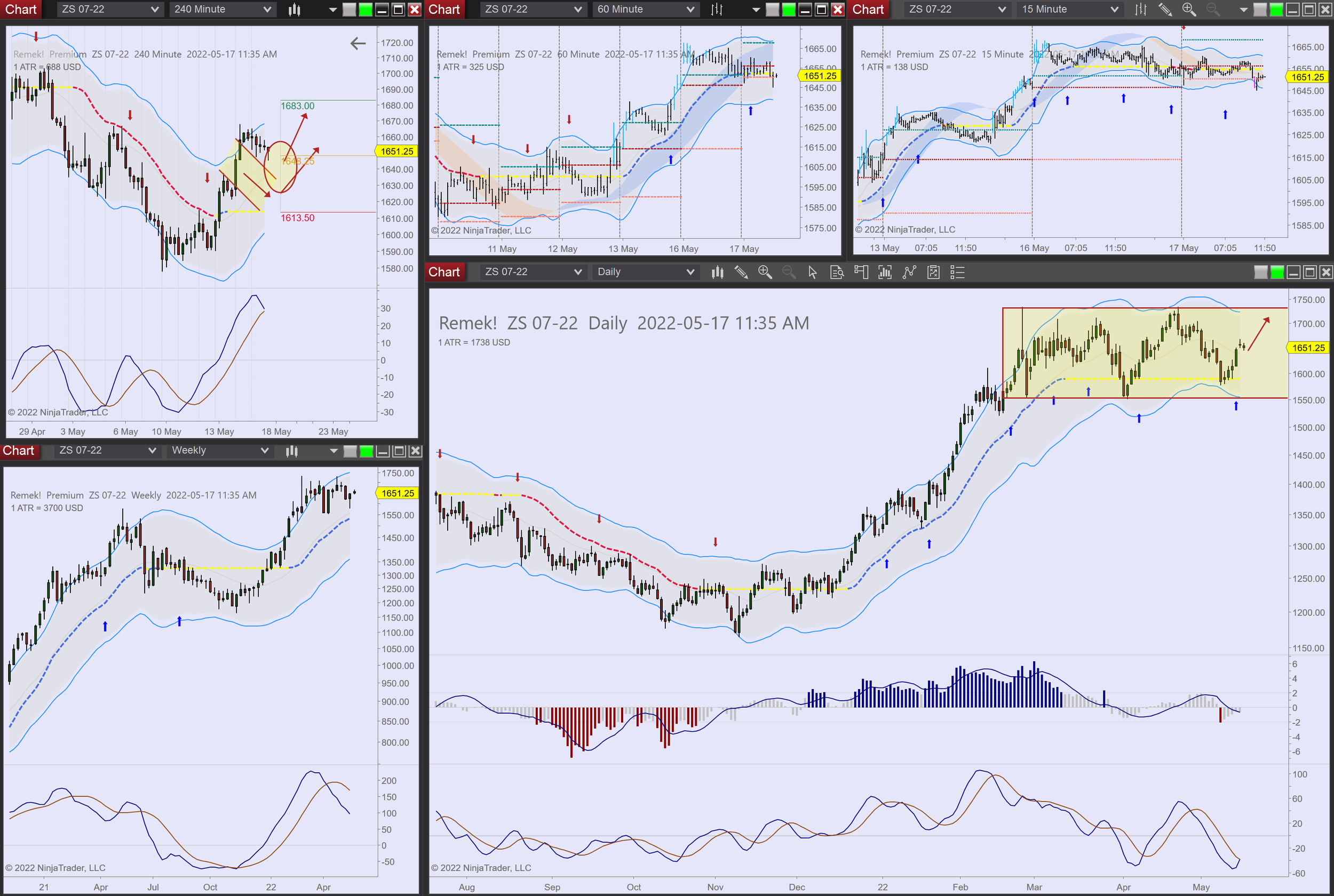

Bearflag on daily showing signs of failing, switching bias to “long”. Expecting a journey to the upper half of the daily range. (Notice that the ‘daily range’ is nothing but a consolidation above the breakout level on the weekly, making our bullish bias justified. Also note: there are no guarantees in trading, we always work with probabilities.)

May 16:

Drew bullflag on 240min as an expected next step.

May 17:

We have the bullflag. Next step: to “structure the trade” (define trigger/target/stop/sizing, aka turning this opportunity into a trade with an edge). One good way to execute the (expected) upcoming trade is with our software.

May 18:

Triggered in. Aiming for a 1R as always.

May 19:

Controlling urges to abandon the trade. Patience is a skill.

May 20:

1R hit, out and gone biking.

Note: all timestamps in real time. Join us now for trades like this as they happen, or wait a few days for further details on this and other trades as generated by our methodology.

Do you want to do these trades while controlling your emotions and remove unfounded psychological urges from your trading? Consider deploying our advanced software tools in your trading office! Also note, it’s “Indicators Month”, check out our indicator specials!