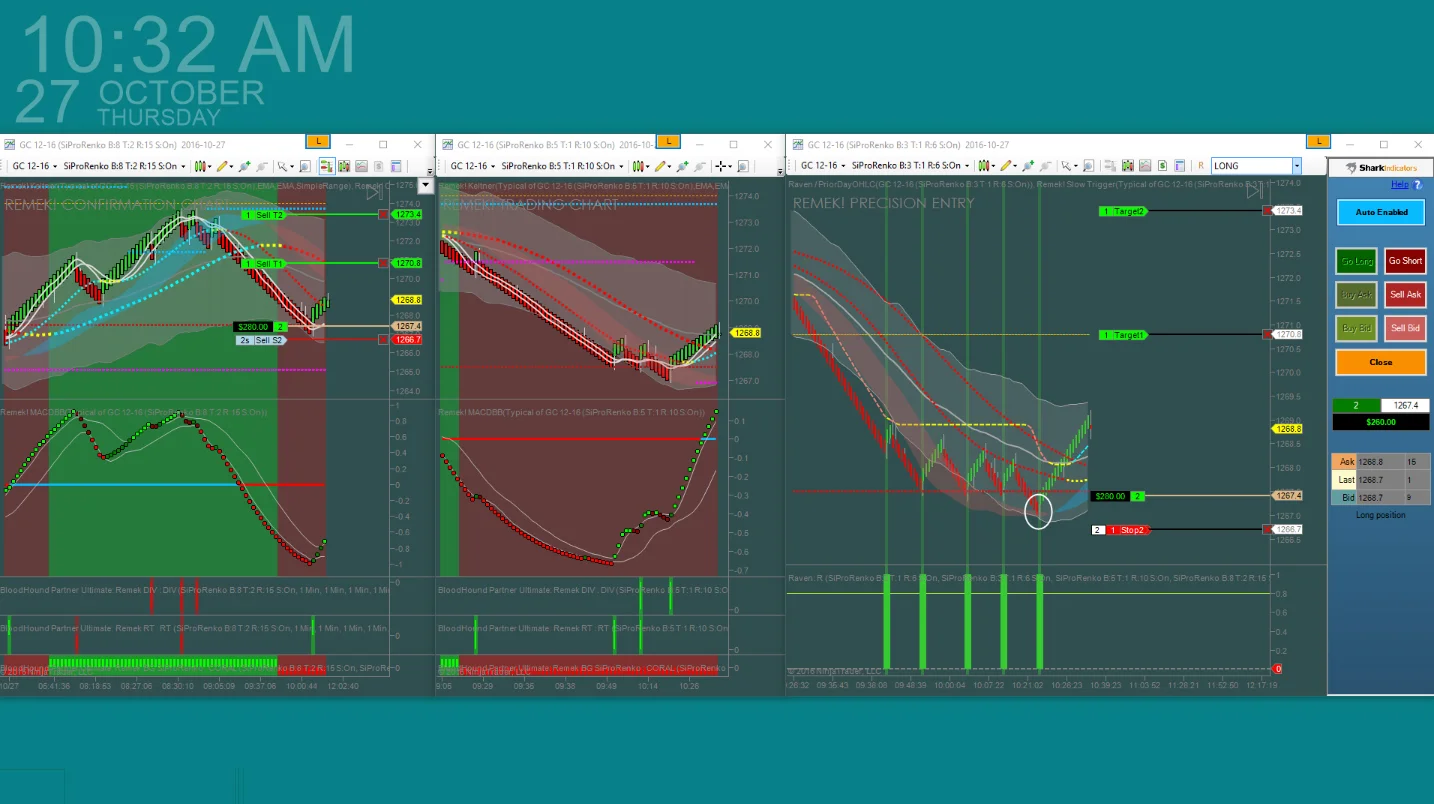

After our busy August on the markets, and after having showed the strength of our tools and our method in a forward-trading scenario, it’s easy to lose sight of the foundations. So let’s revisit the biggest challenge we traders face every day on the job!

But first, some facts:

Fact Nr. 1:

On financial markets, prices change because there emerges, for whatever reason, an imbalance between buying and selling pressure. By price moving where it moves, that imbalance is neutralized, i.e. price arrives, albeit fleetingly, at an equilibrium, until the next imbalance emerges. At which time the process starts again.Fact Nr. 2:

The only way to make money on the markets (as a technically motivated directional trader) is by identifying those imbalances in advance and act on them.So far, nothing new.

But we have two problems:

a) Not every imbalance will show on the chart as a pattern. (See why.)

b) Not every pattern we see on our charts is the result of an imbalance. (See why.)

That is it! That is what we need to wrap our head around.

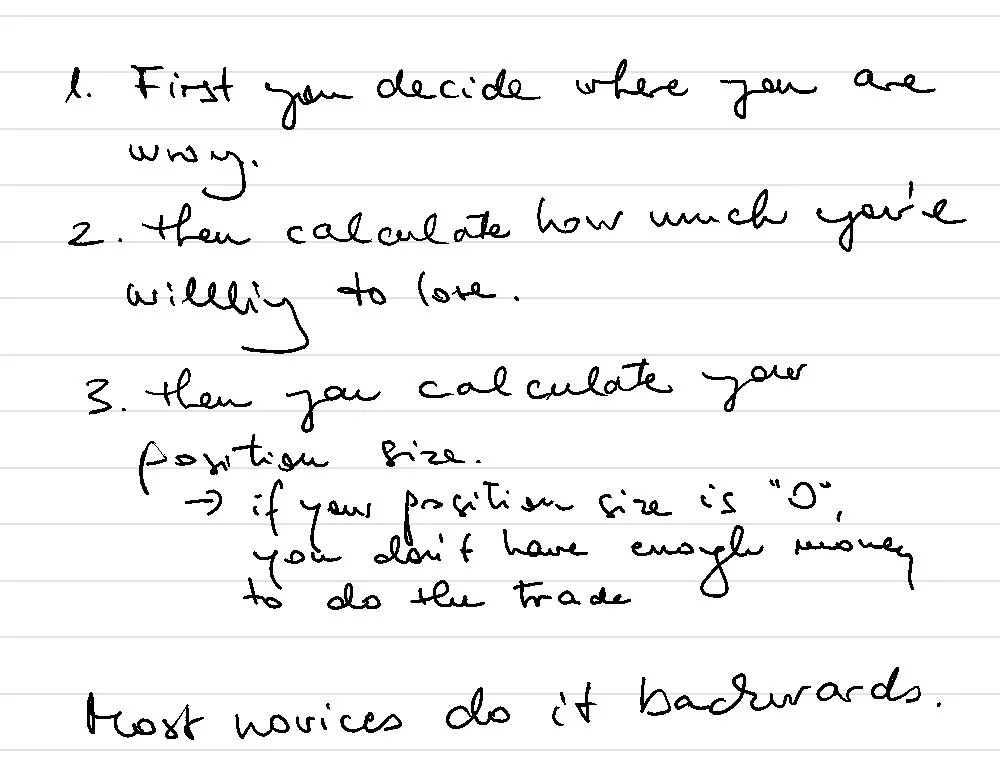

See, in trading, it is not possible to separate the wheat from the chaff with 100% accuracy. Which means, we have to enter the trade not knowing

a) if the pattern we trade is the result of a real imbalance, or

b) it’s just a formation that looks like a pattern by random chance.

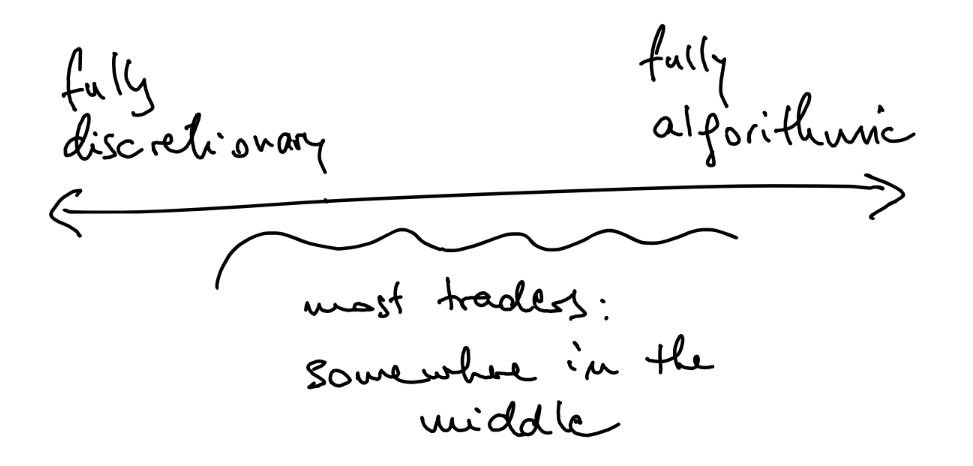

We humans are not comfortable with uncertainty, we in fact spend much of our lives in pretense of certainties. Which explains why many aspiring traders, even when they see a system with a demonstrated probabilistic edge, will still keep looking and looking and looking, … for certainty.

Instead of developing the skill of thinking in probabilities.