Defining the correct timeframe* to trade is an important part of being successful in trading. Consider the following:

1. In order to make money trading the financial markets, you must have an edge, in other words, a statistical advantage. We knew this, so far so good. But many traders miss the next point:

2. Edges are a result of human herd behaviour and, thus, surface on a given timeframe. Even on that given timeframe, edges may, over time, come and go, simply because market participants’ behaviour changes (just think of the late-90s NQ strategy of “press button, make money” , which, certainly doesn’t work any more). So ensuring that we have an edge is ongoing work. Again, so far so good.

Now let’s imagine that you have found and verified your edge. You are now in the 1% elite club of all traders (simply because few retail traders ever actually care to do this work).

And now you have to be careful. For even those who verified their edge, there’s one more danger lurking out there: many will think that they can just change the timeframe under their edge (e.g. to accommodate their account size or their daily routine or whatnot) and expect their hard-won edge will just keep working. Well, sometimes it might. Mostly it won’t. Let’s see why:

See, the timeframe is part of the edge. You can’t just change a major component of your edge and expect things to continue to work. Why? Well, for starters, you’ll be up against a different group of people, using different technology, different techniques, different access to the market, differently sized trading funds belonging to different owners with wildly different mandates and portfolio-building rules, trading totally different strategies and risk profiles, and we could probably think of a hundred other reasons. The chances of an edge to work on another, non-tested, timeframe is practically… well, let’s just say: very low.

Point is: edges do exist, but they will not come to the timeframe of your dreams. You’ll have to go to them: you’ll have to trade the timeframe where the edge is**, simply because the timeframe is part of that edge.

Mindful trading!

* in lieu of a better term amongst trading professionals, we'll use this term here for any type of chart, whether time-, volume-, tick-, movement- or otherwise-based

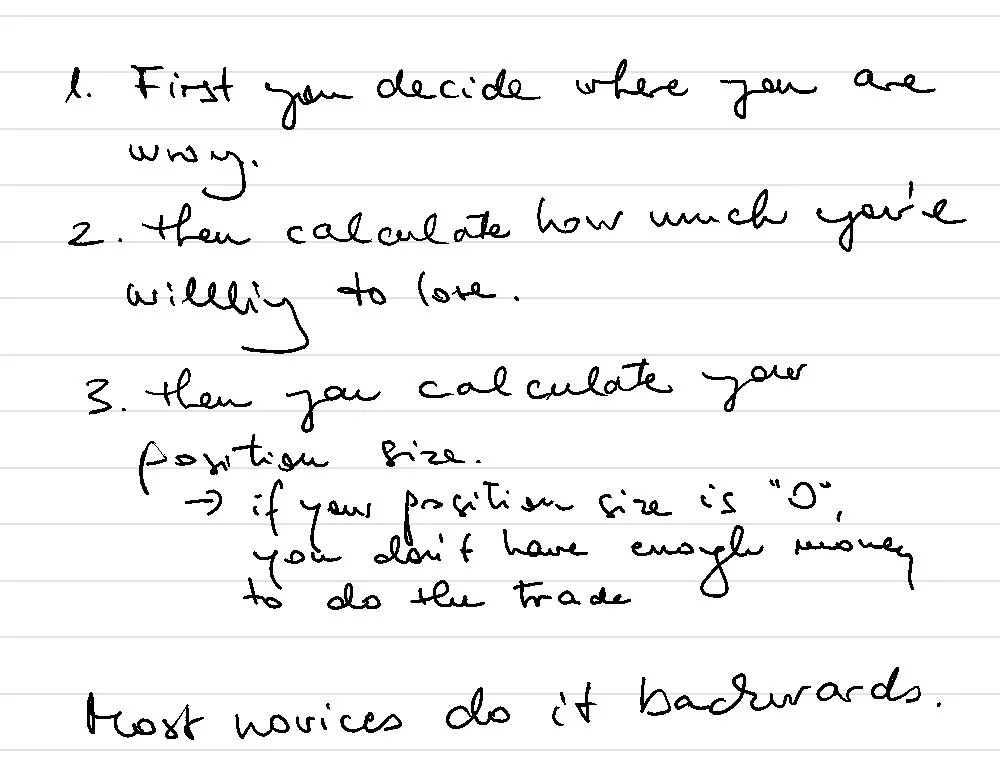

** account not big enough to trade the verified timeframe? Consider this: it's better to trade the micro contracts with an edge than trade the standard instruments with no edge and blow the account. Also, for all the currency futures trades, you can always jump on forex and do them there!