Understanding the trading process from identifying an opportunity (a general concept) through structuring a trade and execution (which are trader-specific) is probably the biggest success factor in trading.

Let’s review these three stages again:

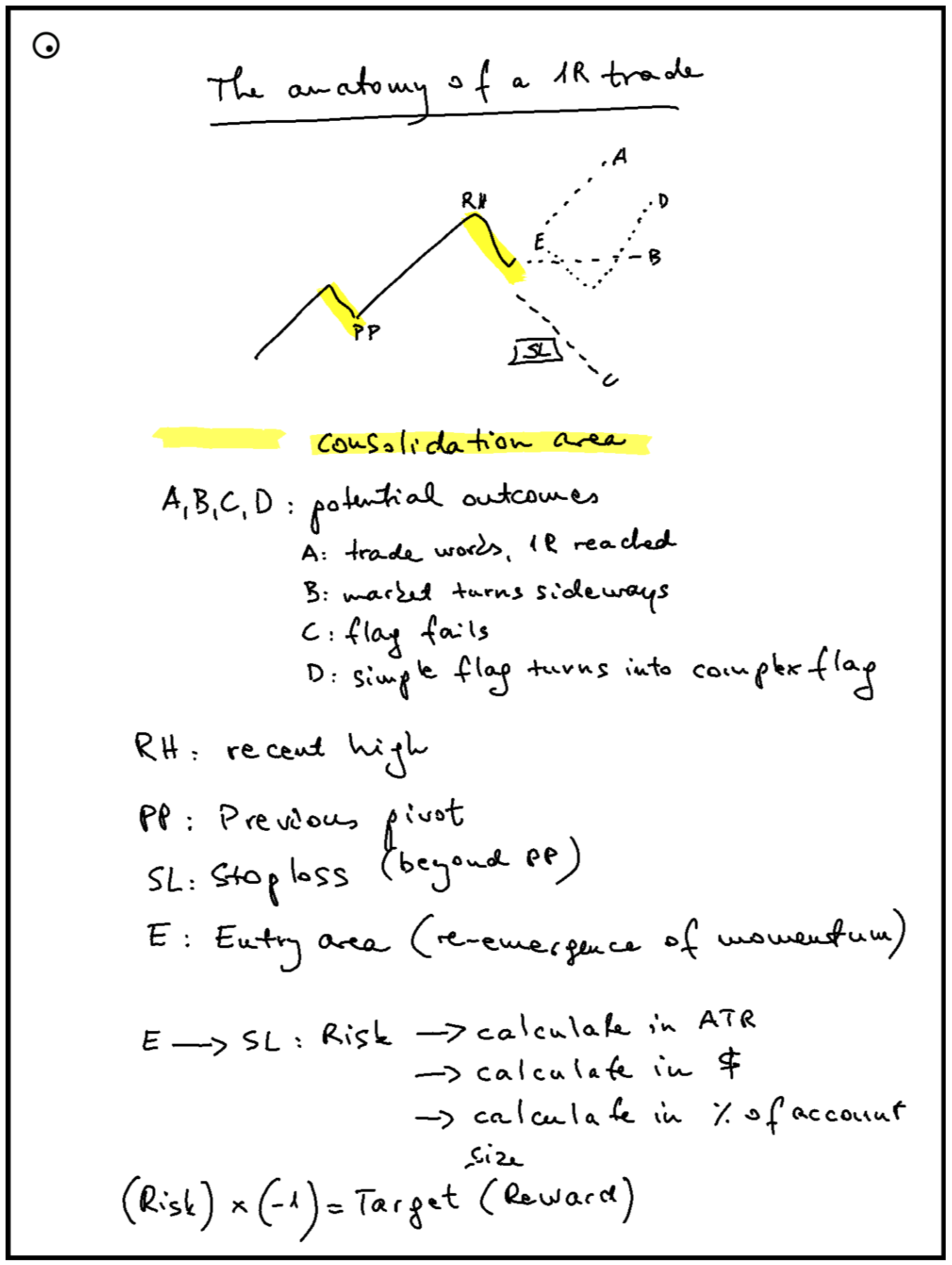

From identifying an opportunity to structuring the trade*

Identifying the opportunity

As the name suggests, this initial stage involves just that: idenfitying the opportunity. Identifying the opportunity is not a trade yet. This stage requires a sound theoretical foundation in technically motivated directional trading as well as an understanding of crowd psychology as it manifests itself on financial markets. Note that this stage requires none of the psychological skills and none of the financial resources and little of the math skills required for successful trading. (Many people can get very good at this stage, who then never become traders.)Structuring the trade

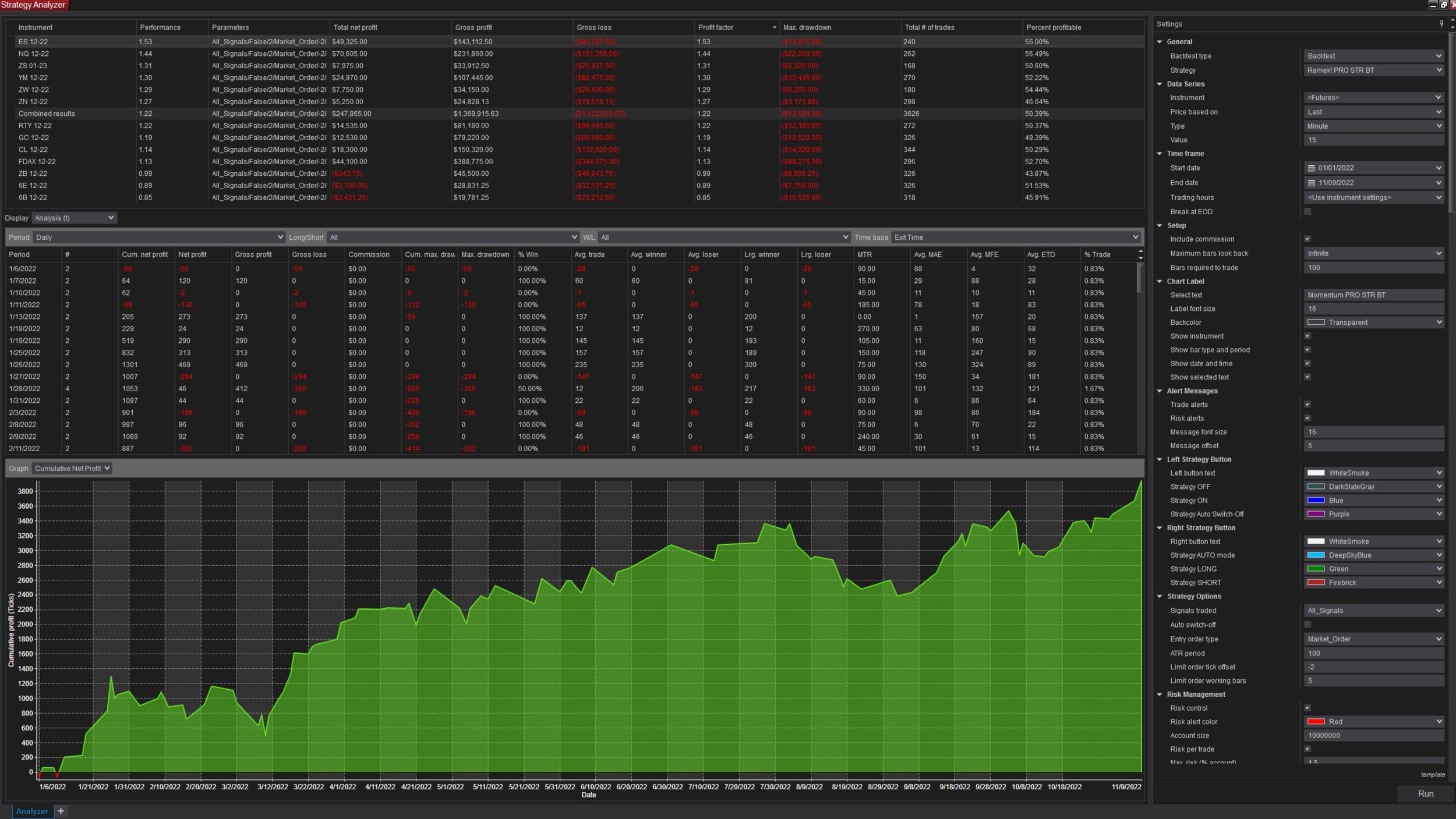

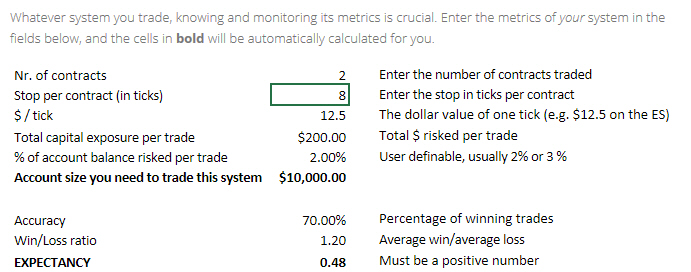

After idenfying the opportunity, we need to make a plan: how can we profit from this opportunity? We call this stage “structuring the trade”. This stage involves planning the trade which is based on the opportunity and which stays within our risk management rules (a trader-specific limitation). We must note: understanding and mastering this stage can be a challenge to many aspiring traders (partly because the avalanche of misinformation out there about the process of successful trading). This stage involves being able to do some math, much of which, though, can be done automatically with our software, see our Remek! Converter and the risk management module and other functionality in BT). At the end of this stage, we have an exact battle plan for the trade we want to do. (Note: since much of our work is done routinely and with software, this stage in practice can take 5-10 seconds or 5-10 minutes, depending on the trader, the timeframe, etc.)Execution. Having done Stage 2 above, we now know the job. The next question is: what’s the best way to do the job? This involves deciding on what tool to use (we recommend one of ours, of course), as well as the level of automation. As to the latter, the answer depends on the trader as well as the job.

- For example: a fast intraday chart requiring split-second decisions may be best left for BT, while a trade on the daily where we have time to think may call for PRO STR.

- Or some traders may simply decide to do all their trades with our highly algorithmic BT, this simply being the best fit with their personality (since BT removes much of the emotions of the trader from the equation).

- Some other traders might want to decide whether to use PRO STR or BT for each trade, depending on their psychological state or battle-readiness at the time of the job.

All three approaches can be just fine, as long as the trader has defined clear guidelines for themselves.

Having decided upon the tool and the level of automation, we are now ready to execute the trade that is

a) based upon the opportunity identified and

b) is structured (planned to be within our battle/business/risk management rules) and

c) is executed with the optimal tool given our condition as a human being at the moment.

Having gotten this far in this post, we realize: this is probably one of our most important blog entries that we could possibly share with our audience, and thus the best way to start off the new year. Understanding the above process, and then learning to master it (which is what our Premium service can help with) is one of the crucial success factors to technically motivated directional traders.

Mindful trading in 2024!

* in the attached example, we see the interplay between three timeframes and how the HTF can provide context to our plans on lower timeframes. Note though that the process of identifying the opportunity, structuring the trade all the way through execution doesn’t necessarily have to involve multiple timeframes.